Answered step by step

Verified Expert Solution

Question

1 Approved Answer

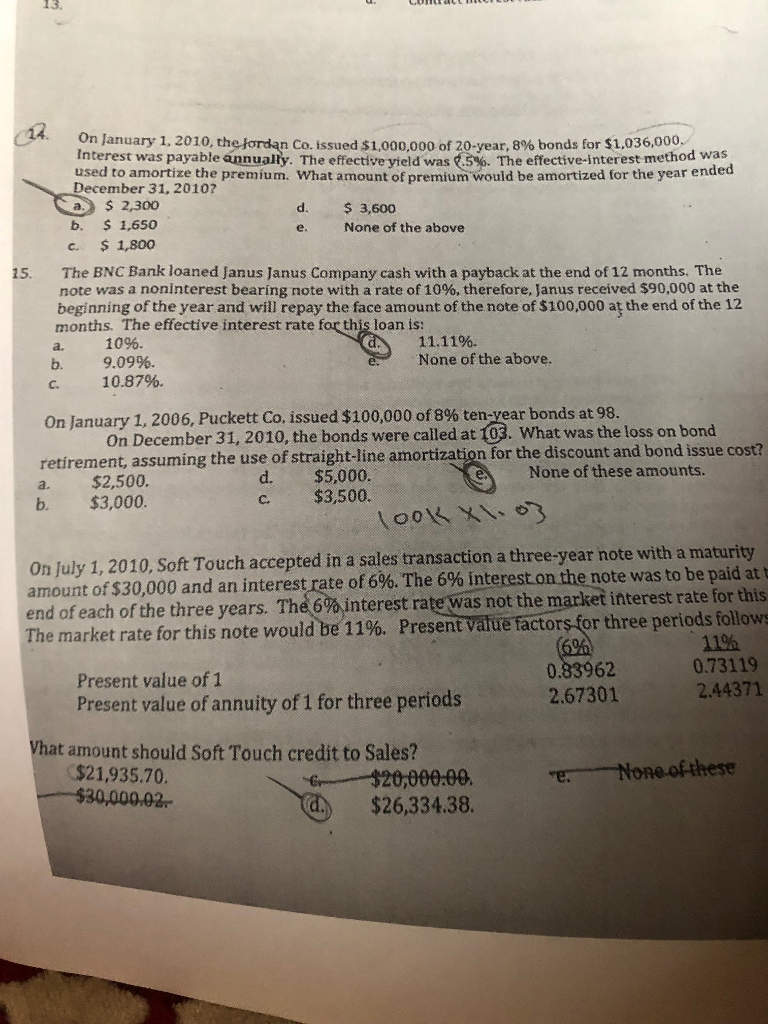

13. On January 1, 2010, the?ordan Co. issued $1,000,000 of 20-year, 8% bonds for $1,036,000. Interest was payable annually. The effective yield was 5%. The

13. On January 1, 2010, the?ordan Co. issued $1,000,000 of 20-year, 8% bonds for $1,036,000." Interest was payable annually. The effective yield was 5%. The effective-interest method was used to amortize the premium. What amount of premium would be amortized for the year ende December 31, 20107 a 2,300 d. 3,600 e. None of the above b. 1,650 c. 1,800 The BNC Bank loaned Janus Janus Company cash with a payback at the end of 12 months. The note was a noninterest bearing note with a rate of 10%, therefore, Janus received $90,000 at the beginning of the year and will repay the face amount of the note of $100,000 at the end of the 12 months. The effective interest rate for this loan is: a. 10%. b. 9.0996. 15. 11.11%. None of the above. C. 10.87%. On January 1, 2006, Puckett Co. issued $100,000 of 8% ten year bonds at 98. On December 31, 2010, the bonds were called at 103. What was the loss on bond retirement, assuming the use of straight-line amortization for the discount and bond issue cost? a. $2,500. b. $3,000 None of these amounts. d. $5,000 C. $3,500 loosx On July 1, 2010, Soft Touch accepted in a sales transacti amount of$30,000 and an interestrate of 6%. The 696 interestontenote was to be paid att on a three-year note with a maturity end of each of the three years. The 6%interest rate was not the market interest rate for this The market rate for this note would be 11%, present fue factorsor three periods follow 0.73119 2.44371 resent value 11% 0.83962 Present value of 1 Present value of annuity of 1 for three periods 2.67301 Vhat amount should Soft Touch credit to Sales? None ofthese $21,935.70. 30,00002 $20,000.00 $26,334.38

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started