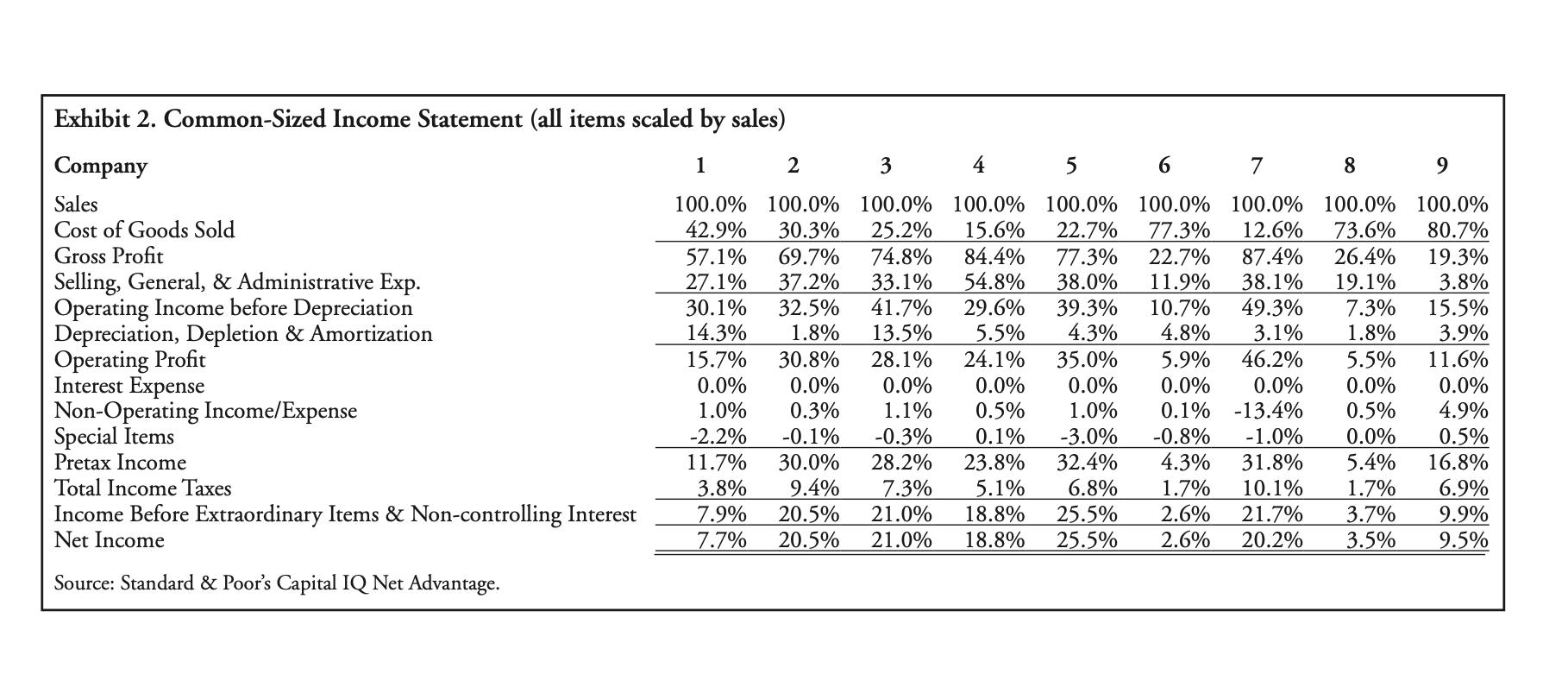

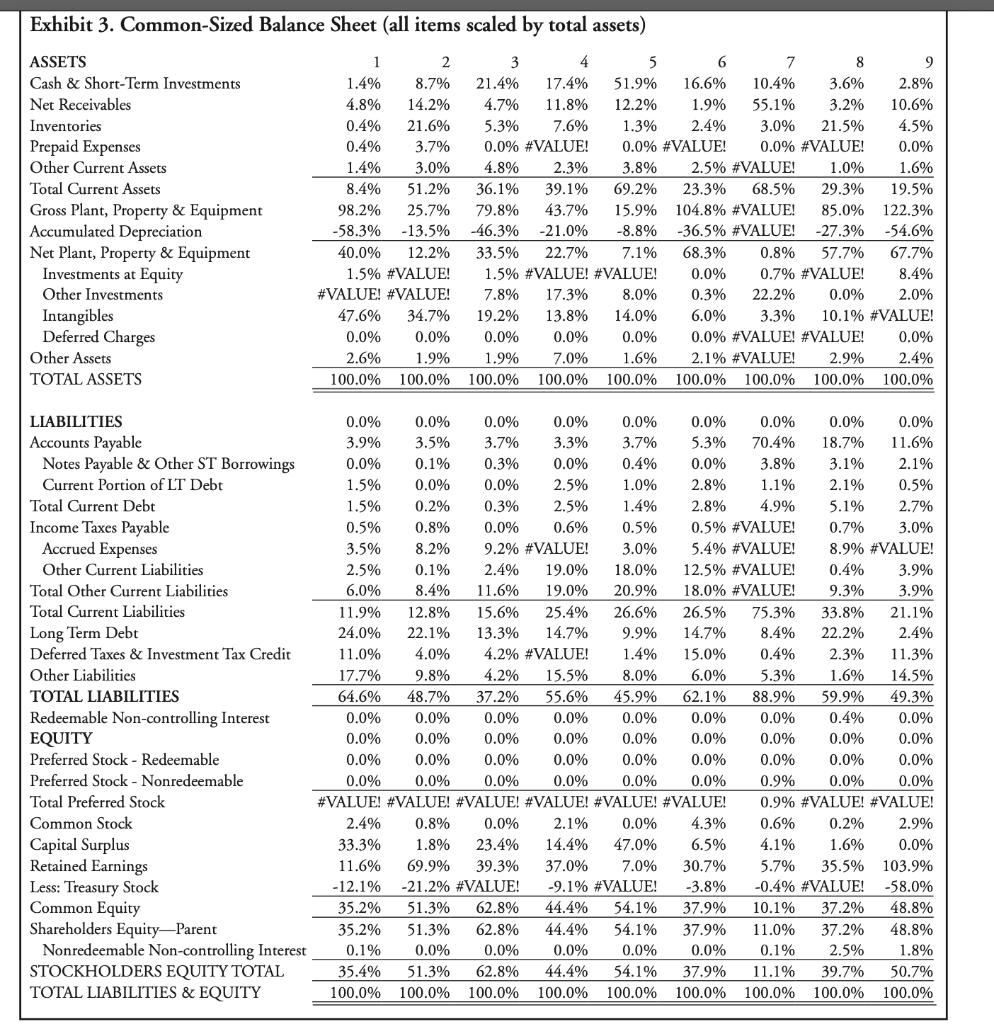

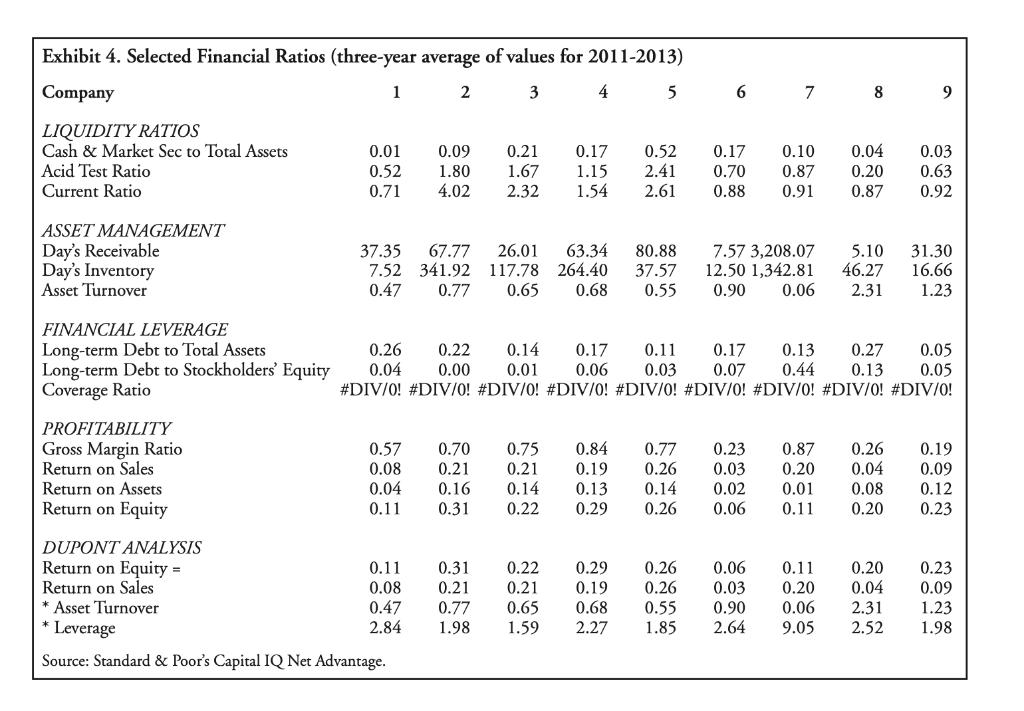

The 9 companies are drawn from the following 9 different industries: Liquor producer and distributor Discount airline Commercial bank (items fitted into the same categories

The 9 companies are drawn from the following 9 different industries:

Liquor producer and distributor

Discount airline

Commercial bank (items fitted into the same categories as the non-financial firms)

Match with the information below. and give some explanation.

