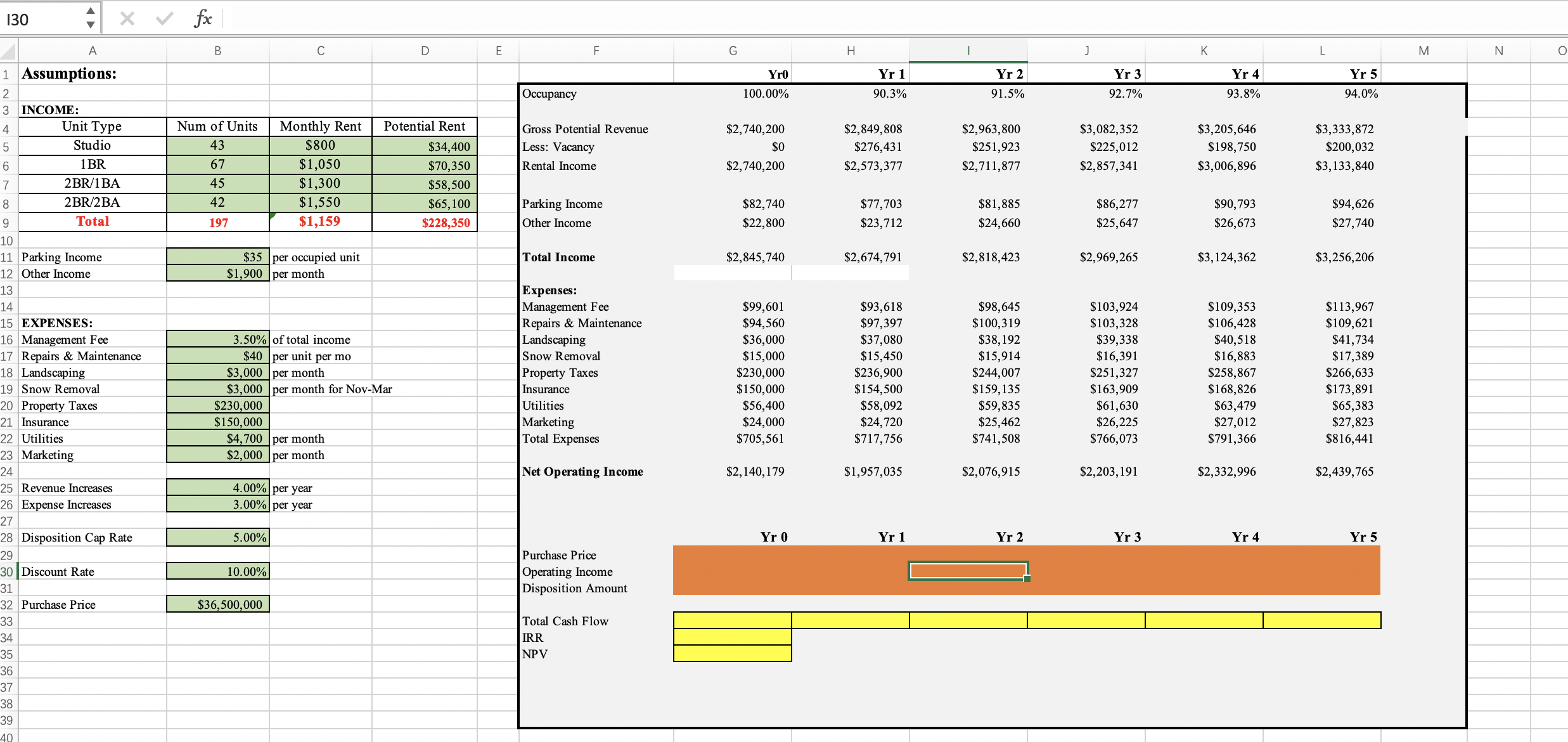

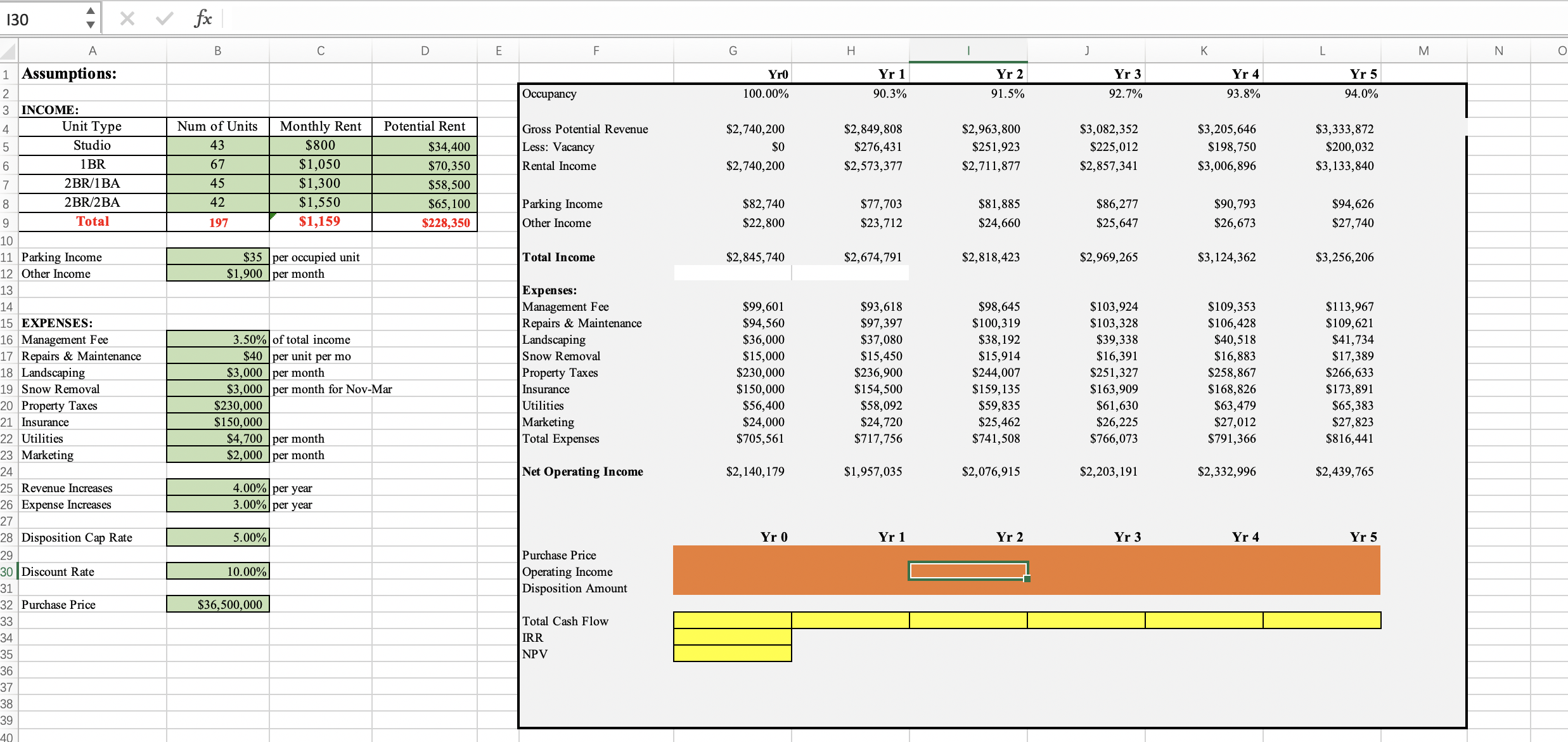

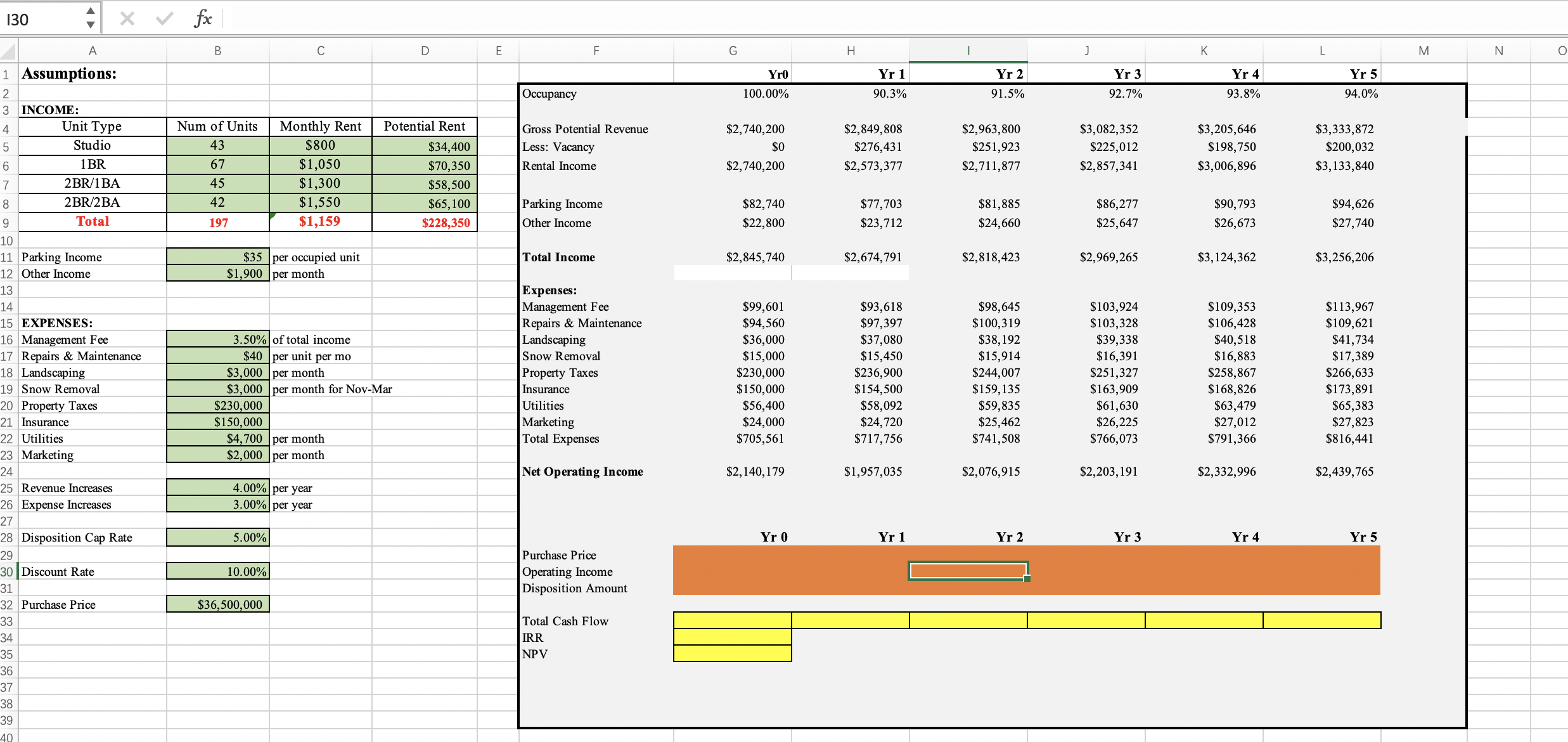

130 X V fx A B C D E F G H J K L M N Assumptions: Yro Yr 1 Yr 2 Ir 3 Yr 4 Yr 5 Occupancy 100.00% 90.3% 91.5% 92.7% 93.8% 94.0% INCOME: Unit Type Num of Units Monthly Rent Potential Rent Gross Potential Revenue $2, 740,200 $2,849,808 $2,963,800 $3,082,352 $3,205,646 $3,333,872 Studio 4 $800 $34,400 Less: Vacancy $0 $276,431 $251,923 $225,012 $198, 750 $200,032 I BR 67 $1,050 $70,350 Rental Income $2, 740,200 $2,573,377 $2,711,877 $2,857,341 $3,006,896 $3, 133,840 2BR/1 BA 45 $1,300 $58,500 2BR/2BA 42 $1,550 $65, 100 Parking Income $82, 740 $77,703 $81,885 $86,277 $90, 793 $94,626 Tota 197 $1,159 $228,350 Other