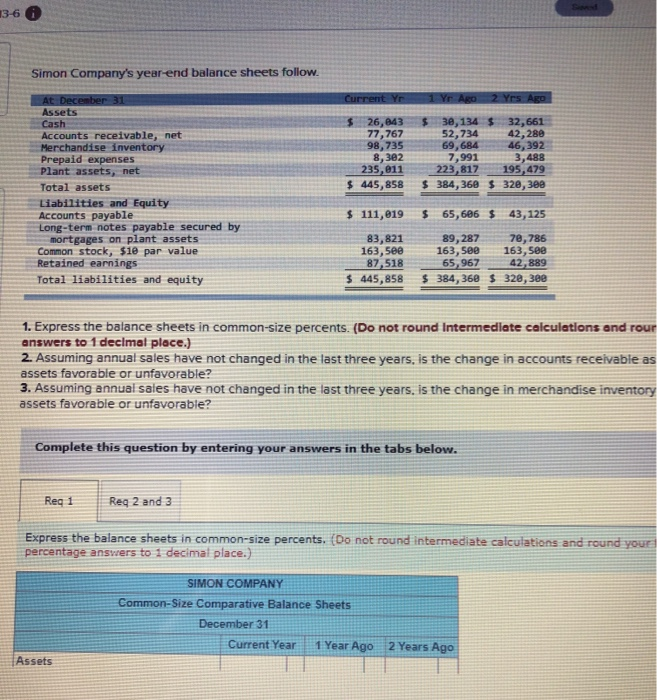

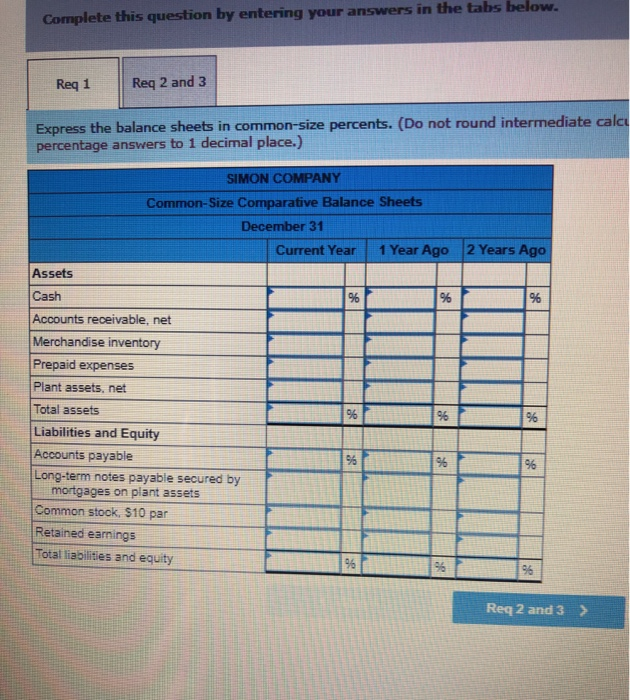

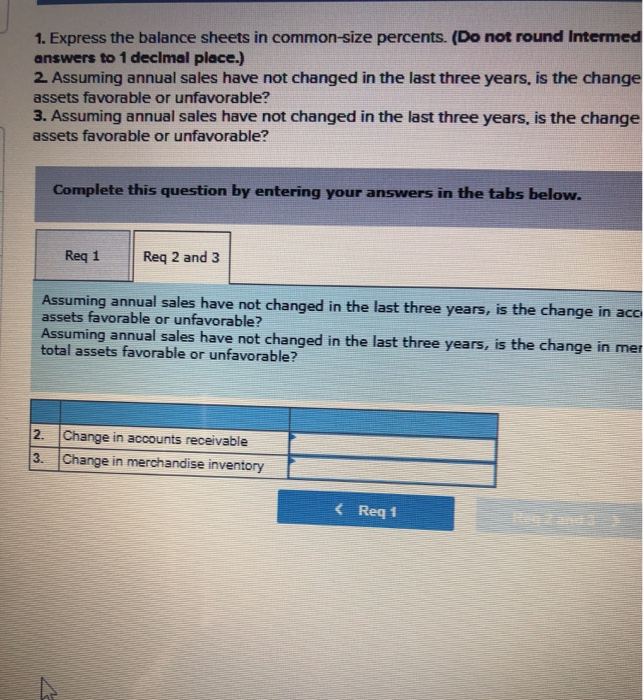

136 Simon Company's year-end balance sheets follow. Current Yr 1 Yr ARO 2 Yrs Ago $ 26,843 77,767 98,735 8,382 235, 011 $ 445,858 $ 30, 134 $ 32,661 52,734 42,280 69,684 46,392 7,991 3,488 223,817 195,479 $ 384,368 $ 320, 3ee At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 111, 019 $ 65,686 $ 43,125 83,821 163,5ee 87,518 $ 445,858 89,287 78,786 163, see 163, see 65,967 42,889 $ 384,368 $ 320, 30e 1. Express the balance sheets in common-size percents. (Do not round Intermediate calculations and rour answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Reg 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round Intermediate calculations and round your percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calau percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets % % %6 % % Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par Retained earnings Total liabilities and equity % 96 %% 96 Req 2 and 3 > 1. Express the balance sheets in common-size percents. (Do not round Intermed answers to 1 decimal place.) 2. Assuming annual sales have not changed in the last three years, is the change assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Assuming annual sales have not changed in the last three years, is the change in acc assets favorable or unfavorable? Assuming annual sales have not changed in the last three years, is the change in mer total assets favorable or unfavorable? 2. Change in accounts receivable 3. Change in merchandise inventory