Question

13. Calculate the company's net income (profit) given the following information: $10,630 $11,370 $11,610 $10,280 14. Nimbus Corporations accounting records disclosed the following information regarding

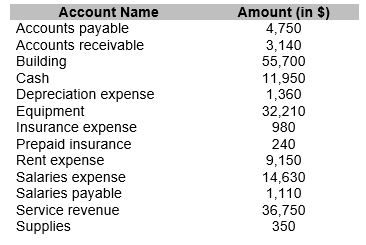

13. Calculate the company's net income (profit) given the following information:

| $10,630 | |

| $11,370 | |

| $11,610 | |

| $10,280 |

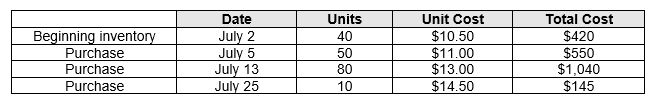

14. Nimbus Corporations accounting records disclosed the following information regarding purchases of inventory item no. 773 during July:

During the month of July, Nimbus sold 140 units at a price of $16.30 each. Calculate cost of goods sold using weighted-average costing. Round your answer to the nearest dollar.

| $2,282 | |

| $1,676 | |

| $2,155 | |

| $514 |

16. Performing services for a customer on account would result in:

| An increase in Accounts Receivable and an increase in Service Revenue | |

| An increase in Cash and a decrease in Accounts Receivable | |

| An increase in Accounts Receivable and an increase in Unearned Revenue | |

| A decrease in Accounts Payable and a decrease in Service Revenue |

19.Kitchener Industries pays $1,300 for salaries for the month. The impact of this transaction would be:

| Cash would increase by $1,300 and Salaries Expense would increase by $1,300 | |

| Cash would decrease by $1,300 and Salaries Expense would decrease by $1,300 | |

| Cash would increase by $1,300 and Salaries Expense would decrease by $1,300 | |

| Cash would decrease by $1,300 and Salaries Expense would increase by $1,300 |

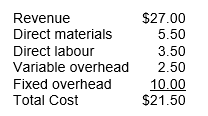

23. Chronos Time Company produces 1,000,000 watches per year and has a total plant capacity of 1,200,000 watches. Based on production of 1,000,000 watches per year, the financial information for one (1) watch is as follows:

A key customer approached the company to provide 200,000 watches at a reduced price. What is the minimum price per unit that the company could accept on this special order?

| $5.50 | |

| $21.50 | |

| $27.00 | |

| $11.50 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started