Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13&23 Problem 13 Intro You bought 50 call option contracts for $1.57 per option. The options have a strike price of $83 and the current

13&23

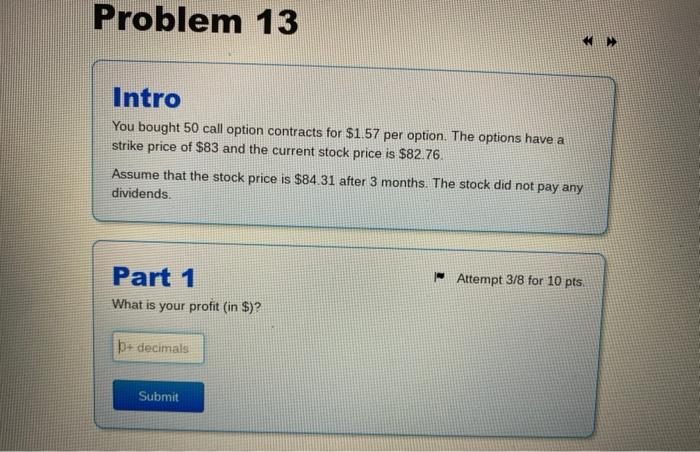

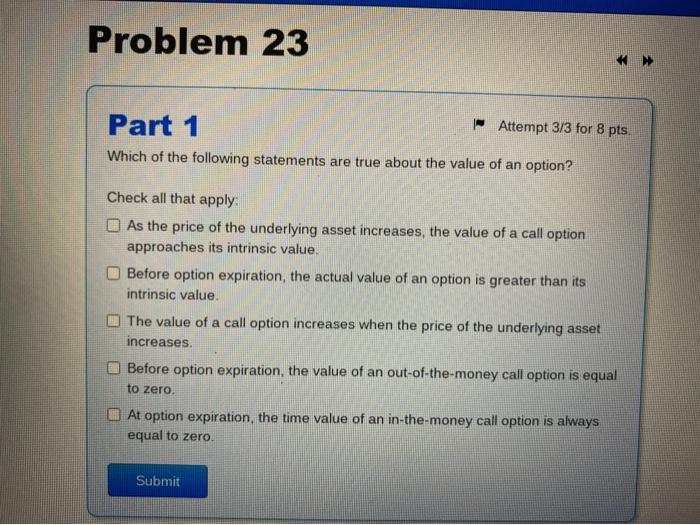

Problem 13 Intro You bought 50 call option contracts for $1.57 per option. The options have a strike price of $83 and the current stock price is $82.76 Assume that the stock price is $84.31 after 3 months. The stock did not pay any dividends. Attempt 3/8 for 10 pts Part 1 What is your profit (in $)? + decimals Submit Problem 23 Part 1 Attempt 3/3 for 8 pts. Which of the following statements are true about the value of an option? Check all that apply As the price of the underlying asset increases, the value of a call option approaches its intrinsic value. Before option expiration, the actual value of an option is greater than its intrinsic value. The value of a call option increases when the price of the underlying asset increases Before option expiration, the value of an out-of-the-money call option is equal to zero At option expiration, the time value of an in-the-money call option is always equal to zero Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started