Income $22,800 $23, 712 $24,660 $25,647 $26,673 $27,740 10 11 Parking Income $35 per occupied unit Total Income $2,845, 740 $2, 674, 791 $2,818,423 $2,969,265 $3, 124,362 $3,256,206 12 Other Income $1,900 per month 13 Expenses: 14 Management Fee $99,601 $93,618 $98,645 $103,924 $109,353 $113,967 15 EXPENSES: Repairs & Maintenance $94,560 $97,397 $100,319 $103,328 $106,428 $109,621 16 Management Fee 3.50% of total income Landscaping $36,000 $37,080 $38, 192 $39,338 $40,518 $41,734 17 Repairs & Maintenance $40 per unit per mo Snow Removal $15,000 $15,450 $15,914 $16,391 $16,883 $17,389 18 Landscaping $3,000 per month Property Taxes $230,000 $236,900 $244,007 $251,327 $258,867 $266,633 19 Snow Removal $3,000 per month for Nov-Mar Insurance $150,000 $154,500 $159,135 $163,909 $168,826 $173,891 20 Property Taxes $230,000 Utilities $56,400 $58,092 $59,835 $61,630 $63,479 $65,383 1 Insurance $150,000 Marketing $24,000 $24, 720 $25,462 $26,225 $27,012 $27,823 22 Utilities $4, 700 per month Total Expenses $705,561 $717,756 $741,508 $766,073 $791,366 $816,441 23 Marketing $2,000 per month Net Operating Income $2, 140, 179 $1,957,035 $2,076,915 $2,203, 191 $2,332,996 $2,439, 765 25 Revenue Increases 4.00% per year 26 Expense Increases 3.00% per year 27 Disposition Cap Rate 5.00% Yr 0 Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 29 Purchase Price Discount Rate 10.00% Operating Income 31 Disposition Amount Purchase Price $36,500,000 33 Total Cash Flow 34 IRR 35 NPV 36 38