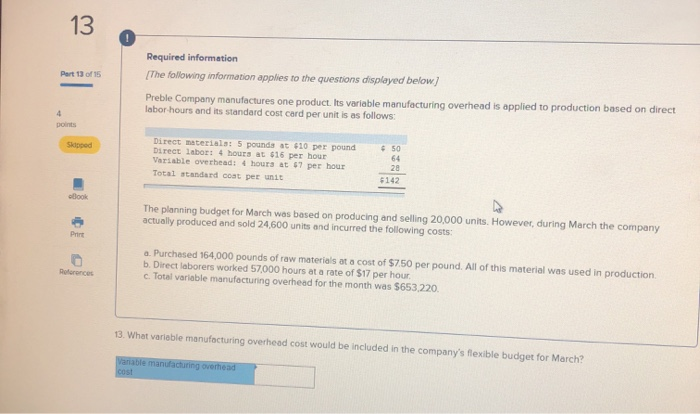

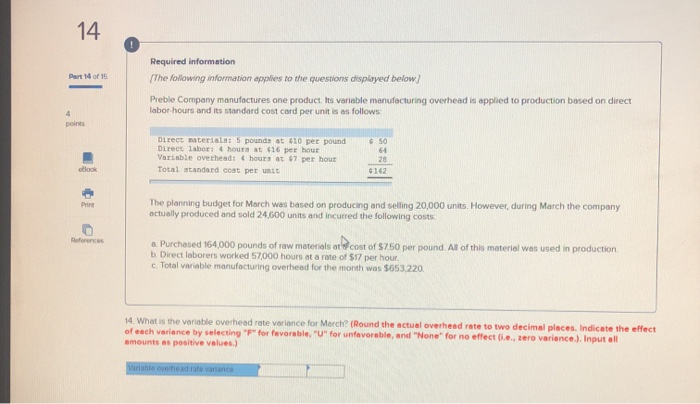

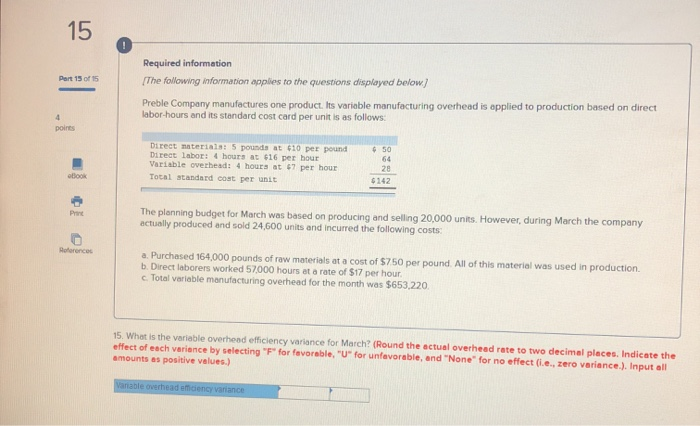

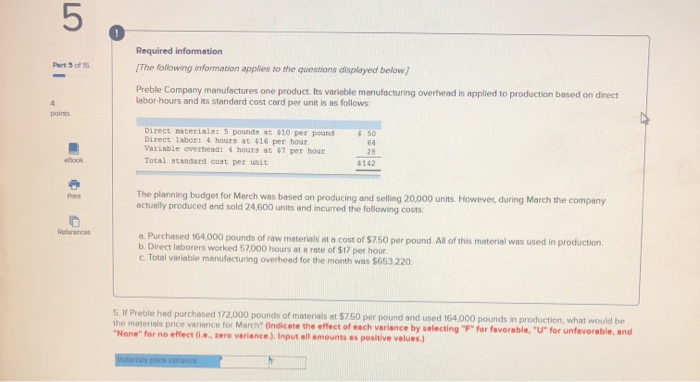

13 Required information [The following information applies to the questions displayed below] Pert 13 of 15 Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: points Direct materials: 5 pounda at 10 per pound Direct labor: 4 hours at $16 per hour Variable overhead: 4 hours at 7 per hour 50 Skipped 64 28 Total standard coat per unit 142 ollook The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 24,600 units and incurred the following costs Print a. Purchased 164.000 pounds of raw materials at a cost of $7.50 per pound. All of this material was used in production b. Direct laborers worked 57,000 hours at a rate of $17 per hour c. Total variable manufacturing overheed for the month was $653.220 Refaronces 13 What variable manufacturing overhead cost would be included in the company's flexible budget for March? Variable manufacturing overhead cost 14 Required information Pert 14 of 15 The following information applies to the questions displayed below Preble Company manufactures one product. Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows points Direct nateriala: 5 pounds at 410 per pound Direct labor: 4 hours at 616 per hour Variable overhead: 4 hours at 67 per hour 50 64 20 Total standard cost per unit oBook #142 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 24,600 units and incurred the following costs Print Refererces a Purchased 164,000 pounds of raw materials at'scost of $750 per pound All of this material wes used in production. b Direct laborers worked 57,000 hours at a rate of $17 per hour c Total variable manufacturing overhead for the month was $653,220. 14. What is the variable overhead rate variance for March? (Round the actual overheed rate to two decimal places. Indicate the effect of eech variance by selecting "F" for favoreble, "U" for unfavoreble, and "None" for no effect (i.e, zero variance.). Input all amounts as positive values.) ariable overhead rate vanance 15 Required information [The following information applies to the questions displayed below/ Pert 15 of 15 Preble Company manufactures one product. Its variable manufacturing overhead is opplied to production based on direct labor-hours and its stendard cost card per unit is as follows: points Direct naterials: 5 pounds at $10 per pound Direct labor: 4 hours at 616 per hour Variable overhead: 4 hours at 47 per hour 50 64 28 olook Total standard cost per unit $142 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 24,G00 units and incurred the following costs Print ferences a. Purchased 164,000 pounds of raw materials at a cost of $750 per pound. All of this material was used in production b. Direct laborers worked 57000 hours et a rate of $17 per hour c. Total variable manufacturing overhead for the month was $653,220 15. What is the variable overhead efficiency variance for March? (Round the actual overhead rate to two decimal places. Indicate the effect of each veriance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero veriance.). Input all amounts as positive velues.) Variable overhead eficiency variance Required informetion The following information applies to the questions displayed below Pert 5 of 15 Preble Company manufactures one product. Its varieble manufacturing overhead is applied to production based on direct lebor-hours and its standard cost card per unit is as follows points Direct natteriala: 5 pounds at 610 per pound Direct labor: 4 hours at $16 per hour Varisble overhead: 4 hours at 47 per hour 50 64 28 eook Total atandard cost per unit $142 The planning budget for March was based on producing and selling 20,000 units. However, during March the company actually produced and sold 24,600 units and incurred the following costs Pere Ruferoncos a. Purchased 164,000 pounds of raw materials at a cost of $750 per pound. All of this material was used in production. b. Direct laborers worked S7,000 hours at a rate of $17 per hour c Total variable manufacturing overhead for the month was $653 220 5. If Preble had purchased 172,000 pounds of materials at $750 per pound and used 164.000 pounds in production, what would be the materiols price varience for March? (Indicate the effect of each veriance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero veriance.), Input all amounts as positive values.) Materials price variance