Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13 Problem 15-13 (Static) [LO 15-4] On 5eptember 30, 2017, Stalling, Incorporated issued 2,000 shares of its publicly traded stock as compersation to its emplayee,

13

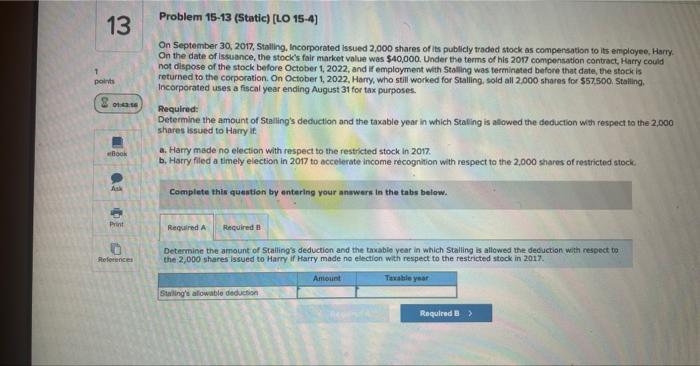

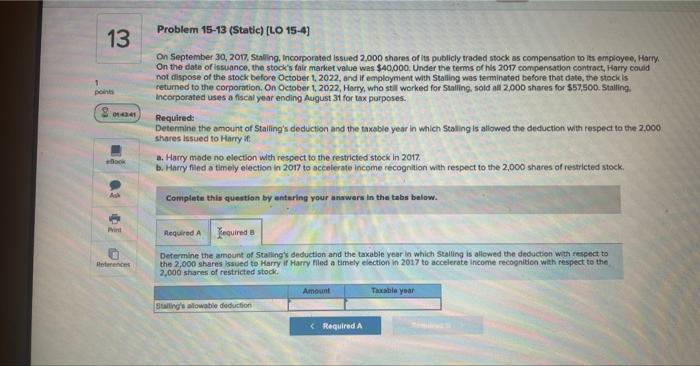

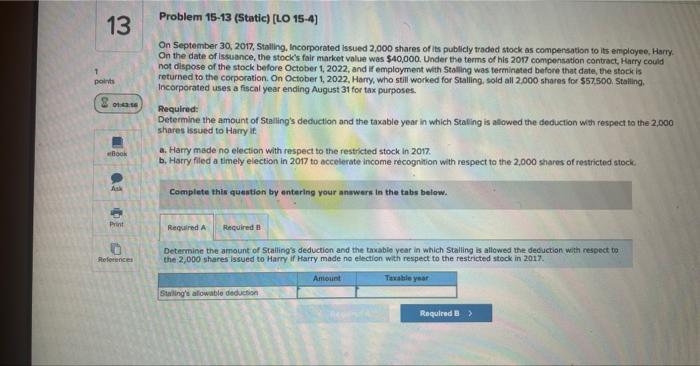

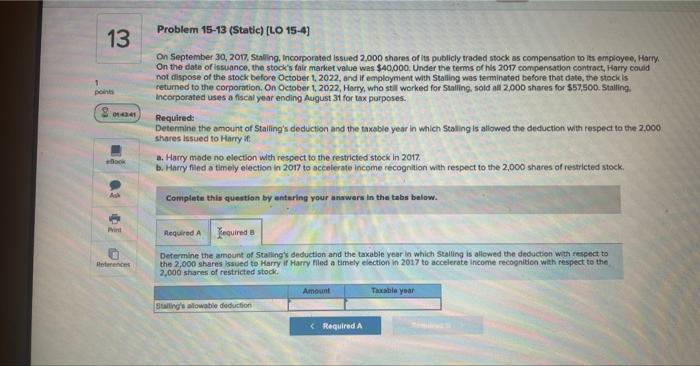

Problem 15-13 (Static) [LO 15-4] On 5eptember 30, 2017, Stalling, Incorporated issued 2,000 shares of its publicly traded stock as compersation to its emplayee, Harry. On the date of issuance, the stock's fair market value was $40,000. Under the terms of his 2017 compensation contract, Harry could not dispose of the stock before October 1, 2022, and if employment with Staling was terminated before that date, the stock is returned to the corporation. On October 1, 2022, Harry, Who still worked for Stalling, sold all 2.000 shares for 557,500 . 5 talling. Incorporated uses a fiscal year ending August 31 for tax purposes. Required: Determine the amount of Stalling's deduction and the taxable year in which Staling is allowed the deduction with respect ta the 2,000 shares issued to Harry it. a. Harry made no election with respect to the restricted stock in 2017. b. Harry filed a timely election in 2017 to accelerate income recognition with respect to the 2,000 shares of restricted stock: Complete this question by entering your answers in the tabs below. Determine the amount of Stalling's deduction and the taxable year in which Stalling is allowed the decuction with respect to. the 2,000 shares issued to Harry if Harry made no election with respect to the restricted stock in 2017 . Problem 15-13 (Static) [LO 15-4] On September 30, 201, Staling, Incorporated issued 2,000 shares of its publicly traded stock as compensation to its empioyee, Hamy On the date of issuance, the stock's tair market value was $40,000. Under the terms of his 2017 compensation contract, Harry could not dispose of the stock before October 1, 2022, and if amplayment with Stalling was terminated before that date, the stock is returned to the corporation. On October 1, 2022, Harry, who still worked for Stalling, sold all 2,000 shares for 557,500 . Stalling incorporated uses a fiscal year ending August 31 for tax purposes. Required: Determine the amourt of Stalling's deduction and the taxable year in which 5 taling is allowed the deduction with respect ta the 2.000 shares issued to Harry it: a. Harcy mode no election with respect to the restricted stock in 2017. b. Harry find a timely election in 2017 to accelerate income recognition with respect to the 2,000 shares of resticted stock. Complete this question by entering your anawers in the tabs below. Determine the amount of 5 taling's deduction and the taxabie year in which stalling is allowed the decuetion with respect to thin 2,000 shares issued to Harry if Harry flled a timely election in 2017 to accelerate income recognition with respect to the 2,000 shares of restricted stook

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started