Answered step by step

Verified Expert Solution

Question

1 Approved Answer

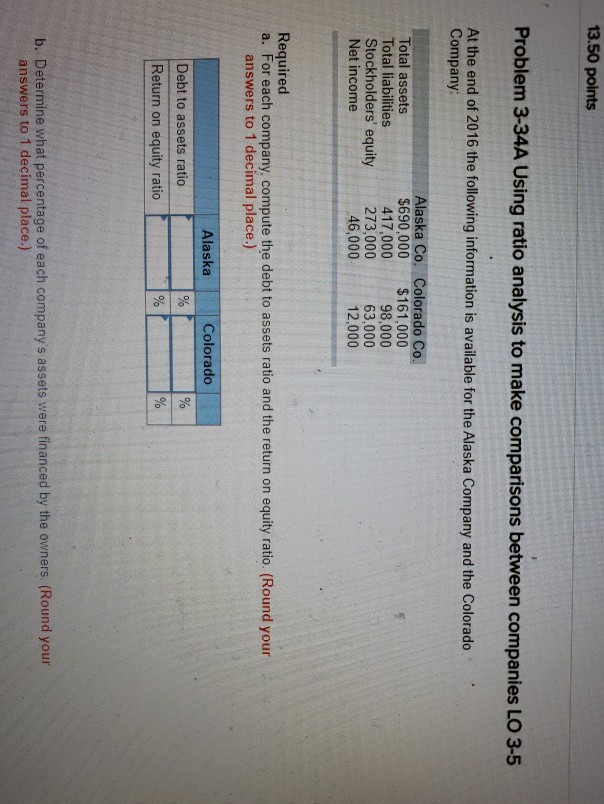

13.50 points Problem 3-34A Using ratio analysis to make comparisons between companies LO 3-5 At the end of 2016 the following information is available for

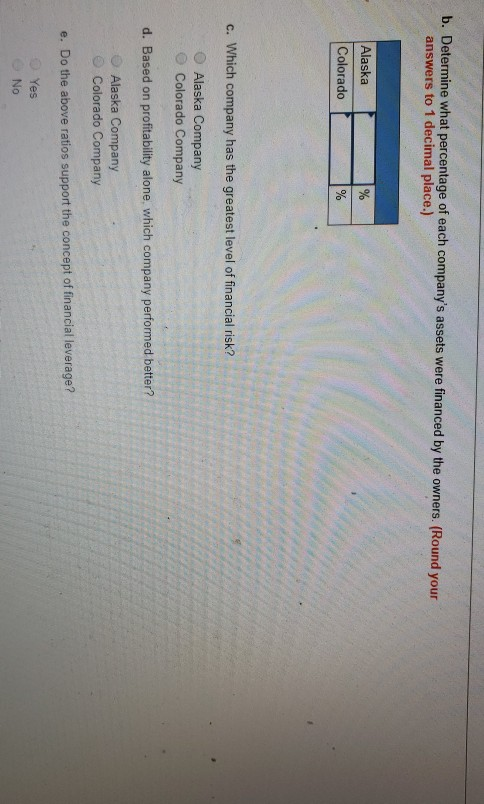

13.50 points Problem 3-34A Using ratio analysis to make comparisons between companies LO 3-5 At the end of 2016 the following information is available for the Alaska Company and the Colorado Company: Total assets Total liabilities Stockholders' equity Net income Alaska Co. Colorado Co. $690,000 $161,000 417,000 98,000 273,000 63,000 46,000 12,000 Required a. For each company, compute the debt to assets ratio and the return on equity ratio. (Round your answers to 1 decimal place.) Alaska Colorado Debt to assets ratio Return on equity ratio b. Determine what percentage of each company's assets were financed by the owners. (Round your answers to 1 decimal place.) b. Determine what percentage of each company's assets were financed by the owners. (Round your answers to 1 decimal place.) Alaska Colorado c. Which company has the greatest level of financial risk? Alaska Company Colorado Company d. Based on profitability alone which company performed better? Alaska Company Colorado Company e. Do the above ratios support the concept of financial leverage? Yes No

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started