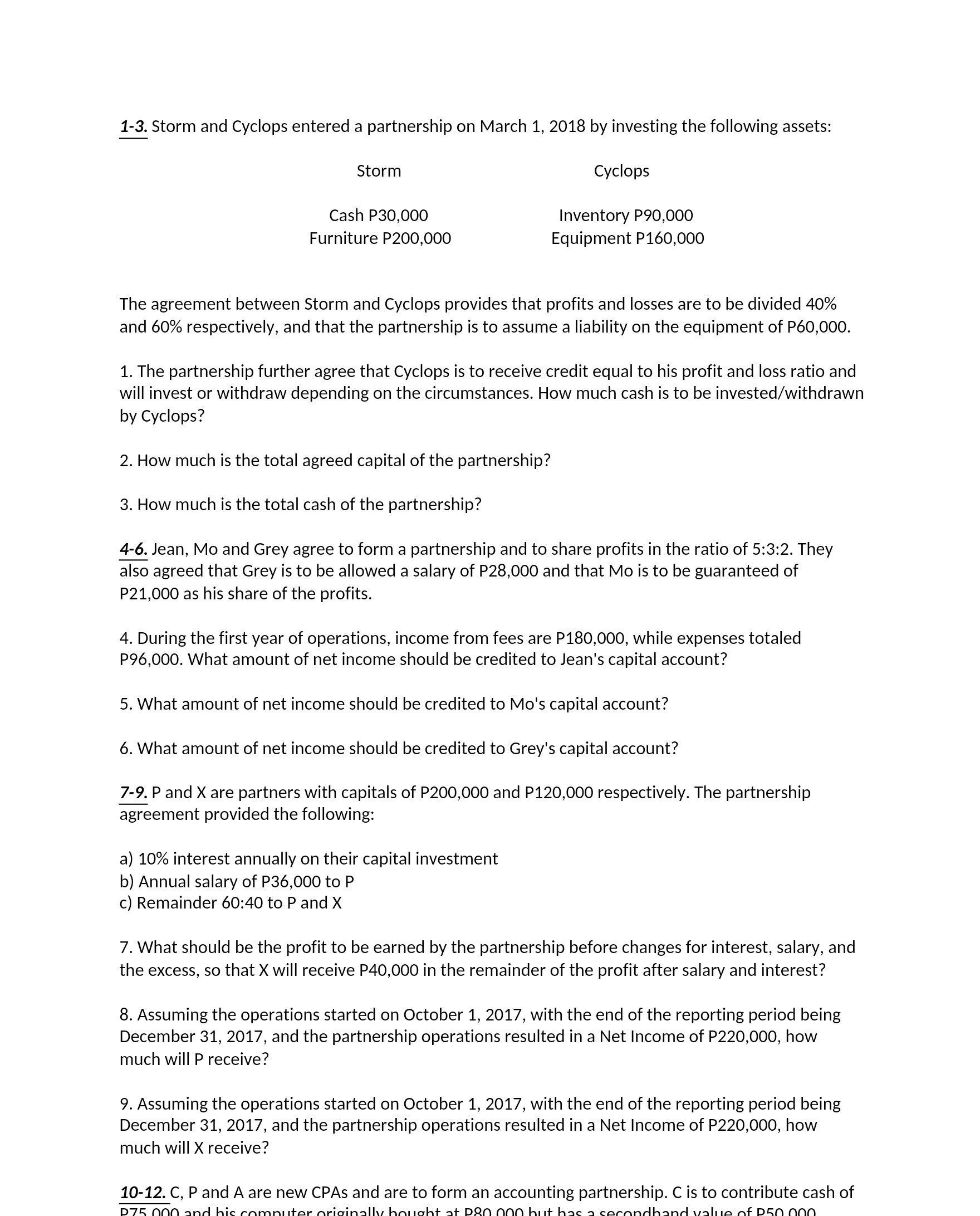

1-3. Storm and Cyclops entered a partnership on March 1, 2018 by investing the following assets: Storm Cyclops Cash P30,000 Inventory P90,000 Furniture P200,000 Equipment P160,000 The agreement between Storm and Cyclops provides that profits and losses are to be divided 40% and 60% respectively, and that the partnership is to assume a liability on the equipment of P60,000. 1. The partnership further agree that Cyclops is to receive credit equal to his profit and loss ratio and will invest or withdraw depending on the circumstances. How much cash is to be invested/withdrawn by Cyclops? 2. How much is the total agreed capital of the partnership? 3. How much is the total cash of the partnership? 4-6. Jean, Mo and Grey agree to form a partnership and to share profits in the ratio of 5:3:2. They also agreed that Grey is to be allowed a salary of P28,000 and that Mo is to be guaranteed of P21,000 as his share of the profits. 4. During the first year of operations, income from fees are P180,000, while expenses totaled P96,000. What amount of net income should be credited to Jean's capital account? 5. What amount of net income should be credited to Mo's capital account? 6. What amount of net income should be credited to Grey's capital account? 7-9. P and X are partners with capitals of P200,000 and P120,000 respectively. The partnership agreement provided the following: a) 10% interest annually on their capital investment b) Annual salary of P36,000 to P c) Remainder 60:40 to P and X 7. What should be the profit to be earned by the partnership before changes for interest, salary, and the excess, so that X will receive P40,000 in the remainder of the profit after salary and interest? 8. Assuming the operations started on October 1, 2017, with the end of the reporting period being December 31, 2017, and the partnership operations resulted in a Net Income of P220,000, how much will P receive? 9. Assuming the operations started on October 1, 2017, with the end of the reporting period being December 31, 2017, and the partnership operations resulted in a Net Income of P220,000, how much will X receive? 10-12. C, P and A are new CPAs and are to form an accounting partnership. C is to contribute cash of