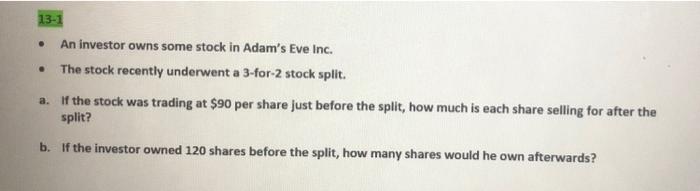

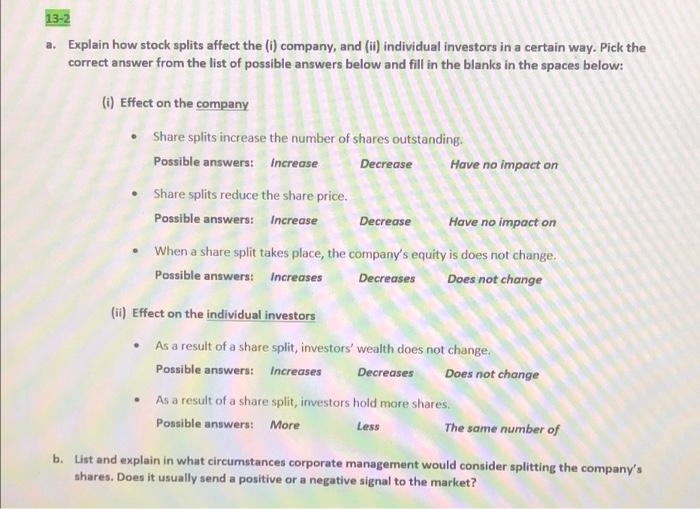

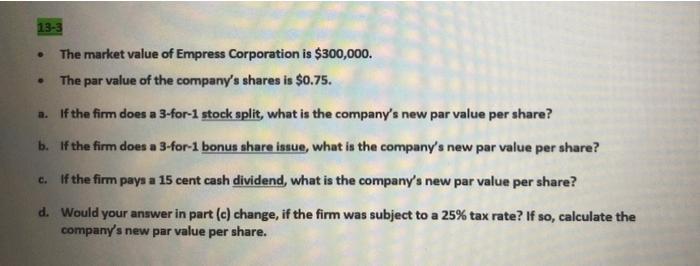

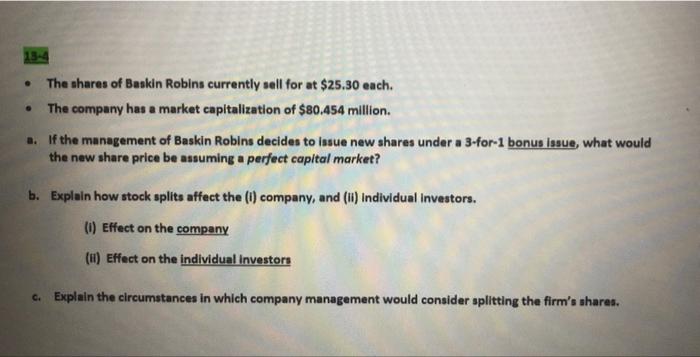

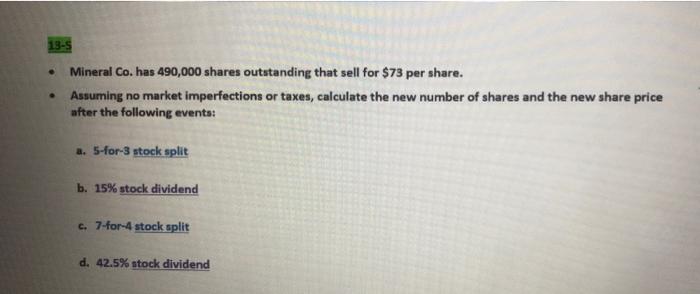

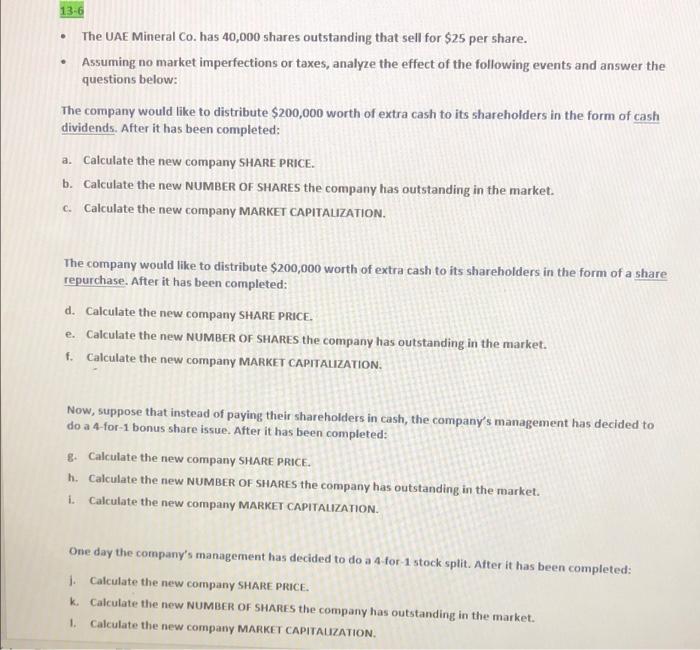

13-1 . . An investor owns some stock in Adam's Eve Inc. The stock recently underwent a 3-for-2 stock split. a. If the stock was trading at $90 per share just before the split, how much is each share selling for after the split? b. If the investor owned 120 shares before the split, how many shares would he own afterwards? 13-2 a. Explain how stock splits affect the (i) company, and (ii) individual investors in a certain way. Pick the correct answer from the list of possible answers below and fill in the blanks in the spaces below: (i) Effect on the company Share splits increase the number of shares outstanding. Possible answers: Increase Decrease Have no impact on Share splits reduce the share price. Possible answers: Increase Decrease Have no impact on When a share split takes place, the company's equity is does not change. Possible answers: Increases Decreases Does not change (ii) Effect on the individual investors As a result of a share split, investors' wealth does not change. Possible answers: Increases Decreases Does not change As a result of a share split, investors hold more shares Possible answers: More Less The same number of b. List and explain in what circumstances corporate management would consider splitting the company's shares. Does it usually send a positive or a negative signal to the market? 13-3 . The market value of Empress Corporation is $300,000. The par value of the company's shares is $0.75. . . If the firm does a 3-for-1 stock split, what is the company's new par value per share? b. If the firm does a 3-for-1 bonus share issue, what is the company's new par value per share? If the firm pays a 15 cent cash dividend, what is the company's new par value per share? C. d. Would your answer in part (c) change, if the firm was subject to a 25% tax rate? If so, calculate the company's new par value per share. . . The shares of Baskin Robins currently sell for at $25.30 each. The company has a market