1-32 study guide questions

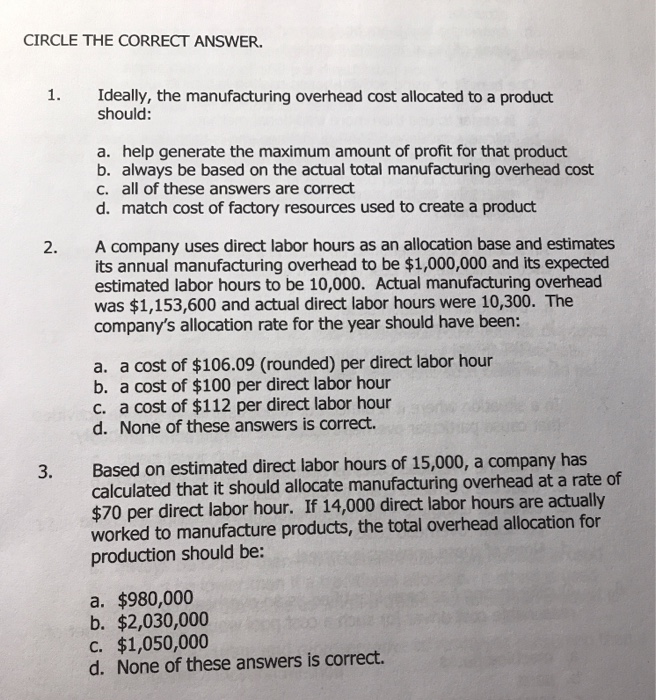

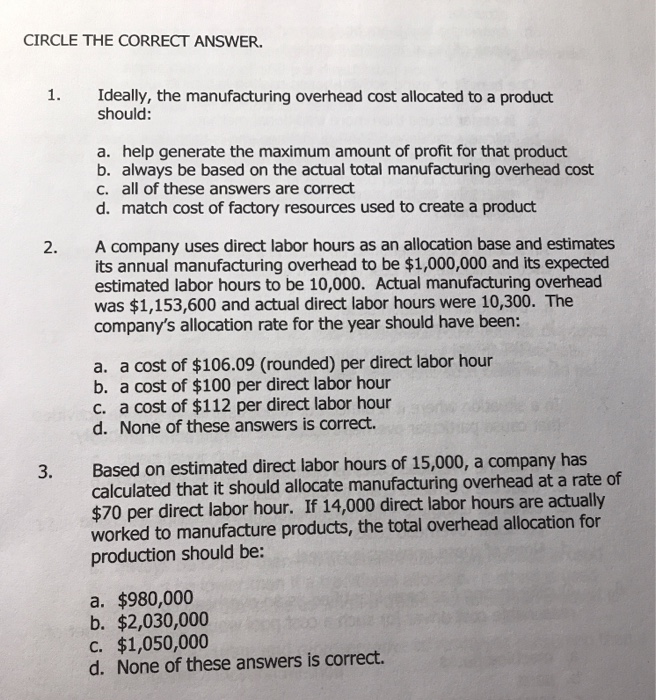

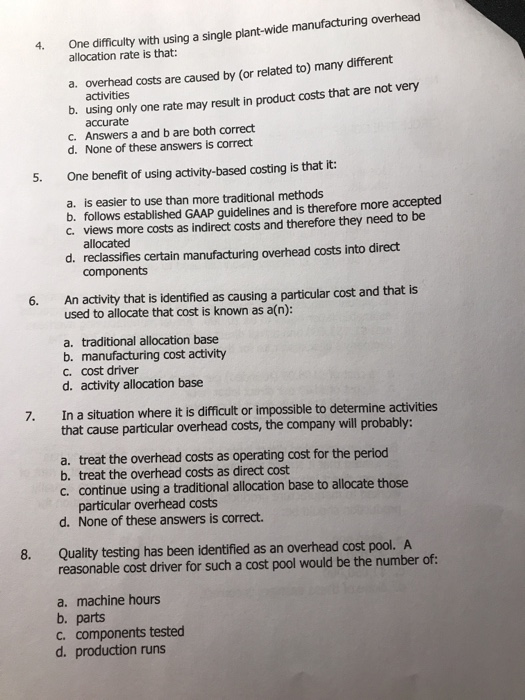

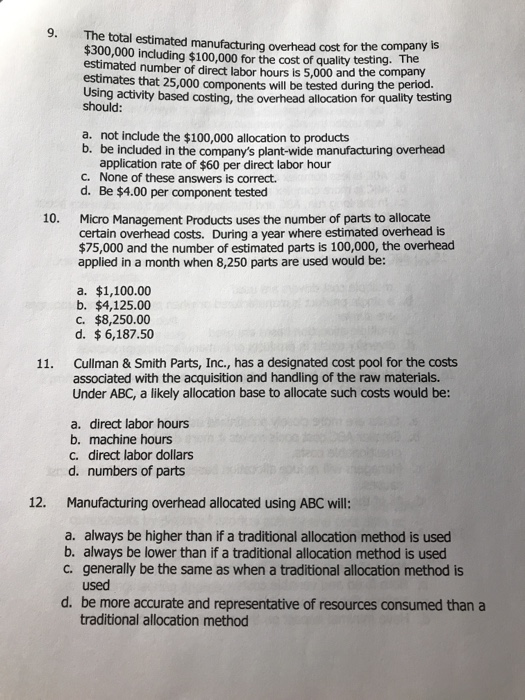

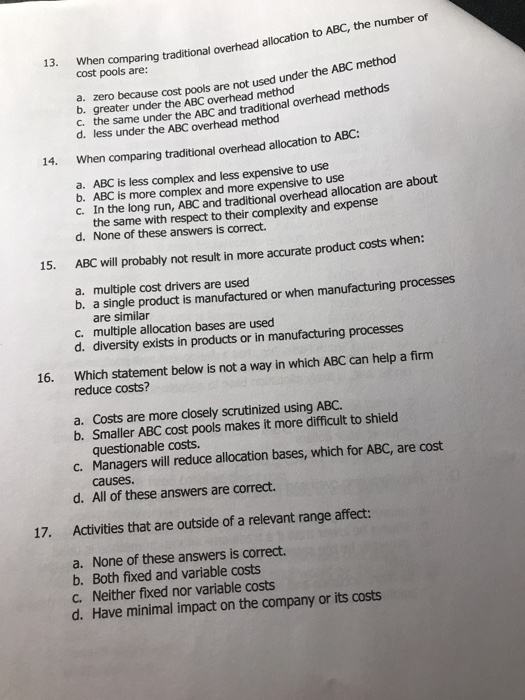

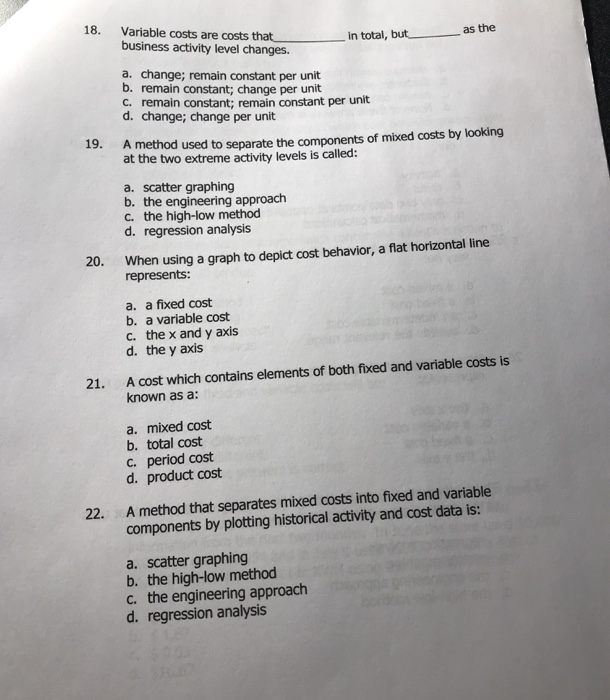

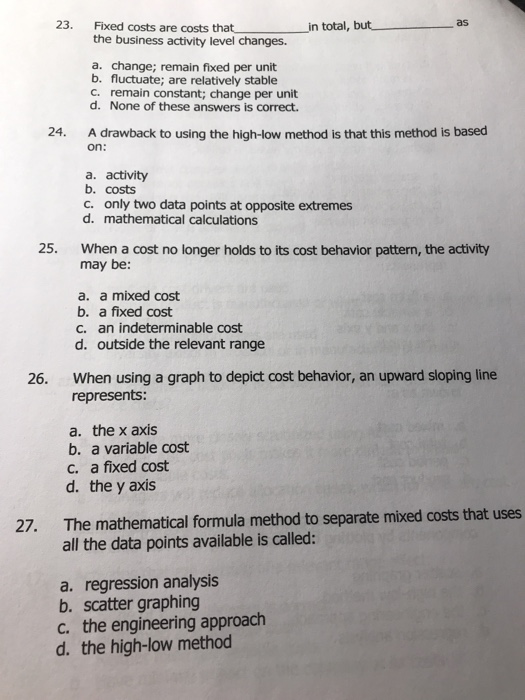

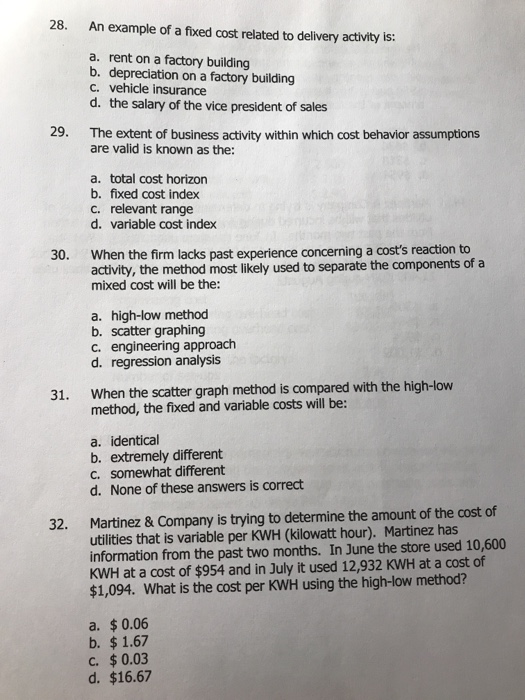

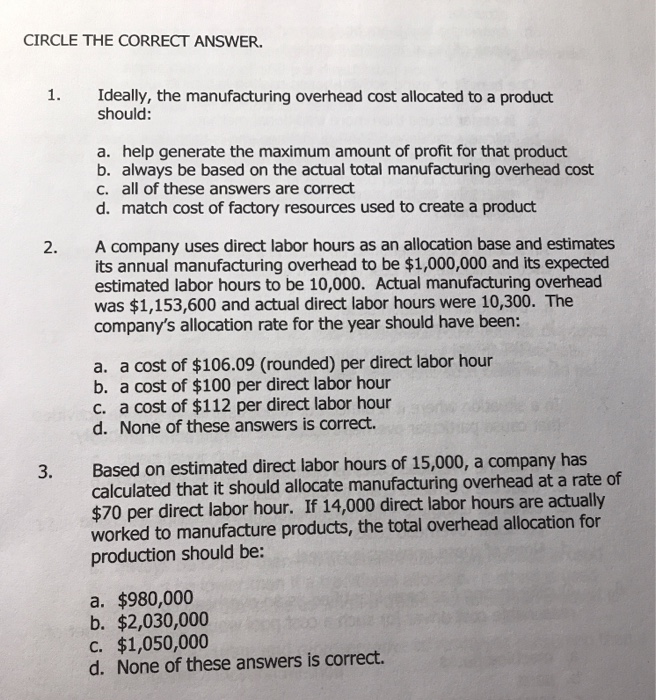

CIRCLE THE CORRECT ANSWER. Ideally, the manufacturing overhead cost allocated to a product should: a. help generate the maximum amount of profit for that product b. always be based on the actual total manufacturing overhead cost C. all of these answers are correct d. match cost of factory resources used to create a product A company uses direct labor hours as an allocation base and estimates its annual manufacturing overhead to be $1,000,000 and its expected estimated labor hours to be 10,000. Actual manufacturing overhead was $1,153,600 and actual direct labor hours were 10,300. The company's allocation rate for the year should have been: a. a cost of $106.09 (rounded) per direct labor hour b. a cost of $100 per direct labor hour c. a cost of $112 per direct labor hour d. None of these answers is correct. Based on estimated direct labor hours of 15,000, a company has calculated that it should allocate manufacturing overhead at a rate of $70 per direct labor hour. If 14,000 direct labor hours are actually worked to manufacture products, the total overhead allocation for production should be: a. $980,000 b. $2,030,000 C. $1,050,000 d. None of these answers is correct. One difficulty with using a single plant-wide manufacturing overhead