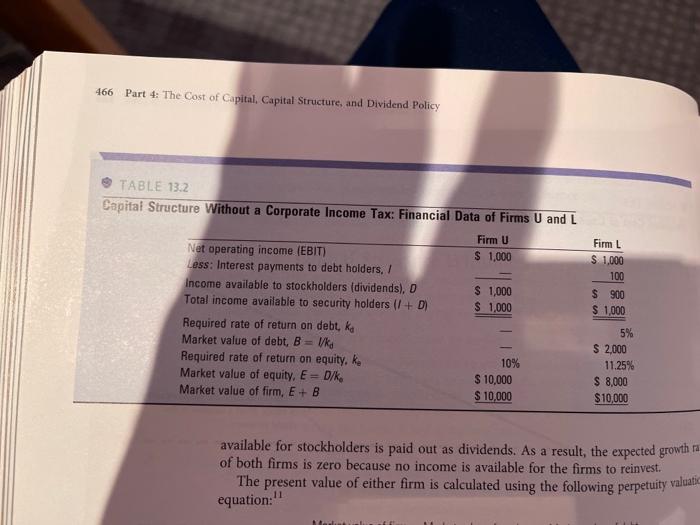

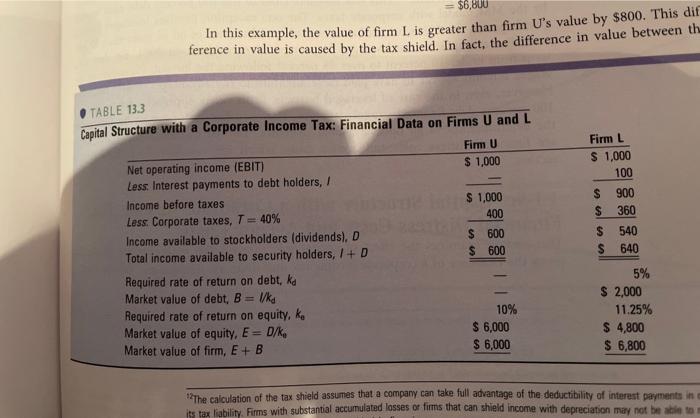

| 13-10 Problems 1. Referring to Table 13.2, calculate the market value of firm L (without a corporate income tax) if the city amount in its capital structure decreases to $5,000 and Color blocks behind the numbers denola problems that have check answers provided at the end of the book of Capital, Capital Structure, and Dividend Policy the debt amount increases to $5,000. At this capital structure, the cost of equity is 15 percent. 2. a. Referring to Table 13.3, calculate the market value of firm L (with a corporate income tax) if the equity amount in its capital structure decreases to $3,000 and the debt amount increases to $3,000. b. For firm L (with equity = $3,000 and debt $3,000), calculate (i) the income available to the stockholders and (ii) the cost of equity. 466 Part 4: The Cost of Capital, Capital Structure, and Dividend Policy TABLE 13.2 Capital Structure Without a Corporate Income Tax: Financial Data of Firms U and L Firm U Net operating income (EBIT) $ 1,000 Less: Interest payments to debt holders, Income available to stockholders (dividends), D $ 1,000 Total income available to security holders (I + D) $ 1,000 Required rate of return on debt, ka Market value of debt, B = Uka Required rate of return on equity, ko 10% Market value of equity, E= D/K, $ 10,000 Market value of firm, E+ B $ 10,000 Firm L $ 1.000 100 $ 900 $ 1,000 5% $ 2,000 11.25% $ 8,000 $10,000 available for stockholders is paid out as dividends. As a result, the expected growth ra of both firms is zero because no income is available for the firms to reinvest. The present value of either firm is calculated using the following perpetuity valuatio- equation: $6,800 In this example, the value of firm L is greater than firm U's value by $800. This dif ference in value is caused by the tax shield. In fact, the difference in value between the TABLE 13.3 Firm L $ 1,000 100 $ $ 900 360 Capital Structure with a Corporate Income Tax: Financial Data on Firms U and L Firm U Net operating income (EBIT) $ 1,000 Less Interest payments to debt holders, Income before taxes $ 1,000 Less: Corporate taxes, T=40% 400 Income available to stockholders (dividends), D $ 600 Total income available to security holders, I+D $ 600 Required rate of return on debt, ka Market value of debt, B= Wkd Required rate of return on equity, ko 10% Market value of equity, E= D/K. $ 6,000 Market value of firm, E+ B $ 6,000 $ S 540 640 5% $ 2,000 11.25% $ 4,800 $ 6,800 The calculation of the tax shield assumes that a company can take full advantage of the deductibility of interest payments in its tax liability. Firms with substantial accumulated losses or firms that can shield income with depreciation may not be able to | 13-10 Problems 1. Referring to Table 13.2, calculate the market value of firm L (without a corporate income tax) if the city amount in its capital structure decreases to $5,000 and Color blocks behind the numbers denola problems that have check answers provided at the end of the book of Capital, Capital Structure, and Dividend Policy the debt amount increases to $5,000. At this capital structure, the cost of equity is 15 percent. 2. a. Referring to Table 13.3, calculate the market value of firm L (with a corporate income tax) if the equity amount in its capital structure decreases to $3,000 and the debt amount increases to $3,000. b. For firm L (with equity = $3,000 and debt $3,000), calculate (i) the income available to the stockholders and (ii) the cost of equity. 466 Part 4: The Cost of Capital, Capital Structure, and Dividend Policy TABLE 13.2 Capital Structure Without a Corporate Income Tax: Financial Data of Firms U and L Firm U Net operating income (EBIT) $ 1,000 Less: Interest payments to debt holders, Income available to stockholders (dividends), D $ 1,000 Total income available to security holders (I + D) $ 1,000 Required rate of return on debt, ka Market value of debt, B = Uka Required rate of return on equity, ko 10% Market value of equity, E= D/K, $ 10,000 Market value of firm, E+ B $ 10,000 Firm L $ 1.000 100 $ 900 $ 1,000 5% $ 2,000 11.25% $ 8,000 $10,000 available for stockholders is paid out as dividends. As a result, the expected growth ra of both firms is zero because no income is available for the firms to reinvest. The present value of either firm is calculated using the following perpetuity valuatio- equation: $6,800 In this example, the value of firm L is greater than firm U's value by $800. This dif ference in value is caused by the tax shield. In fact, the difference in value between the TABLE 13.3 Firm L $ 1,000 100 $ $ 900 360 Capital Structure with a Corporate Income Tax: Financial Data on Firms U and L Firm U Net operating income (EBIT) $ 1,000 Less Interest payments to debt holders, Income before taxes $ 1,000 Less: Corporate taxes, T=40% 400 Income available to stockholders (dividends), D $ 600 Total income available to security holders, I+D $ 600 Required rate of return on debt, ka Market value of debt, B= Wkd Required rate of return on equity, ko 10% Market value of equity, E= D/K. $ 6,000 Market value of firm, E+ B $ 6,000 $ S 540 640 5% $ 2,000 11.25% $ 4,800 $ 6,800 The calculation of the tax shield assumes that a company can take full advantage of the deductibility of interest payments in its tax liability. Firms with substantial accumulated losses or firms that can shield income with depreciation may not be able to