Answered step by step

Verified Expert Solution

Question

1 Approved Answer

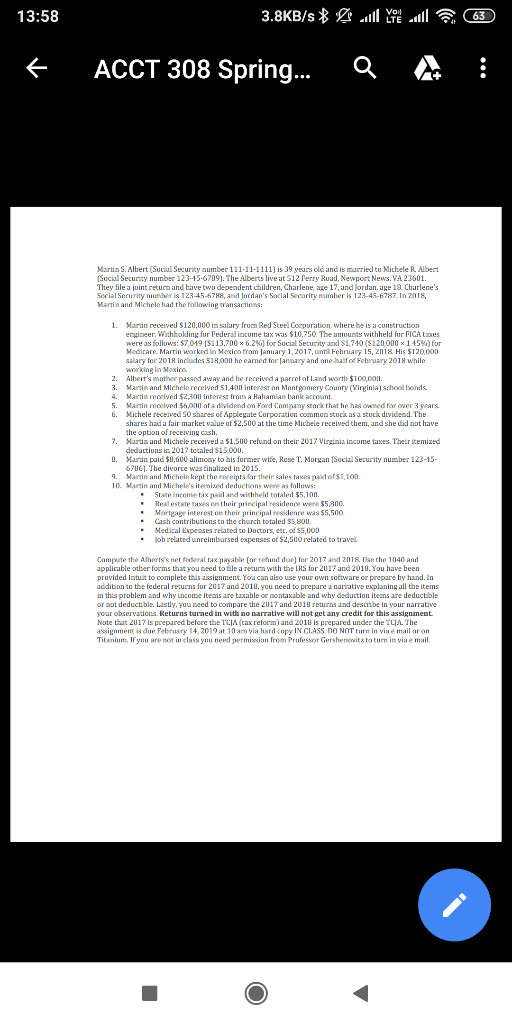

13:58 ACCT 308 Spring A Martin S. Albert (Sucial Security number 111-11-1111 is 39 years old and is married tu Michele R. Albert Sucial Security

13:58 ACCT 308 Spring A Martin S. Albert (Sucial Security number 111-11-1111 is 39 years old and is married tu Michele R. Albert Sucial Security number 123-15-6709]. The Alberts live at 512 Terry Road Newport News. VA 23601. They file a joint return and have two dependent children, Charlene, age 17, and lordan.age 13 Charlene's Secial Security number is 123-45-578, and Jordan's Social Security mamber is 123-45-6787.In 2018 Martin and Michele had the following transactions: 1 Martin reveived $120,000 in salary frum Redl Steel Corporation where be is a construction engineer, withholding fur Federal incume tax was $10,750 amuunts withheld fur FICA taxes were as follows: $7,049 [S11 3.700% 6,2%) for Sucial Security and $1,740 ($120 000% 1 45%) for Modicare Martin worknd Iin Mexioo from January 1, 2017, ul Feay 15, 2018 His $120,000 salary for 2018 incudes $18,00n he earned tor Janaary and one-halfof February 201H while wwrking in Mexico. 2. Albert's mother passed away and he received a parcel of Land worth $10o,. . Martin and Michele received $1 400 interest on Montgomery County (Virginia) school bonds. 4. Martin received $2300 interest fros a Rahamian bank accunt. 5. Martin received $6,000 fa dividend on Ford Company stockthat he has owned For over 3 years. 6. Michele received 50 shares of Applegate Corporation common stock as a stuck dividend. The shares had a fair market value of $2,500 at the time Mihele received them, and she did mot have the option of receving cash. Martin and Michele received deductions in 2017 totaled $15,000. Martin paid $0,600 alimoay to his furmer wie, Rase T. Norgan (Sacial Security number 123-15 6786]. The divorce was finalized in 2015. 7 S 1.500 refund on their 2017 Virginia income taxes. Their itemized . Martin and Michele kept the receipts for their sales taxes paid of$1,100 10. Martin and Michele's itemized deductions were as Tollows: State income tax paid and withheld totaled $5,100. Real estate taxes en their principal residene wene $5,800. Mortgage interest on their principal residence was $5,500 Cash contributions to the church totaled $5,80u. Medscal Expenses related to Doctors, etc.od 5S,U0D job related unreimbarsed expenses of $2,500 related to travel Compute the Alberts's net federal tax payae Cor refund due] fer 2017 and 201R lse the 1040 and applicable other forms that youa need to Ele a reura with the LRS for 2017 and 2018. You have been provided lntust to complete this assignment. Yoa can also use your own software or prepare by hand. In ddition to the federal reurns for 2017 and 2018, ou need to prepare a narative explaning all the items in this problem and why income items are taxable oraxable and why deduction items are deductble or mot deductible. Lastly, you eed to compare the 2017 and 2019 returns and describe In your narrative your observations Returns turned in with no narrative will not get any credit for this assignme Note that 2017 Is prepared before the TCIA(tax reform) and 2018 is prepared under the TCIA The assignment is due February 14, 2019 at 10 am via hardcopy IN CLASS no NOT turn in viaernail or on Titanium. Iryou are not in class you need permission frem Professor Gershenovit & toturn in viae mail

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started