Computer software company

Large integrated oil and gas company

The mobile phone service operator

R&D-based pharmaceutical manufacturer

Retail grocery company

R&D-based semiconductor manufacturer

this is all information estimate base on this info

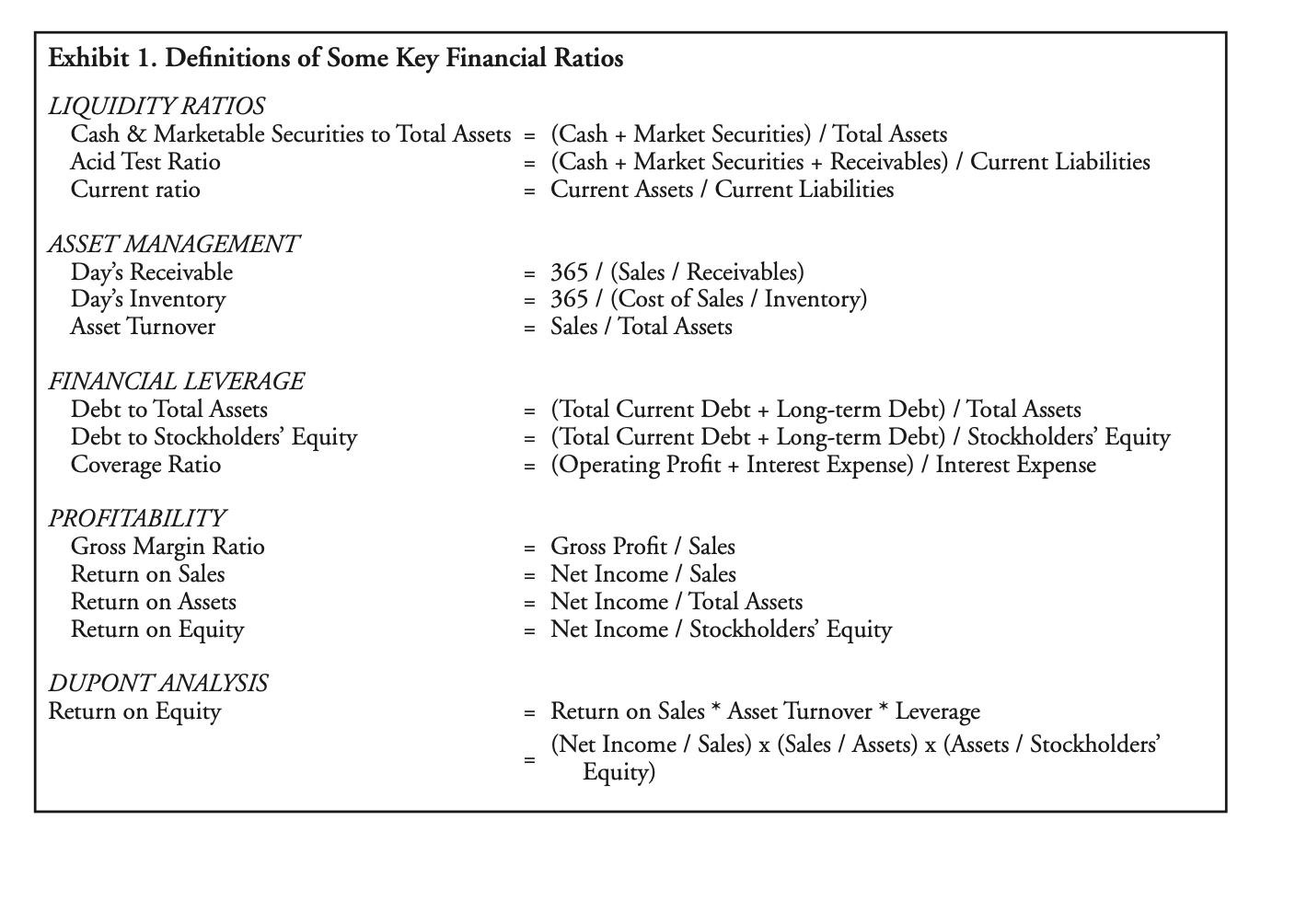

Exhibit 1. Definitions of Some Key Financial Ratios LIQUIDITY RATIOS Cash & Marketable Securities to Total Assets = Acid Test Ratio (Cash + Market Securities) / Total Assets (Cash + Market Securities + Receivables) / Current Liabilities = Current Assets / Current Liabilities Current ratio ASSET MANAGEMENT Day's Receivable Day's Inventory Asset Turnover = 365 / (Sales / Receivables) = 365 / (Cost of Sales / Inventory) Sales / Total Assets FINANCIAL LEVERAGE Debt to Total Assets Debt to Stockholders' Equity Coverage Ratio (Total Current Debt + Long-term Debt) / Total Assets (Total Current Debt + Long-term Debt) / Stockholders' Equity (Operating Profit + Interest Expense) / Interest Expense PROFITABILITY = Gross Profit / Sales = Net Income / Sales = Net Income / Total Assets = Net Income / Stockholders' Equity Gross Margin Ratio Return on Sales Return on Assets Return on Equity DUPONT ANALYSIS Return on Equity Return on Sales * Asset Turnover * Leverage (Net Income / Sales) x (Sales / Assets) x (Assets / Stockholders' Equity) %3D

Step by Step Solution

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Financial Industry Commercial banks These firms have high expectations of being granted high loans and payables have high rates of assets compared to ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards