Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13. Assumptions in CAPM and cost of failure Aa Aa You are the managing partner at a venture capital firm, and you feel that to

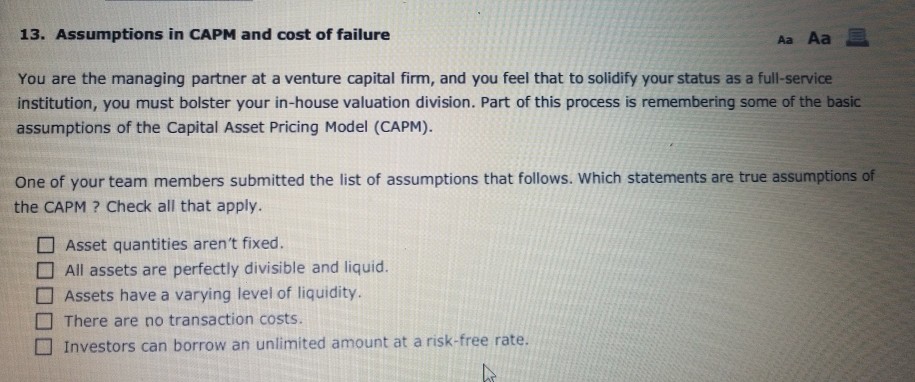

13. Assumptions in CAPM and cost of failure Aa Aa You are the managing partner at a venture capital firm, and you feel that to solidify your status as a full-service institution, you must bolster your in-house valuation division. Part of this process is remembering some of the basic assumptions of the Capital Asset Pricing Model (CAPM). One of your team members submitted the list of assumptions that follows. Which statements are true assumptions of the CAPM? Check all that apply. Asset quantities aren't fixed. All assets are perfectly divisible and liquid. Assets have a varying level of liquidity. There are no transaction costs. Investors can borrow an unlimited amount at a risk-free rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started