Question

13. The organization tasked by Congress with the legal authority to prescribe accounting principles is: (a) the Securities and Exchange Commission (SEC). (b) the Financial

13. The organization tasked by Congress with the legal authority to prescribe accounting principles is:

(a) the Securities and Exchange Commission (SEC).

(b) the Financial Accounting Standards Board (FASB).

(c) the Financial Accounting Foundation (FAF).

(d) the Accounting Principles Board (APB).

14. The three major sections of the statement of cash flows are cash flows from:

(a) operating activities, selling activities, and investing activities.

(b) continuing activities, financing activities, and investing activities.

(c) operating activities, financing activities, and investing activities.

(d) operating activities, discontinued activities, and extraordinary activities.

15. The retained earnings are reported on which statement?

(a) Statement of cash flows

(b) Income statement

(c) Statement of retained earnings

(d) Balance sheet

16. In a multiple-step income statement, the amount left after subtracting operating expenses from gross profit but before other losses and gains that do not relate to the primary activities of the company is called:

(a) net income.

(b) earnings per share.

(c) operating income.

(d) income from continuing operations.

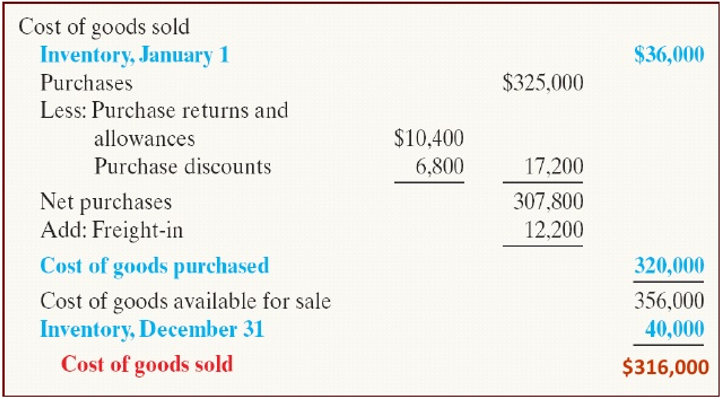

17. Using the information in the table below, calculate the proper amount of cost of goods sold for the period. Adapt the provided formula to the amounts given to find the answer.

Purchases - $275,000

Purchase Returns - $12,500

Freight-In - $45,000

Freight-Out - $15,000

Beginning Inventory - $95,000

Ending Inventory - $67,000

(a) $290,500

(b) $303,500

(c) $320,500

(d) $335,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started