Answered step by step

Verified Expert Solution

Question

1 Approved Answer

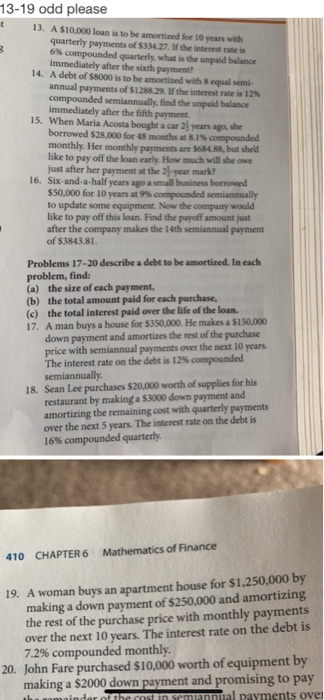

13-19 odd please 13-19 odd please 4 13. A $10,000 loan is to be amortized for 10 years with quarterly payments of $33.27. If the

13-19 odd please

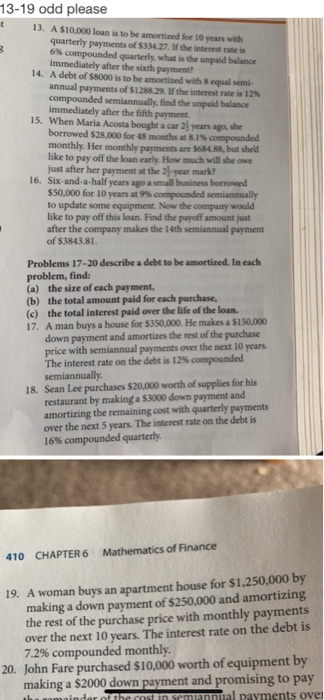

13-19 odd please 4 13. A $10,000 loan is to be amortized for 10 years with quarterly payments of $33.27. If the interest rate is 6% compounded quarterly, what is the unpaid balance immediately after the sixth payment? 14. A debt of 58000 is to be amortized with equal semi- annual payments of $1288.29. If the interest rate is 12% compounded semiannually find the unpaid balance immediately after the fifth payment 15. When Maria Acosta bought a car 2 years ago, she borrowed $28,000 for 18 months at 8.1 compounded monthly. Her monthly payments are 5684.88, but sheid like to pay off the loan carly. How much will she owe just after her payment at the 24-year mark? 16. Six-and-a-half years ago a small business borrowed 550,000 for 10 years at 9 compounded semiannually to update some equipment. Now the company would like to pay off this loan. Find the payoff amount just after the company makes the 14th semiannual payment of $3843.81 Problems 17-20 describe a debt to be amortized. In each problem, find: (a) the size of each payment, (b) the total amount paid for each purchase, (c) the total interest paid over the life of the loan. 17. A man buys a house for $350.000. He makes a $150,000 down payment and amortizes the rest of the purchase price with semiannual payments over the next 10 years. The interest rate on the debt is 12 compounded semiannually. 18. Sean Lee purchases $20,000 worth of supplies for his restaurant by making a $3000 down payment and amortizing the remaining cost with quarterly payments over the next 5 years. The interest rate on the debt is 16% compounded quarterly 410 CHAPTER 6 Mathematics of Finance 19. A woman buys an apartment house for $1,250,000 by making a down payment of $250,000 and amortizing the rest of the purchase price with monthly payments over the next 10 years. The interest rate on the debt is 7.2% compounded monthly. 20. John Fare purchased $10,000 worth of equipment by making a $2000 down payment and promising to pay ha amainder of the cost in semiannual payments over

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started