Question

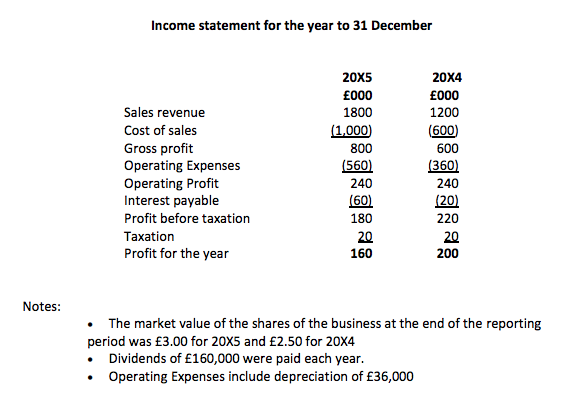

13. Preparing a Cash Flow Statement Using the same statement of financial position and income statements of Megem Ltd.from question 12 and using the template

13. Preparing a Cash Flow Statement Using the same statement of financial position and income statements of Megem Ltd.from question 12 and using the template provided, prepare a Statement of Cash Flows for Megem Ltd. for 20X5. For Fixed Assets you can assume the only movement in Fixed Assets apart from the revaluation, was depreciation of 36,000.

Total (15 marks)

Template for Question 13: This can be submitted as a written answer in a scanned document or copied and pasted into a Word document submission.

Statement of Cash Flows for the year ended ..:

|

|

|

|

| Cash flows from operating activities |

|

|

| Profit before taxation (after interest) |

|

|

| Adjustments for: |

|

|

| - Depreciation |

|

|

| - Interest expense |

|

|

|

|

|

|

| Increase/decrease in trade receivables |

|

|

| Increase /decrease in trade payables |

|

|

| Increase/decrease in inventories |

|

|

| Cash generated from operations |

|

|

| - Interest paid |

|

|

| - Taxation paid |

|

|

| - Dividend paid |

|

|

| Net cash from operating activities |

|

|

|

|

|

|

| Cash flows from investing activities |

|

|

| - Payments to acquire tangible non-current assets |

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

|

|

|

|

| Cash flows from financing activities |

|

|

| - Loan issued/repayment |

|

|

|

|

|

| Net cash from financing activities |

|

|

|

|

|

|

| Net increase in cash and cash equivalents |

|

|

| Cash and cash equivalents at 1 January |

|

|

| Cash and cash equivalents at 31 December |

|

|

|

|

|

|

|

|

|

|

| Non-current Asset Acquisition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

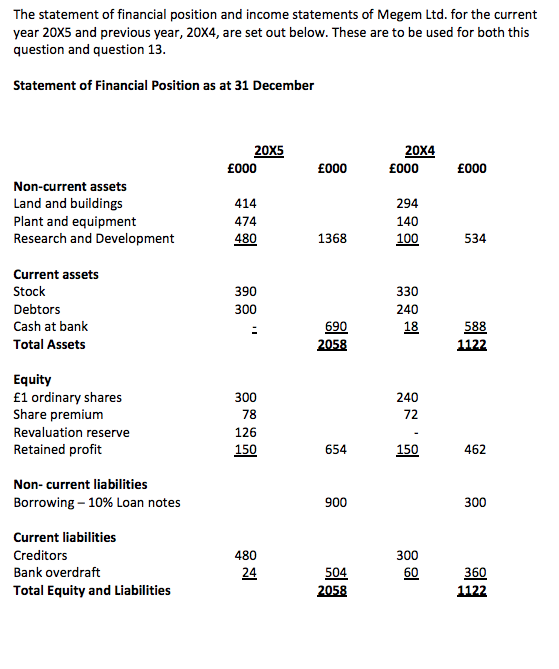

The statement of financial position and income statements of Megem Ltd. for the current year 20x5 and previous year, 20x4, are set out below. These are to be used for both this question and question 13. Statement of Financial Position as at 31 December 20x5 000 000 20X4 000 000 Non-current assets Land and buildings Plant and equipment Research and Development 414 474 480 294 140 100 1368 534 Current assets Stock Debtors Cash at bank Total Assets 390 300 330 240 18 690 2058 588 1122 Equity 1 ordinary shares Share premium Revaluation reserve Retained profit 240 72 300 78 126 150 654 150 462 900 300 Non-current liabilities Borrowing - 10% Loan notes Current liabilities Creditors Bank overdraft Total Equity and Liabilities 480 24 300 60 504 2058 360 1122 Income statement for the year to 31 December Sales revenue Cost of sales Gross profit Operating Expenses Operating Profit Interest payable Profit before taxation Taxation Profit for the year 20x5 000 1800 (1,000) 800 (560) 240 (60) 180 20 160 20X4 000 1200 (600) 600 (360) 240 (20) 220 20 200 Notes: The market value of the shares of the business at the end of the reporting period was 3.00 for 20x5 and 2.50 for 20x4 Dividends of 160,000 were paid each year. Operating Expenses include depreciation of 36,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started