Answered step by step

Verified Expert Solution

Question

1 Approved Answer

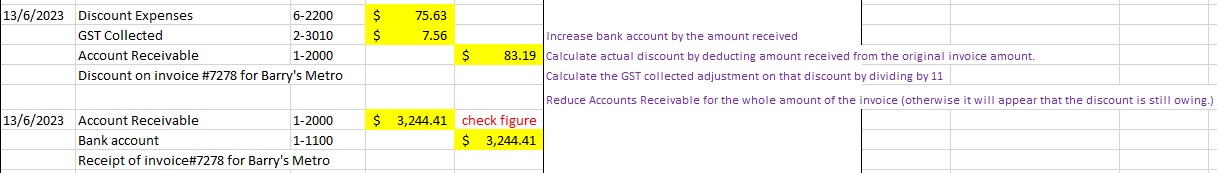

13/6/2023 Discount Expenses GST Collected Account Receivable 6-2200 $ 75.63 2-3010 $ 7.56 1-2000 $ Discount on invoice #7278 for Barry's Metro 13/6/2023 Account

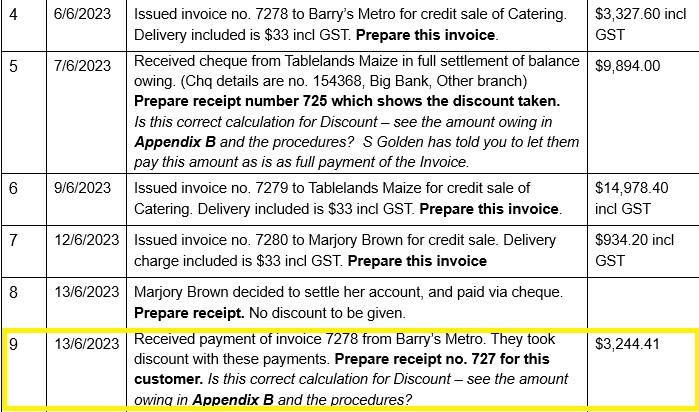

13/6/2023 Discount Expenses GST Collected Account Receivable 6-2200 $ 75.63 2-3010 $ 7.56 1-2000 $ Discount on invoice #7278 for Barry's Metro 13/6/2023 Account Receivable Bank account Increase bank account by the amount received 83.19 Calculate actual discount by deducting amount received from the original invoice amount. Calculate the GST collected adjustment on that discount by dividing by 11 Reduce Accounts Receivable for the whole amount of the invoice (otherwise it will appear that the discount is still owing.) 1-2000 1-1100 $ 3,244.41 check figure $ 3,244.41 Receipt of invoice#7278 for Barry's Metro 4 6/6/2023 5 7/6/2023 6 9/6/2023 7 8 Issued invoice no. 7278 to Barry's Metro for credit sale of Catering. Delivery included is $33 incl GST. Prepare this invoice. Received cheque from Tablelands Maize in full settlement of balance owing. (Chq details are no. 154368, Big Bank, Other branch) Prepare receipt number 725 which shows the discount taken. Is this correct calculation for Discount - see the amount owing in Appendix B and the procedures? S Golden has told you to let them pay this amount as is as full payment of the Invoice. Issued invoice no. 7279 to Tablelands Maize for credit sale of Catering. Delivery included is $33 incl GST. Prepare this invoice. 12/6/2023 Issued invoice no. 7280 to Marjory Brown for credit sale. Delivery charge included is $33 incl GST. Prepare this invoice 13/6/2023 Marjory Brown decided to settle her account, and paid via cheque. Prepare receipt. No discount to be given. 13/6/2023 Received payment of invoice 7278 from Barry's Metro. They took discount with these payments. Prepare receipt no. 727 for this customer. Is this correct calculation for Discount - see the amount owing in Appendix B and the procedures? $3,327.60 incl GST $9,894.00 $14,978.40 incl GST $934.20 incl GST $3,244.41

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started