Answered step by step

Verified Expert Solution

Question

1 Approved Answer

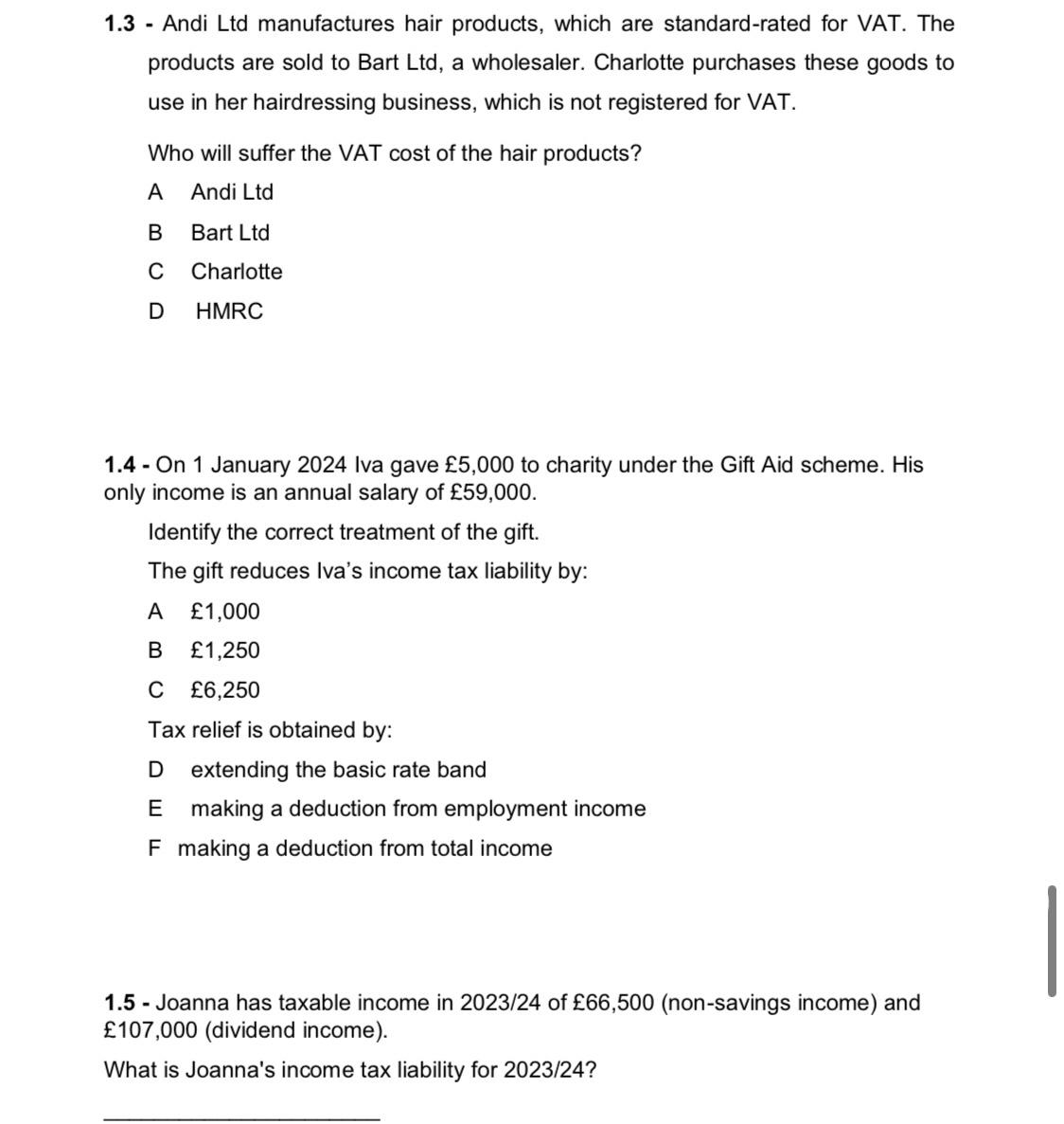

1.3 - Andi Ltd manufactures hair products, which are standard-rated for VAT. The products are sold to Bart Ltd, a wholesaler. Charlotte purchases these

1.3 - Andi Ltd manufactures hair products, which are standard-rated for VAT. The products are sold to Bart Ltd, a wholesaler. Charlotte purchases these goods to use in her hairdressing business, which is not registered for VAT. Who will suffer the VAT cost of the hair products? A Andi Ltd B Bart Ltd C Charlotte D HMRC 1.4 - On 1 January 2024 Iva gave 5,000 to charity under the Gift Aid scheme. His only income is an annual salary of 59,000. Identify the correct treatment of the gift. The gift reduces Iva's income tax liability by: A 1,000 B 1,250 C 6,250 Tax relief is obtained by: D extending the basic rate band E making a deduction from employment income F making a deduction from total income 1.5 - Joanna has taxable income in 2023/24 of 66,500 (non-savings income) and 107,000 (dividend income). What is Joanna's income tax liability for 2023/24?

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 13 B Bart Ltd Bart Ltd being the wholesaler will suffer the VAT cost of the hair products Sin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started