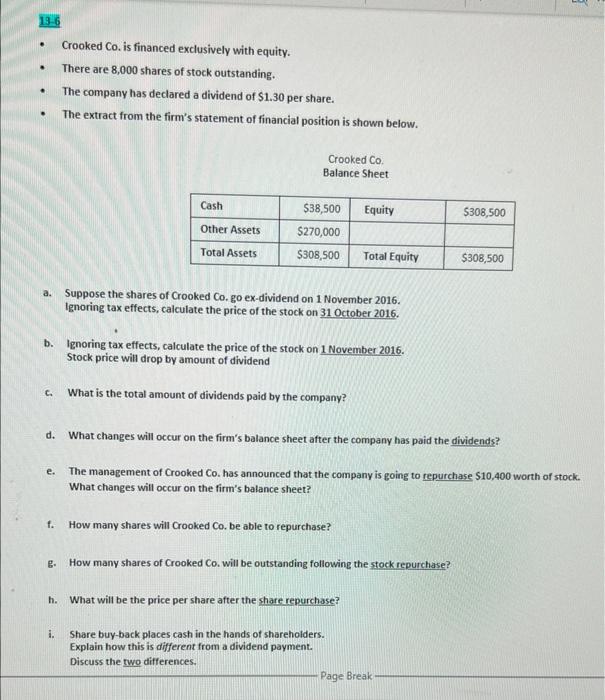

13-6 . . Crooked Co. is financed exclusively with equity. There are 8,000 shares of stock outstanding. The company has declared a dividend of $1.30 per share. The extract from the firm's statement of financial position is shown below. . . Crooked Co. Balance Sheet Cash Equity 5308,500 Other Assets $38,500 $270,000 $308,500 Total Assets Total Equity $308,500 a. Suppose the shares of Crooked Co.go ex-dividend on 1 November 2016. Ignoring tax effects, calculate the price of the stock on 31 October 2016. b. Ignoring tax effects, calculate the price of the stock on 1 November 2016. Stock price will drop by amount of dividend c. What is the total amount of dividends paid by the company? d. What changes will occur on the firm's balance sheet after the company has paid the dividends? e. The management of Crooked Co. has announced that the company is going to repurchase $10,400 worth of stock. What changes will occur on the firm's balance sheet? . How many shares will Crooked Co. be able to repurchase? How many shares of Crooked Co. will be outstanding following the stock repurchase? h. What will be the price per share after the share repurchase? i. Share buy-back places cash in the hands of shareholders. Explain how this is different from a dividend payment. Discuss the two differences. Page Break 13-6 . . Crooked Co. is financed exclusively with equity. There are 8,000 shares of stock outstanding. The company has declared a dividend of $1.30 per share. The extract from the firm's statement of financial position is shown below. . . Crooked Co. Balance Sheet Cash Equity 5308,500 Other Assets $38,500 $270,000 $308,500 Total Assets Total Equity $308,500 a. Suppose the shares of Crooked Co.go ex-dividend on 1 November 2016. Ignoring tax effects, calculate the price of the stock on 31 October 2016. b. Ignoring tax effects, calculate the price of the stock on 1 November 2016. Stock price will drop by amount of dividend c. What is the total amount of dividends paid by the company? d. What changes will occur on the firm's balance sheet after the company has paid the dividends? e. The management of Crooked Co. has announced that the company is going to repurchase $10,400 worth of stock. What changes will occur on the firm's balance sheet? . How many shares will Crooked Co. be able to repurchase? How many shares of Crooked Co. will be outstanding following the stock repurchase? h. What will be the price per share after the share repurchase? i. Share buy-back places cash in the hands of shareholders. Explain how this is different from a dividend payment. Discuss the two differences. Page Break