Question

question 1 discounted payback period For this question, you will calculate the discounted payback period on the following series of cash flows: $-10,000, $2,000, $4,000,

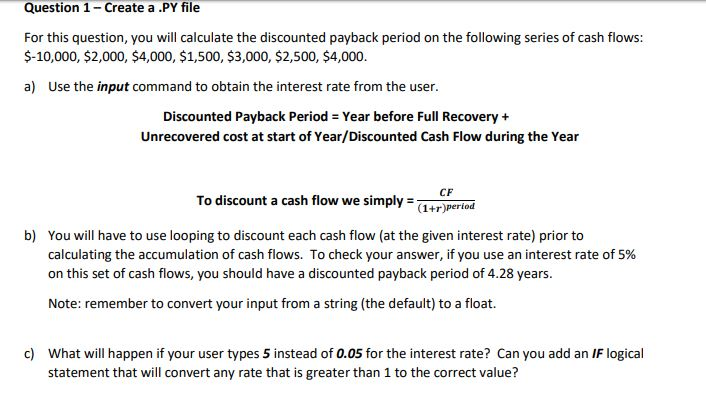

question 1 discounted payback period

For this question, you will calculate the discounted payback period on the following series of cash flows: $-10,000, $2,000, $4,000, $1,500, $3,000, $2,500, $4,000. a) Use the input command to obtain the interest rate from the user. Discounted Payback Period = Year before Full Recovery + Unrecovered cost at start of Year/Discounted Cash Flow during the Year To discount a cash flow we simply = (+)

b) You will have to use looping to discount each cash flow (at the given interest rate) prior to calculating the accumulation of cash flows. To check your answer, if you use an interest rate of 5% on this set of cash flows, you should have a discounted payback period of 4.28 years. Note: remember to convert your input from a string (the default) to a float.

c) What will happen if your user types 5 instead of 0.05 for the interest rate? Can you add an IF logical statement that will convert any rate that is greater than 1 to the correct value?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started