Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(13) A partnership that consists of two classes of partners, one that participates in management of the company and have unlimited liability, and another that

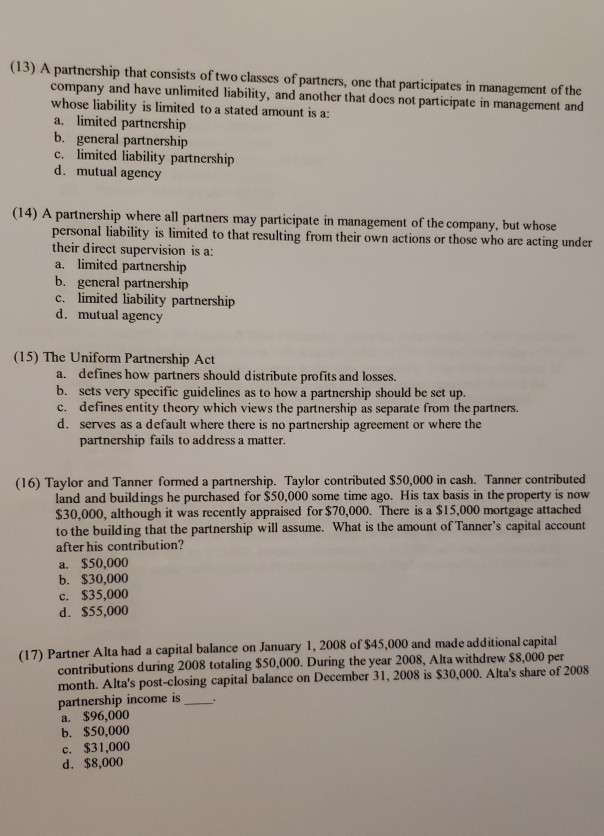

(13) A partnership that consists of two classes of partners, one that participates in management of the company and have unlimited liability, and another that does not participate in management and whose liability is limited to a stated amount is a: a. limited partnership b. general partnership c. limited liability partnership d. mutual agency (14) A partnership where all partners may participate in management of the company, but whose personal liability is limited to that resulting from their own actions or those who are acting under their direct supervision is a: a. limited partnership b. general partnership c. limited liability partnership d. mutual agency (15) The Uniform Partnership Act a. defines how partners should distribute profits and losses. b. sets very specific guidelines as to how a partnership should be set up. c. defines entity theory which views the partnership as separate from the partners. d. serves as a default where there is no partnership agreement or where the partnership fails to address a matter. (16) Taylor and Tanner formed a partnership. Taylor contributed $50,000 in cash. Tanner contributed land and buildings he purchased for $50,000 some time ago. His tax basis in the property is now $30,000, although it was recently appraised for $70,000. There is a $15,000 mortgage attached to the building that the partnership will assume. What is the amount of Tanner's capital account after his contribution? a. $50,000 b. $30,000 c. $35,000 d. $55,000 (17) Partner Alta had a capital balance on January 1, 2008 of $45,000 and made additional capital contributions during 2008 totaling $50,000. During the year 2008, Alta withdrew $8,000 per month. Alta's post-closing capital balance on December 31, 2008 is $30,000. Alta's share of 2008 partnership income is a. $96,000 b. $50,000 c. $31,000 d. $8,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started