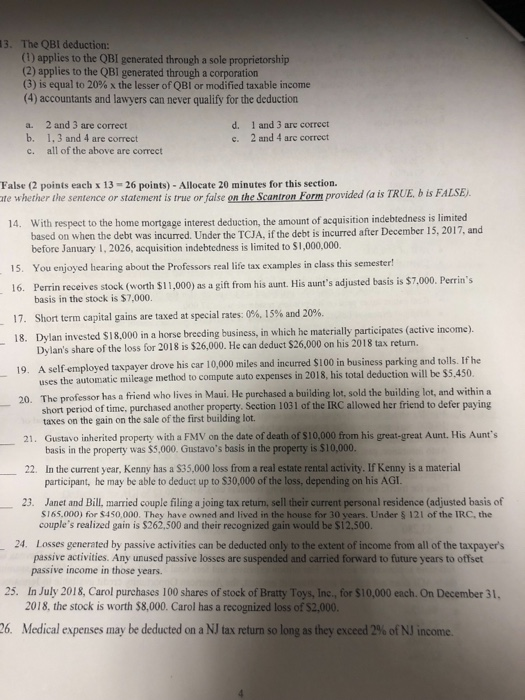

13. The QBI deduction: (1) applies to the OBI generated through a sole proprietorship (2) applies to the QBI generated through a corporation (3) is equal to 20% x the lesser of QBI or modified taxable income (4) accountants and lawyers can never qualify for the deduction 1 and 3 are correct 2 and 4 arc correct 2 and 3 are correct 1,3 and 4 are correct all of the above are correct d. a. b. c. c. False (2 points each x 13-26 points) - Allocate 20 minutes for this section. te whether the sentence or statement is true or false on the Scantron Form provided (a is TRUE, b is FALSE With respect to the home mortgage interest deduction, the amount of acquisition indebtedness is limited 14. based on when the debt was incurred. Under the TCJA, if the debt is incurred after December 15, 2017, and before January I, 2026, acquisition indebtedness is limited to $1,000,000. 15. You enjoyed hearing about the Professors real life tax examples in class this semester! 16. Perrin receives stock (worth $11,000) as a gift from his aunt. His aunt's adjusted basis is $7,000. Perrin's 17, Short term capital gains are taxed at special rates: 0%. I 5% and 20%. 18. Dylan invested $18.000 in a horse breeding business, in which he materially participates (active income). basis in the stock is $7,000. Dylan's share of the loss for 2018 is $26,000. He can deduct $26,000 on his 2018 tax return. A self employed taxpayer drove his car 10,000 miles and ineurred $100 in business parking and tolls. If he 19. the automatie mileage method to compute auto expenses in 2018, his total deduction will be $5,450. The professor has a friend who lives in Maui. He purchased a building lot, sold the building lot, and within a taxes on the gain on the sale of the first building lot. basis in the property was $5,000. Gustavo's basis in the property is S10,000. uses 20. short period of time, purchased another property. Section 1031 of the IRC allowed her friend to de 21. Gustavo inherited property with a FMV on the date of death of $10,000 from his great-great Aunt, His Aunt's 22. In the current year, Kenny has a $35,000 loss from a real estate rental activity. If Kenny is a material 23. Janet and Bill, married couple filing a joing tax return, sell their current personal residence (adjusted basis of participant, he may be able to deduct up to $30,000 of the loss, depending on his AGI. $165,000) for$4 $0.000. They have owned and lived in the house for 30 years. Under 121 of the IRC, the couple's realized gain is $262,500 and their recognized gain would be $12.500. 24. Losses generated by passive activities can be deducted only to the extent of income from all of the taxpayer's passive activities. Any unused passive losses are suspended and carried forward to future years to offset passive income in those years. 25. In July 2018, Carol purchases 100 shares of stock of Bratty Toys, Inc., for $10,000 each. On December 31, 2018, the stock is worth $8,000. Carol has a recognized loss of $2,000. 86, Medical expenses may be deducted on a NJ tax return so long as they exceed 2% of NJ income. 13. The QBI deduction: (1) applies to the OBI generated through a sole proprietorship (2) applies to the QBI generated through a corporation (3) is equal to 20% x the lesser of QBI or modified taxable income (4) accountants and lawyers can never qualify for the deduction 1 and 3 are correct 2 and 4 arc correct 2 and 3 are correct 1,3 and 4 are correct all of the above are correct d. a. b. c. c. False (2 points each x 13-26 points) - Allocate 20 minutes for this section. te whether the sentence or statement is true or false on the Scantron Form provided (a is TRUE, b is FALSE With respect to the home mortgage interest deduction, the amount of acquisition indebtedness is limited 14. based on when the debt was incurred. Under the TCJA, if the debt is incurred after December 15, 2017, and before January I, 2026, acquisition indebtedness is limited to $1,000,000. 15. You enjoyed hearing about the Professors real life tax examples in class this semester! 16. Perrin receives stock (worth $11,000) as a gift from his aunt. His aunt's adjusted basis is $7,000. Perrin's 17, Short term capital gains are taxed at special rates: 0%. I 5% and 20%. 18. Dylan invested $18.000 in a horse breeding business, in which he materially participates (active income). basis in the stock is $7,000. Dylan's share of the loss for 2018 is $26,000. He can deduct $26,000 on his 2018 tax return. A self employed taxpayer drove his car 10,000 miles and ineurred $100 in business parking and tolls. If he 19. the automatie mileage method to compute auto expenses in 2018, his total deduction will be $5,450. The professor has a friend who lives in Maui. He purchased a building lot, sold the building lot, and within a taxes on the gain on the sale of the first building lot. basis in the property was $5,000. Gustavo's basis in the property is S10,000. uses 20. short period of time, purchased another property. Section 1031 of the IRC allowed her friend to de 21. Gustavo inherited property with a FMV on the date of death of $10,000 from his great-great Aunt, His Aunt's 22. In the current year, Kenny has a $35,000 loss from a real estate rental activity. If Kenny is a material 23. Janet and Bill, married couple filing a joing tax return, sell their current personal residence (adjusted basis of participant, he may be able to deduct up to $30,000 of the loss, depending on his AGI. $165,000) for$4 $0.000. They have owned and lived in the house for 30 years. Under 121 of the IRC, the couple's realized gain is $262,500 and their recognized gain would be $12.500. 24. Losses generated by passive activities can be deducted only to the extent of income from all of the taxpayer's passive activities. Any unused passive losses are suspended and carried forward to future years to offset passive income in those years. 25. In July 2018, Carol purchases 100 shares of stock of Bratty Toys, Inc., for $10,000 each. On December 31, 2018, the stock is worth $8,000. Carol has a recognized loss of $2,000. 86, Medical expenses may be deducted on a NJ tax return so long as they exceed 2% of NJ income