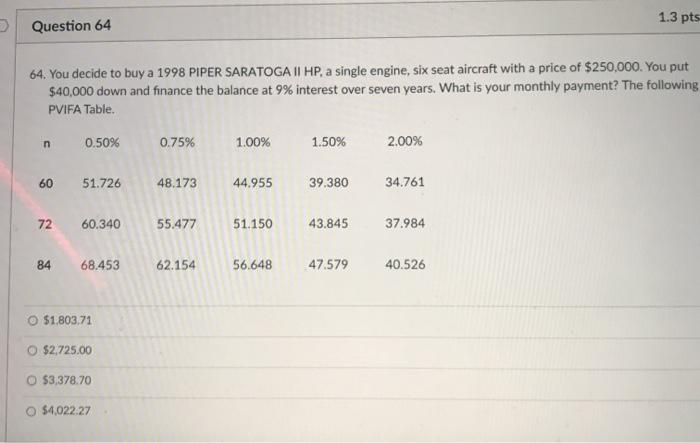

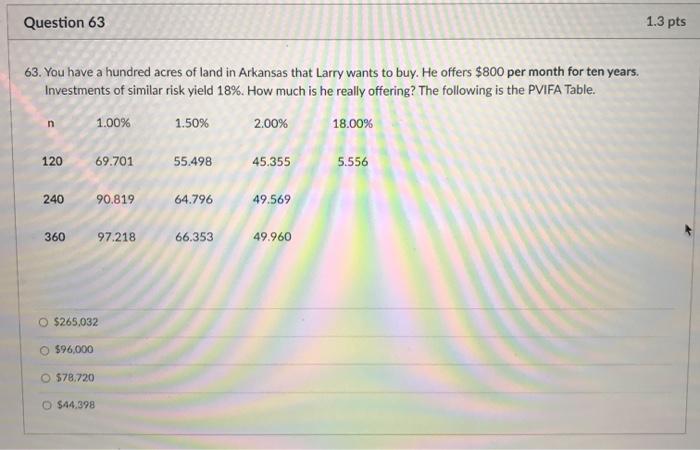

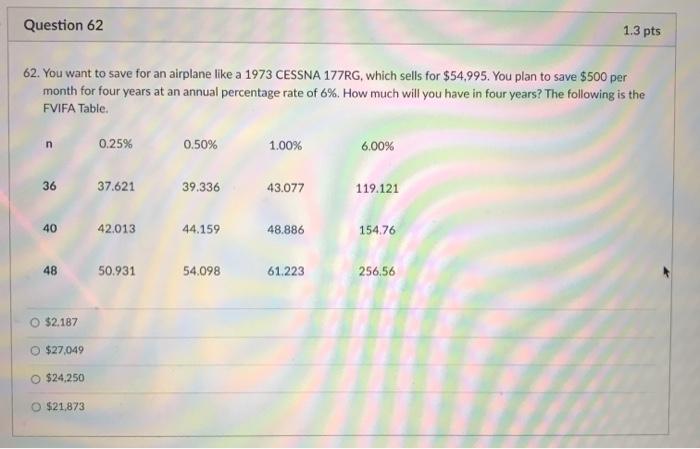

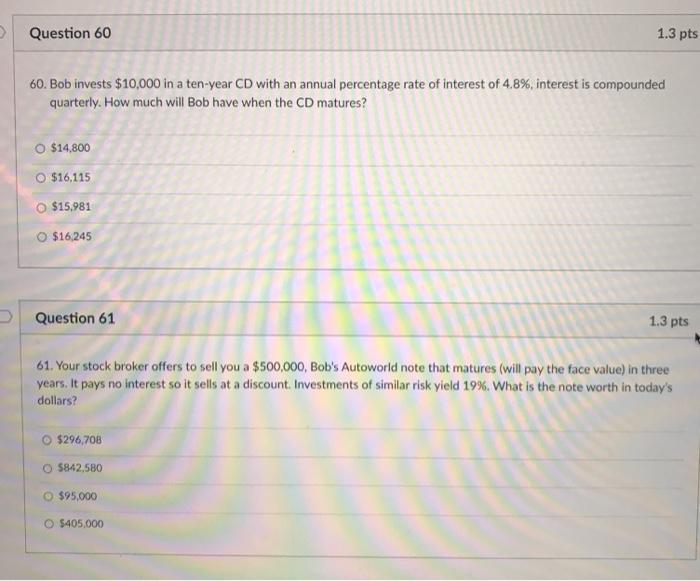

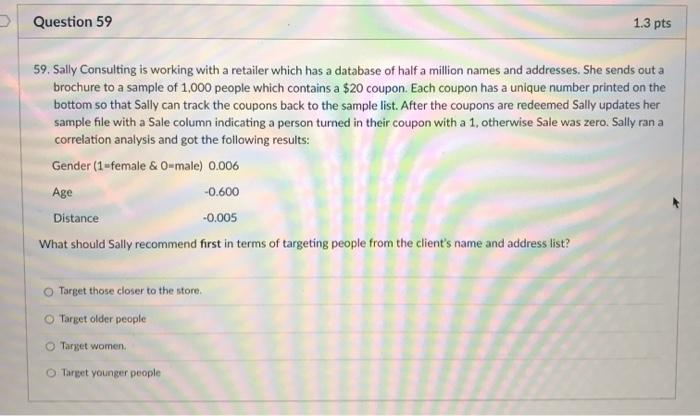

1.3 pts Question 64 64. You decide to buy a 1998 PIPER SARATOGA II HP, a single engine, six seat aircraft with a price of $250,000. You put $40,000 down and finance the balance at 9% interest over seven years. What is your monthly payment? The following PVIFA Table. n 0.50% 0.75% 1.00% 1.50% 2.00% 60 51.726 48.173 44.955 39.380 34.761 72 60.340 55.477 51.150 43.845 37.984 84 68.453 62.154 56.648 47.579 40.526 $1,803.71 $2,725.00 O $3,378.70 O $4,022.27 Question 63 1.3 pts 63. You have a hundred acres of land in Arkansas that Larry wants to buy. He offers $800 per month for ten years. Investments of similar risk yield 18%. How much is he really offering? The following is the PVIFA Table. 1.00% 1.50% 2.00% 18.00% n 120 69.701 55.498 45.355 5.556 240 90.819 64.796 49.569 360 97.218 66.353 49.960 $265,032 $96,000 $78.720 O $44.398 Question 62 1.3 pts 62. You want to save for an airplane like a 1973 CESSNA 177RG, which sells for $54.995. You plan to save $500 per month for four years at an annual percentage rate of 6%. How much will you have in four years? The following is the FVIFA Table n 0.25% 0.50% 1.00% 6.00% 36 37.621 39.336 43.077 119.121 40 42.013 44.159 48.886 154.76 48 