Answered step by step

Verified Expert Solution

Question

1 Approved Answer

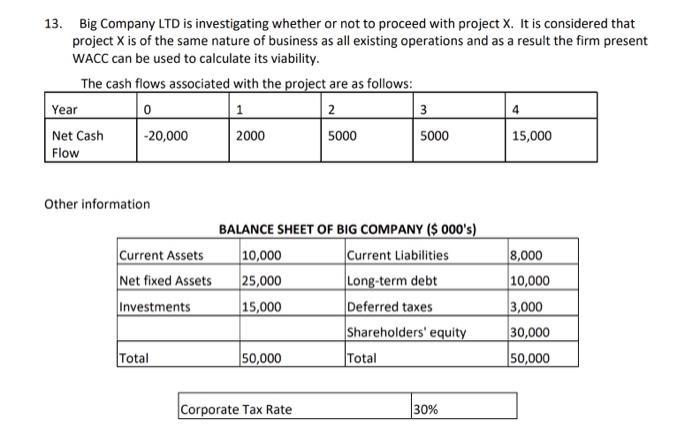

13. Big Company LTD is investigating whether or not to proceed with project X. It is considered that project X is of the same

13. Big Company LTD is investigating whether or not to proceed with project X. It is considered that project X is of the same nature of business as all existing operations and as a result the firm present WACC can be used to calculate its viability. The cash flows associated with the project are as follows: 0 1 2 2000 Year Net Cash Flow -20,000 Other information Current Assets Net fixed Assets Investments Total 10,000 25,000 15,000 BALANCE SHEET OF BIG COMPANY ($ 000's) Current Liabilities Long-term debt Deferred taxes Shareholders' equity 50,000 5000 Corporate Tax Rate 3 5000 Total 30% 4 15,000 8,000 10,000 3,000 30,000 50,000 Number of shares on issue Current Share Price Equity Beta Expected Return on the Market Risk Free Rate applicable 10 million $7.25 1.47 12% 7% Long Term Debt consists of "Junk" Bonds issued at a face value of $7 million. These pay interest semi-annually at a rate of 16 % p.a. (compounding semi-annually). They have 3 years to maturity and a coupon payment was made yesterday. Long Term Debt also includes a secured liability to Huge Company Ltd which currently sits in the books at $3 million. Interest is payable annually on this at a fixed rate of 10% p.a. (which is also the current market rate for this liability). The market yield on the junk bonds is 18 % p.a. (compounding semi-annually) Compute the WACC of Big Company and determine the project's NPV.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started