allocation rate is that: a. overhead costs are caused by (or related to many different activities b. using only one rate may result in product costs that are not very accurate c. Answers a and b are both correct d. None of these answers is correct One benefit of using activity-based costing is that it: a. is easier to use than more traditional methods b. follows established GAAP quidelines and is therefore more accepted C. Views more costs as Indirect costs and therefore they need to be allocated d. reclassifies certain manufacturing overhead costs into direct components 6. An activity that is identified as causing a particular cost and that is used to allocate that cost is known as a(n): a. traditional allocation base b. manufacturing cost activity C. cost driver d. activity allocation base 7. In a situation where it is difficult or impossible to determine activities that cause particular overhead costs, the company will probably: a. treat the overhead costs as operating cost for the period b. treat the overhead costs as direct cost C. continue using a traditional allocation base to allocate those particular overhead costs d. None of these answers is correct. 8. Quality testing has been identified as an overhead cost pool. A reasonable cost driver for such a cost pool would be the number of: a. machine hours b. parts C. components tested d. production runs 13. hen comparing traditional overhead allocation to ABC, the number of cost pools are: st pools are not used under the ABC method a. zero because cost pools are not used under the ABC b. greater under the ABC overhead method C. the same under the ABC and traditional overhead methods d. less under the ABC overhead method 14. When comparing traditional overhead allocation to ABC: a. ABC is less complex and less expensive to use b. ABC is more complex and more expensive to use C. In the long run, ABC and traditional overhead allocation are about the same with respect to their complexity and expense d. None of these answers is correct. ABC will probably not result in more accurate product costs when: 16. a. multiple cost drivers are used b. a single product is manufactured or when manufacturing processes are similar C. multiple allocation bases are used d. diversity exists in products or in manufacturing processes Which statement below is not a way in which ABC can help a firm reduce costs? a. Costs are more closely scrutinized using ABC. b. Smaller ABC cost pools makes it more difficult to shield questionable costs. C. Managers will reduce allocation bases, which for ABC, are cost causes. d. All of these answers are correct. 17. Activities that are outside of a relevant range affect: a. None of these answers is correct. b. Both fixed and variable costs C. Neither fixed nor variable costs d. Have minimal impact on the company or its costs 23. Fixed costs are costs that the business activity level changes. _in total, but a. change; remain fixed per unit b. fluctuate; are relatively stable C. remain constant; change per unit d. None of these answers is correct. 