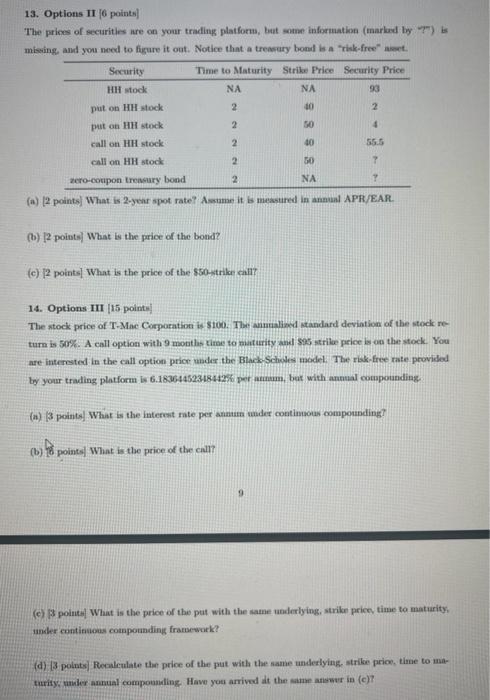

13. Options II [0 pointer ] The prices of securities ure on your trading platform, luat some information (marlay by . T7) is miseing, and you need to figure it out. Notiee that a treascary bond is a "riak-free" abeet. (a) (2 points) What is 2 -year spot rate? Asume it is messured in anmual APF/EAR. (b) [2 points) What is the price of the bond? (c) [2 points] What is the price of the 850-striler call? 14. Options III |15 point:| The stock price of T-Mine Corparation is \$100. Tlot annutilind standard devintion of the stock return is 50\%. A call option with 9 mothth times to misturity and ses strike price is on the stock. You are interested in the call option prioe under the Btack-Scholes model. The risk-free rate peovided ty your trading platform is 6.183644523184126 fit per unman, but with anmal cotapounding. (a) (3 points) What is the interest mate per anauste under continoous componeding? (b) 16 points) What is the prioe of the call? (c) 3 pointa) What is the price of the pat with the same underlying, strike price, time to maturity, under contintous cotapoundling framework? (d) 3 potnts) Fecalculate the price of the put with the name underlying. strike prion, time to matarity: maber annual compounding. Have yoe arrived at the aine answer in (c)? 13. Options II [0 pointer ] The prices of securities ure on your trading platform, luat some information (marlay by . T7) is miseing, and you need to figure it out. Notiee that a treascary bond is a "riak-free" abeet. (a) (2 points) What is 2 -year spot rate? Asume it is messured in anmual APF/EAR. (b) [2 points) What is the price of the bond? (c) [2 points] What is the price of the 850-striler call? 14. Options III |15 point:| The stock price of T-Mine Corparation is \$100. Tlot annutilind standard devintion of the stock return is 50\%. A call option with 9 mothth times to misturity and ses strike price is on the stock. You are interested in the call option prioe under the Btack-Scholes model. The risk-free rate peovided ty your trading platform is 6.183644523184126 fit per unman, but with anmal cotapounding. (a) (3 points) What is the interest mate per anauste under continoous componeding? (b) 16 points) What is the prioe of the call? (c) 3 pointa) What is the price of the pat with the same underlying, strike price, time to maturity, under contintous cotapoundling framework? (d) 3 potnts) Fecalculate the price of the put with the name underlying. strike prion, time to matarity: maber annual compounding. Have yoe arrived at the aine answer in (c)