Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13. When you are valuing a company, the usual methodology is to forecast near-term cashflows based on available information and use the growing perpetuity formula

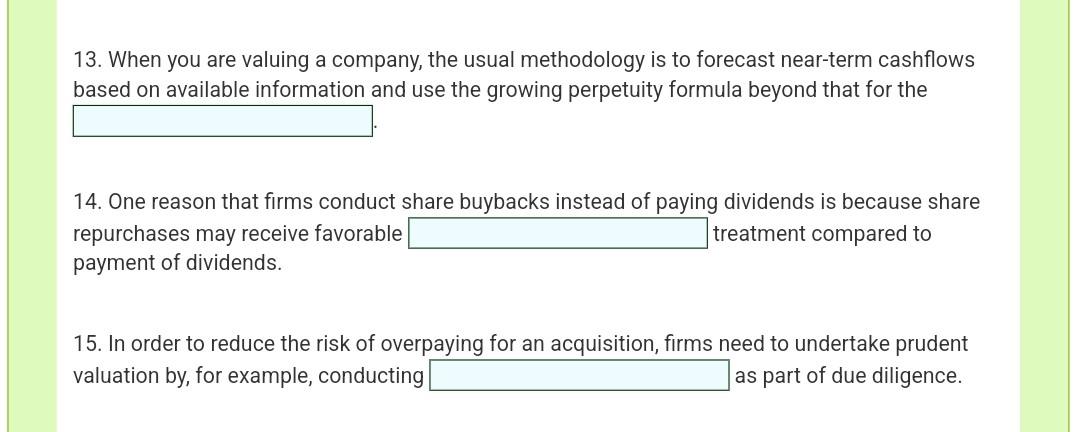

13. When you are valuing a company, the usual methodology is to forecast near-term cashflows based on available information and use the growing perpetuity formula beyond that for the 14. One reason that firms conduct share buybacks instead of paying dividends is because share repurchases may receive favorable treatment compared to payment of dividends. 15. In order to reduce the risk of overpaying for an acquisition, firms need to undertake prudent valuation by, for example, conducting as part of due diligence

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started