24. A drawback to using the high-low method is that this method is based on: a. activity b. costs c. only two data points at opposite extremes d. mathematical calculations 25. When a cost no longer holds to its cost behavior pattern, the activity may be: a. a mixed cost b. a fixed cost c. an indeterminable cost d. outside the relevant range 26. When using a graph to depict cost behavior, an upward sloping line represents: a. the x axis b. a variable cost c. a fixed cost d. the y axis 27. The mathematical formula method to separate mixed costs that uses all the data points available is called: a. regression analysis b. scatter graphing C. the engineering approach d. the high-low method 28. An example of a fixed cost related to delivery activity is: a. rent on a factory building b. depreciation on a factory building C. vehicle insurance d. the salary of the vice president of sales 29. The extent of business activity within which cost behavior assumptions are valid is known as the: a. total cost horizon b. fixed cost index C. relevant range d. variable cost index 30. When the firm lacks past experience concerning a cost's reaction to activity, the method most likely used to separate the components of a mixed cost will be the: a. high-low method b. scatter graphing C. engineering approach d. regression analysis 31. When the scatter graph method is compared with the high-low method, the fixed and variable costs will be: a. identical b. extremely different C. somewhat different d. None of these answers is correct 32. Martinez & Company is trying to determine the amount of the cost of utilities that is variable per KWH (kilowatt hour). Martinez has information from the past two months. In June the store used 10,600 KWH at a cost of $954 and in July it used 12,932 KWH at a cost of $1,094. What is the cost per KWH using the high-low method? a. $ 0.06 b. $ 1.67 c. $ 0.03 d. $16.67