Answered step by step

Verified Expert Solution

Question

1 Approved Answer

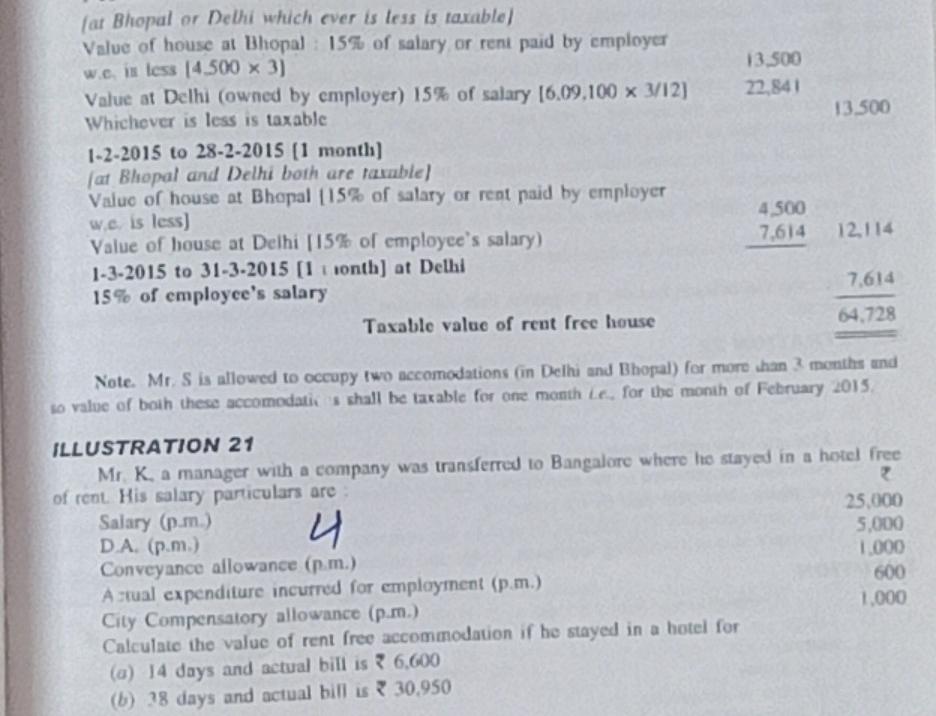

13.500 22.841 13.500 (at Bhopal or Delhi which ever is less is taxable) Value of house at Bhopal 15% of salary or rent paid by

13.500 22.841 13.500 (at Bhopal or Delhi which ever is less is taxable) Value of house at Bhopal 15% of salary or rent paid by employer we in less [4.500 x 3) Value at Delhi (owned by employer) 15% of salary 16.09.100 x 3/12) Whichever is less is taxable 1-2-2015 to 28-2-2015 (1 month) at Bhopal and Delhi both are taxable) Value of house at Bhopal [15% of salary or rent paid by employer we is less) Value of house at Delhi [15% of employee's salary) 1-3-2015 to 31-3-2015 [1 tsonth) at Delhi 15% of employee's salary Taxable value of rent free house 4.500 7,614 12.114 7.614 64.728 Note. Mr. S is allowed to occupy two accomodations (in Delhi and Bhopal) for more chan months and so value of both these accomodati shall be taxable for one month le for the month of February 2015 ILLUSTRATION 21 Mr K. a manager with a company was transferred to Bangalore where he stayed in a hotel free of rent His salary particulars are 2 Salary (p.m.) 25.000 4 DA (p.m.) 5.000 Conveyance allowance (p.m.) 1.000 A sual expenditure incurred for employment (p.m.) 600 City Compensatory allowance (p.mm.) 1.000 Calculate the value of rent free accommodation if he stayed in a hotel for (a) 14 days and actual bill is 3 6.600 (b) 38 days and actual bill is? 30.950

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started