50.931 54.098 61.223 256,56 O $2.187 $27,049 $24.250 $21,873 > Question 60 1.3 pts 60. Bob invests $10,000 in a ten-year CD with an annual percentage rate of interest of 4.8%, interest is compounded quarterly. How much will Bob have when the CD matures? O $14,800 O $16,115 $15,981 O $16,245 Question 61 1.3 pts 61. Your stock broker offers to sell you a $500,000, Bob's Autoworld note that matures (will pay the face value) in three years. It pays no interest so it sells at a discount Investments of similar risk yield 19%. What is the note worth in today's dollars? $296,708 5842.580 $95.000 O $405.000 Question 59 1.3 pts 59. Sally Consulting is working with a retailer which has a database of half a million names and addresses. She sends out a brochure to a sample of 1,000 people which contains a $20 coupon. Each coupon has a unique number printed on the bottom so that Sally can track the coupons back to the sample list. After the coupons are redeemed Sally updates her sample file with a Sale column indicating a person turned in their coupon with a 1, otherwise Sale was zero. Sally ran a correlation analysis and got the following results: Gender (1-female & O-male) 0.006 Age -0.600 Distance -0.005 What should Sally recommend first in terms of targeting people from the client's name and address list? Torget those closer to the store. Target older people Target women Tarpet younger people