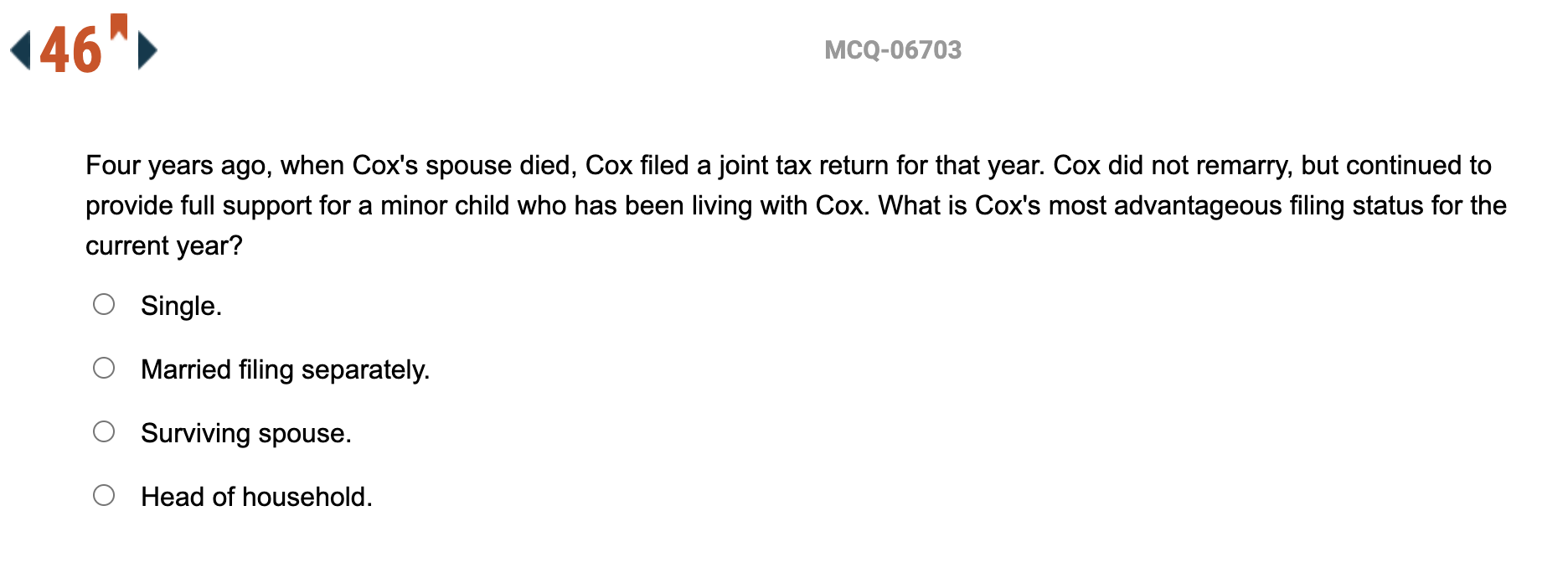

137" MCQ-06435 Mort and Mindy met at a New Year's Eve party held December 31, Year 1. They instantly bonded, fell madly in love, and were married at 11:38 p.m. that night. Sadly, Mort passed away November 15, Year 2. In January, Year 3, Mindy gave birth to triplets Mark, Mandy, and Maureen. Assuming that Mindy has not remarried, what filing status should she use for Year 4? Single. Married filing jointly. Head of household. Qualifying widow(er) with dependent child. 144" MCQ-06432 John and Theresa are in the process of obtaining a divorce. Although they are not legally separated, John moved out of the family home in October of Year 1 and moved into an apartment nearby. John and Theresa's two children, Jenna and Stella, lived with Theresa in the family home for more than half of the tax year. What filing status can Theresa use to file her Year 1 tax return? Head of household. Married filing jointly/separately. Surviving spouse (qualifying widow). Single. ( 145"> MCQ-03187 Molly Morris is 15 years old. Molly's parents (James and Beth) divorced in May of the current tax year. Molly lived with both parents until the divorce. Molly does not provide more than half of her own support. After the divorce, Molly's mother has custody of Molly, but Molly lives equal time with both parents. James'AGI is $40,000 and Beth's AGI is $35,000. Molly's parents cannot decide who can claim Molly as a dependent for tax purposes. Assuming neither parent waives their right to claim Molly as a dependent, which statement is true? Both parents may claim Molly as a dependent because she lives equal time with each parent James may claim Molly as a dependent because his AGI is higher. Beth may claim Molly as a dependent because her AGI is lower. Beth and James must alternate claiming Molly as a dependent. 146" MCQ-06703 Four years ago, when Cox's spouse died, Cox filed a joint tax return for that year. Cox did not remarry, but continued to provide full support for a minor child who has been living with Cox. What is Cox's most advantageous filing status for the current year? Single. O Married filing separately. Surviving spouse. Head of household