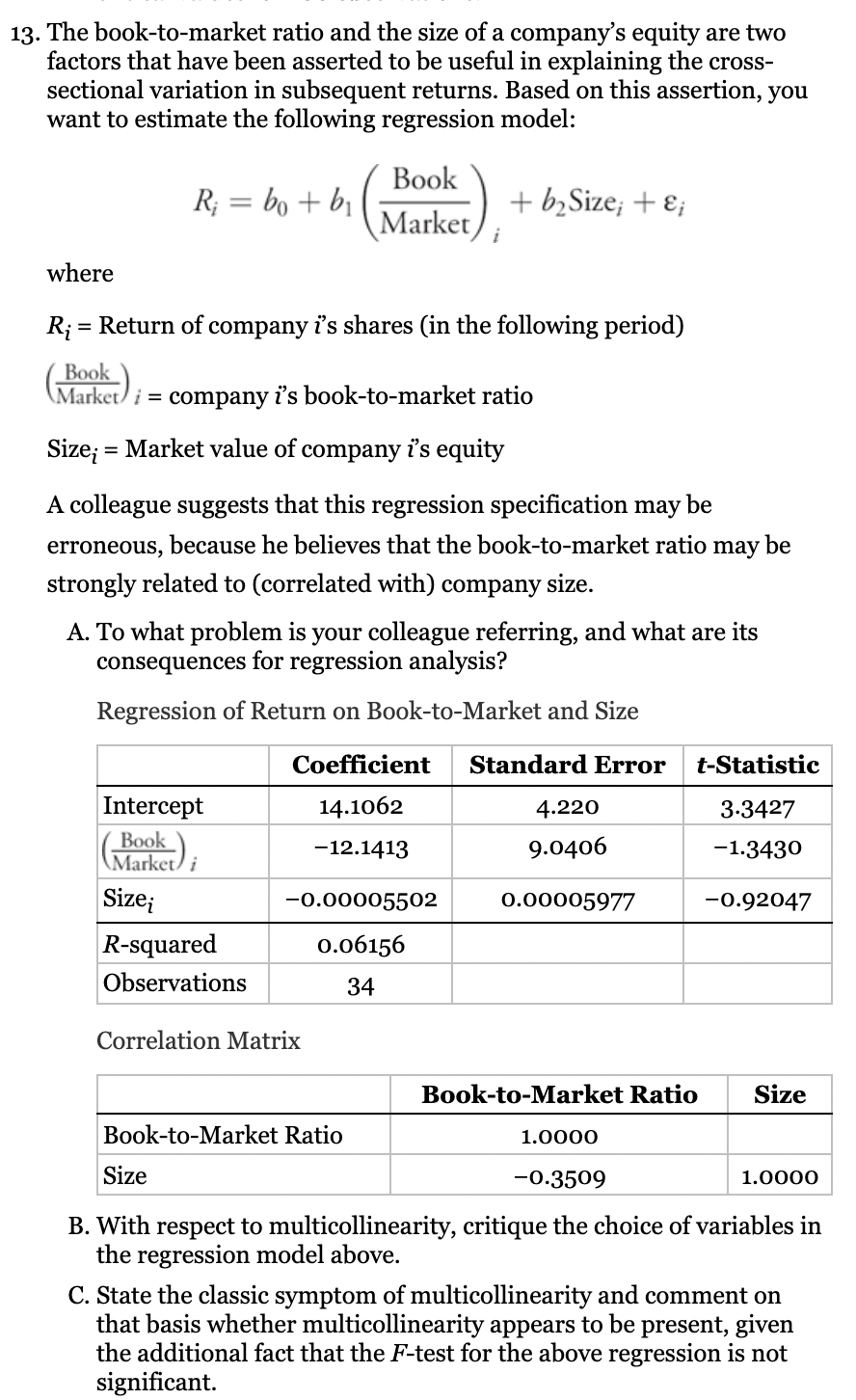

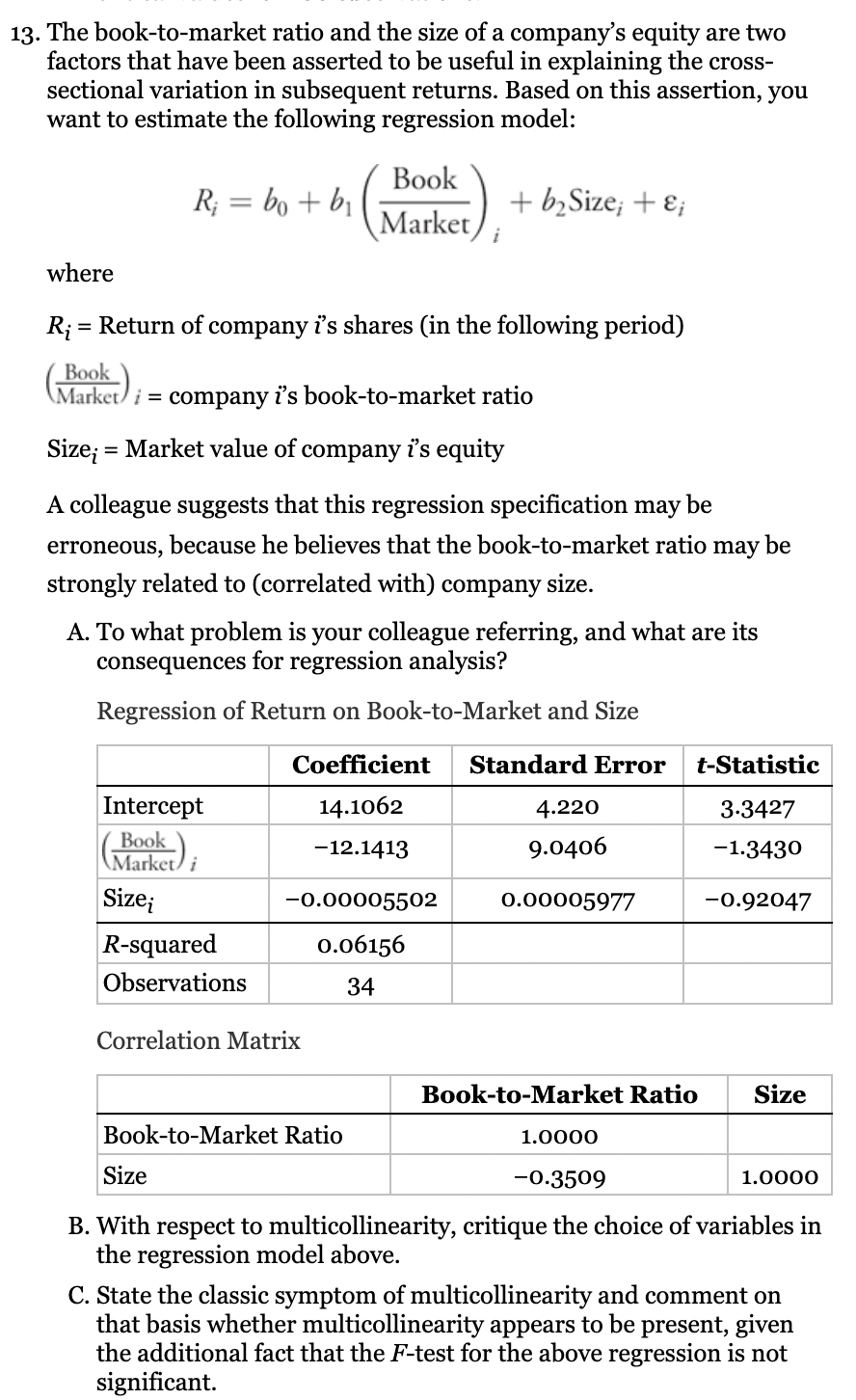

13. The book-to-market ratio and the size of a company's equity are two factors that have been asserted to be useful in explaining the cross- sectional variation in subsequent returns. Based on this assertion, you want to estimate the following regression model: R; = bo + b1 Book Market + b2 Size; + & where R; = Return of company is shares in the following period) (Market) ; = company i's book-to-market ratio Size; = Market value of company is equity A colleague suggests that this regression specification may be erroneous, because he believes that the book-to-market ratio may be strongly related to (correlated with) company size. A. To what problem is your colleague referring, and what are its consequences for regression analysis? Regression of Return on Book-to-Market and Size Coefficient Standard Error t-Statistic Intercept 14.1062 4.220 3.3427 Book) -12.1413 9.0406 -1.3430 Market Size; -0.00005502 0.00005977 -0.92047 0.06156 R-squared Observations 34 Correlation Matrix Book-to-Market Ratio Size Book-to-Market Ratio 1.0000 Size -0.3509 1.0000 B. With respect to multicollinearity, critique the choice of variables in the regression model above. C. State the classic symptom of multicollinearity and comment on that basis whether multicollinearity appears to be present, given the additional fact that the F-test for the above regression is not significant. 13. The book-to-market ratio and the size of a company's equity are two factors that have been asserted to be useful in explaining the cross- sectional variation in subsequent returns. Based on this assertion, you want to estimate the following regression model: R; = bo + b1 Book Market + b2 Size; + & where R; = Return of company is shares in the following period) (Market) ; = company i's book-to-market ratio Size; = Market value of company is equity A colleague suggests that this regression specification may be erroneous, because he believes that the book-to-market ratio may be strongly related to (correlated with) company size. A. To what problem is your colleague referring, and what are its consequences for regression analysis? Regression of Return on Book-to-Market and Size Coefficient Standard Error t-Statistic Intercept 14.1062 4.220 3.3427 Book) -12.1413 9.0406 -1.3430 Market Size; -0.00005502 0.00005977 -0.92047 0.06156 R-squared Observations 34 Correlation Matrix Book-to-Market Ratio Size Book-to-Market Ratio 1.0000 Size -0.3509 1.0000 B. With respect to multicollinearity, critique the choice of variables in the regression model above. C. State the classic symptom of multicollinearity and comment on that basis whether multicollinearity appears to be present, given the additional fact that the F-test for the above regression is not significant