capitalization of $80.454 million. a. If the management of Baskin Robins decides to issue new shares under a 3-for-1 bonus issue, what would the new share price be assuming a perfect capital market? b. Explain how stock splits affect the (1) company, and (ii) Individual Investors. (1) Effect on the company (ii) Effect on the individual investors c. Explain the circumstances in which company management would consider splitting the firm's shares. 13-5 . Mineral Co. has 490,000 shares outstanding that sell for $73 per share. Assuming no market imperfections or taxes, calculate the new number of shares and the new share price after the following events: a. 5-for-3 stock split b. 15% stock dividend c. 7-for-4 stock split d. 42.5% stock dividend 13-6 . The UAE Mineral Co. has 40,000 shares outstanding that sell for $25 per share. Assuming no market imperfections or taxes, analyze the effect of the following events and answer the questions below: The company would like to distribute $200,000 worth of extra cash to its shareholders in the form of cash dividends. After it has been completed: a. Calculate the new company SHARE PRICE. b. Calculate the new NUMBER OF SHARES the company has outstanding in the market. c. Calculate the new company MARKET CAPITALIZATION. The company would like to distribute $200,000 worth of extra cash to its shareholders in the form of a share repurchase. After it has been completed: d. Calculate the new company SHARE PRICE. e Calculate the new NUMBER OF SHARES the company has outstanding in the market. f. Calculate the new company MARKET CAPITALIZATION. Now, suppose that instead of paying their shareholders in cash, the company's management has decided to do a 4-for-1 bonus share issue. After it has been completed: 8. Calculate the new company SHARE PRICE. h. Calculate the new NUMBER OF SHARES the company has outstanding in the market. 1. Calculate the new company MARKET CAPITALIZATION. One day the company's management has decided to do a 4 for 1 stock split. After it has been completed: 1. Calculate the new company SHARE PRICE. k. Calculate the new NUMBER OF SHARES the company has outstanding in the market. 1. Calculate the new company MARKET CAPITAUZATION