13

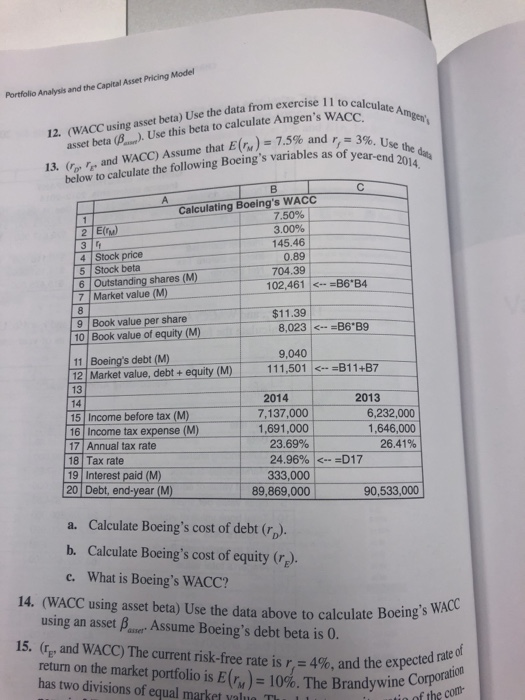

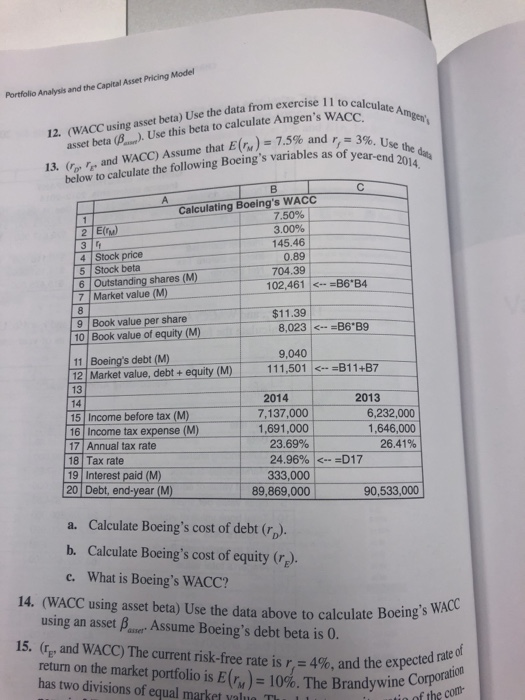

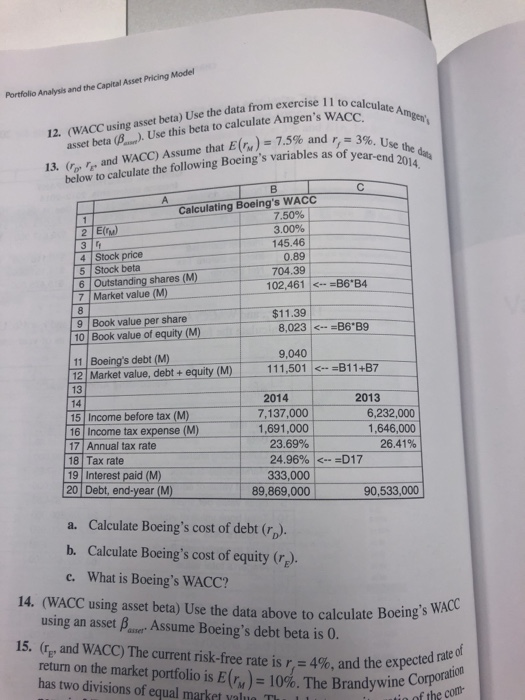

Analysis and the Capital Asset Pricing Model Portfolio 12. (WACC using asset beta) Use the data from exercise 11 to ca asset beta (B.m. Use this beta to calculate Amgen's WACC 13, (r , r,, and WACC) Assume that E(n)-7.5% and ,,-3% below to calculate the following Boeing's variables as of cu 14. Calculating Boeing's WACC 7.50% 3.00% 145.46 0.89 704.39 4 Stock price 5 Stock beta Outstanding shares (M) 102,461 B6 B4 7 Market value (M) $11.39 9 Book value per share 10 Book value of equity (M) 8,023 -B6'B9 9,040 11 Boeing's debt (M) 12 Market value, debt +equity (M) 111,501 B11+B7 2014 2013 15 Income before tax (M) 16 Income tax expense (M) 17 Annual tax rate 18 Tax rate 7,137,000 1,691,000 2 6,232,000 1,646,000 26.41% 23.69% 24.96% le-D17 333,000 19 Interest paid (M) 20 Debt, end-year (M) 89,869,000 90,533,000 a. Calculate Boeing's cost of debt (rp). b. Calculate Boeing's cost of equity r). What is Boeing's WACC? c. 14. (WACC using asset beta) Use the data above to calculate Boeing s using an asset Assume Boeing's debt beta is 0. 15. (feandWACC)The current risk-free rate isr,: 4%, and the expected ration return on the market portfolio is E(rM)-10%. The Brandywineuf the com has two divisions of equal market value Thu 1 Analysis and the Capital Asset Pricing Model Portfolio 12. (WACC using asset beta) Use the data from exercise 11 to ca asset beta (B.m. Use this beta to calculate Amgen's WACC 13, (r , r,, and WACC) Assume that E(n)-7.5% and ,,-3% below to calculate the following Boeing's variables as of cu 14. Calculating Boeing's WACC 7.50% 3.00% 145.46 0.89 704.39 4 Stock price 5 Stock beta Outstanding shares (M) 102,461 B6 B4 7 Market value (M) $11.39 9 Book value per share 10 Book value of equity (M) 8,023 -B6'B9 9,040 11 Boeing's debt (M) 12 Market value, debt +equity (M) 111,501 B11+B7 2014 2013 15 Income before tax (M) 16 Income tax expense (M) 17 Annual tax rate 18 Tax rate 7,137,000 1,691,000 2 6,232,000 1,646,000 26.41% 23.69% 24.96% le-D17 333,000 19 Interest paid (M) 20 Debt, end-year (M) 89,869,000 90,533,000 a. Calculate Boeing's cost of debt (rp). b. Calculate Boeing's cost of equity r). What is Boeing's WACC? c. 14. (WACC using asset beta) Use the data above to calculate Boeing s using an asset Assume Boeing's debt beta is 0. 15. (feandWACC)The current risk-free rate isr,: 4%, and the expected ration return on the market portfolio is E(rM)-10%. The Brandywineuf the com has two divisions of equal market value Thu 1