Answered step by step

Verified Expert Solution

Question

1 Approved Answer

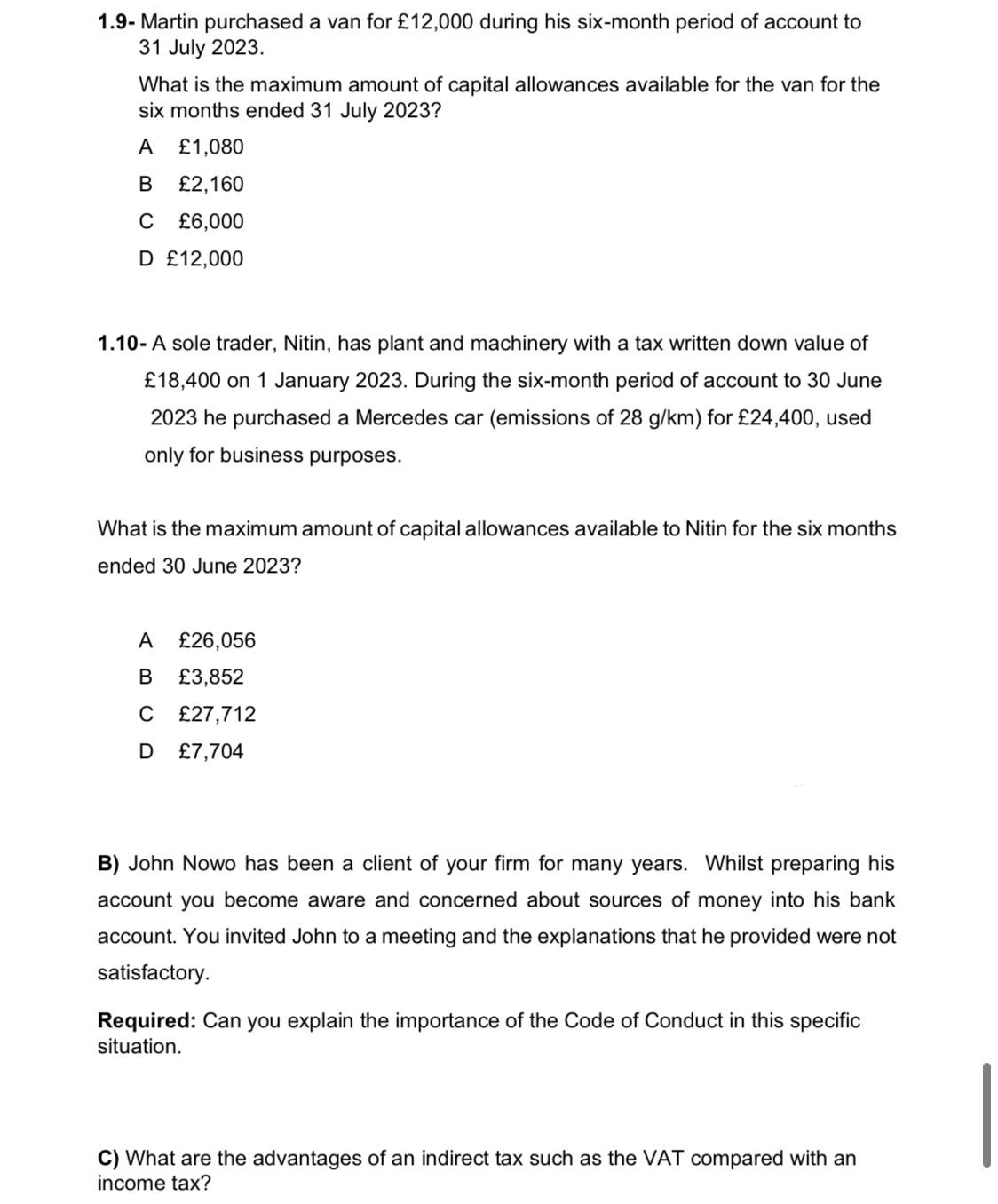

1.9- Martin purchased a van for 12,000 during his six-month period of account to 31 July 2023. What is the maximum amount of capital

1.9- Martin purchased a van for 12,000 during his six-month period of account to 31 July 2023. What is the maximum amount of capital allowances available for the van for the six months ended 31 July 2023? A 1,080 B 2,160 C 6,000 D 12,000 1.10- A sole trader, Nitin, has plant and machinery with a tax written down value of 18,400 on 1 January 2023. During the six-month period of account to 30 June 2023 he purchased a Mercedes car (emissions of 28 g/km) for 24,400, used only for business purposes. What is the maximum amount of capital allowances available to Nitin for the six months ended 30 June 2023? A 26,056 B 3,852 C 27,712 D 7,704 B) John Nowo has been a client of your firm for many years. Whilst preparing his account you become aware and concerned about sources of money into his bank account. You invited John to a meeting and the explanations that he provided were not satisfactory. Required: Can you explain the importance of the Code of Conduct in this specific situation. C) What are the advantages of an indirect tax such as the VAT compared with an income tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

19 B Martin purchased the van for 12000 The annual allowance for a van is 3000 For 6 months it would ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started