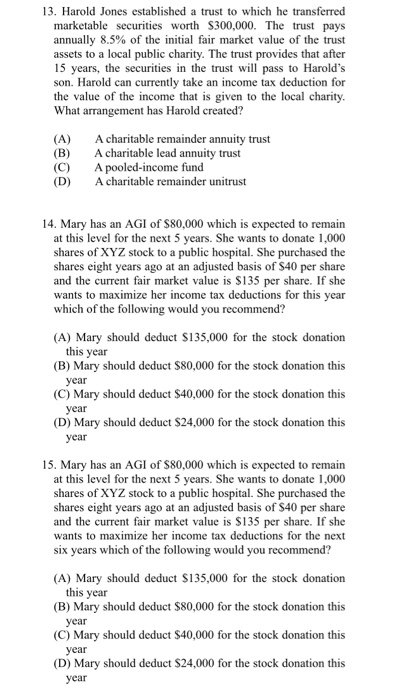

13. Harold Jones established a trust to which he transferred marketable securities worth $300,000. The trust pays annually 8.5% of the initial fair market value of the trust assets to a local public charity. The trust provides that after 15 years, the securities in the trust will pass to Harold's son. Harold can currently take an income tax deduction for the value of the income that is given to the local charity. What arrangement has Harold created? (A) (B) (C) (D) A charitable remainder annuity trust A charitable lead annuity trust A pooled-income fund A charitable remainder unitrust 14. Mary has an AGI of $80,000 which is expected to remain at this level for the next 5 years. She wants to donate 1,000 shares of XYZ stock to a public hospital. She purchased the shares eight years ago at an adjusted basis of $40 per share and the current fair market value is $135 per share. If she wants to maximize her income tax deductions for this year which of the following would you recommend? (A) Mary should deduct $135,000 for the stock donation this year (B) Mary should deduct $80,000 for the stock donation this year (C) Mary should deduct $40,000 for the stock donation this year (D) Mary should deduct $24,000 for the stock donation this year 15. Mary has an AGI of $80,000 which is expected to remain at this level for the next 5 years. She wants to donate 1,000 shares of XYZ stock to a public hospital. She purchased the shares eight years ago at an adjusted basis of $40 per share and the current fair market value is $135 per share. If she wants to maximize her income tax deductions for the next six years which of the following would you recommend? (A) Mary should deduct $135,000 for the stock donation this year (B) Mary should deduct $80,000 for the stock donation this (C) Mary should deduct $40,000 for the stock donation this year (D) Mary should deduct $24,000 for the stock donation this year 13. Harold Jones established a trust to which he transferred marketable securities worth $300,000. The trust pays annually 8.5% of the initial fair market value of the trust assets to a local public charity. The trust provides that after 15 years, the securities in the trust will pass to Harold's son. Harold can currently take an income tax deduction for the value of the income that is given to the local charity. What arrangement has Harold created? (A) (B) (C) (D) A charitable remainder annuity trust A charitable lead annuity trust A pooled-income fund A charitable remainder unitrust 14. Mary has an AGI of $80,000 which is expected to remain at this level for the next 5 years. She wants to donate 1,000 shares of XYZ stock to a public hospital. She purchased the shares eight years ago at an adjusted basis of $40 per share and the current fair market value is $135 per share. If she wants to maximize her income tax deductions for this year which of the following would you recommend? (A) Mary should deduct $135,000 for the stock donation this year (B) Mary should deduct $80,000 for the stock donation this year (C) Mary should deduct $40,000 for the stock donation this year (D) Mary should deduct $24,000 for the stock donation this year 15. Mary has an AGI of $80,000 which is expected to remain at this level for the next 5 years. She wants to donate 1,000 shares of XYZ stock to a public hospital. She purchased the shares eight years ago at an adjusted basis of $40 per share and the current fair market value is $135 per share. If she wants to maximize her income tax deductions for the next six years which of the following would you recommend? (A) Mary should deduct $135,000 for the stock donation this year (B) Mary should deduct $80,000 for the stock donation this (C) Mary should deduct $40,000 for the stock donation this year (D) Mary should deduct $24,000 for the stock donation this year