Answered step by step

Verified Expert Solution

Question

1 Approved Answer

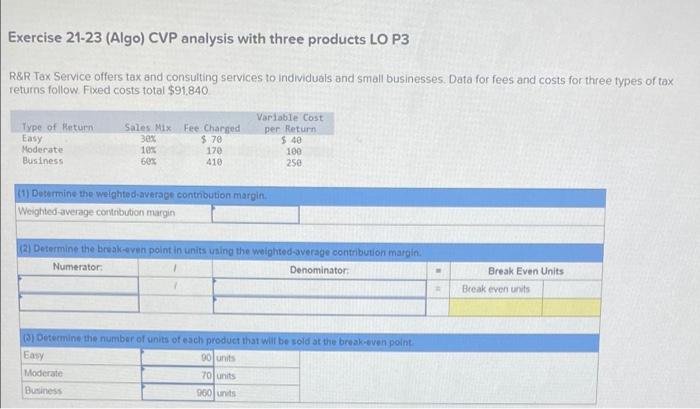

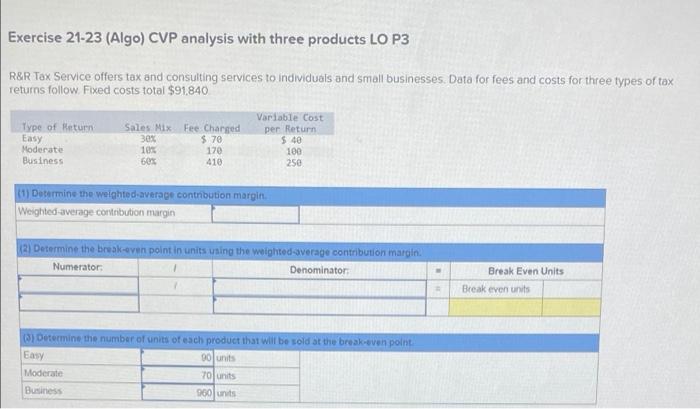

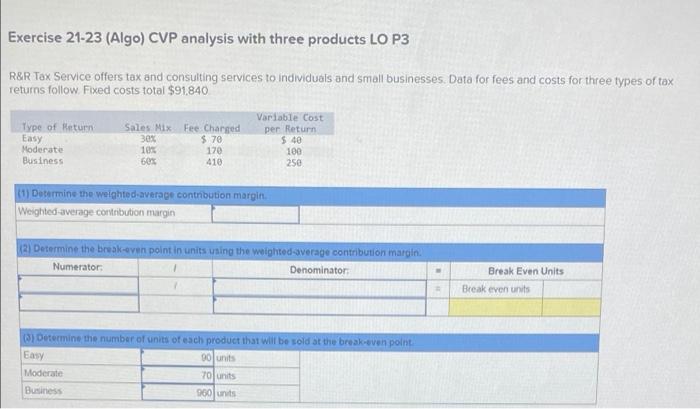

13,7,6 Exercise 21-23 (Algo) CVP analysis with three products LO P3 R&R Tax Service offers tax and consulting services to individuals and small businesses. Data

13,7,6

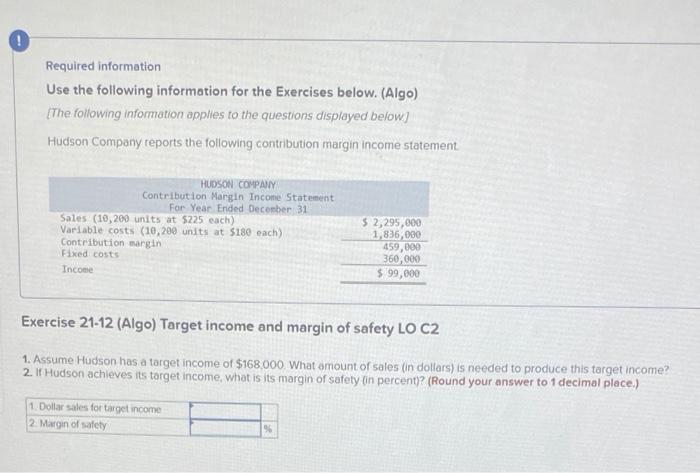

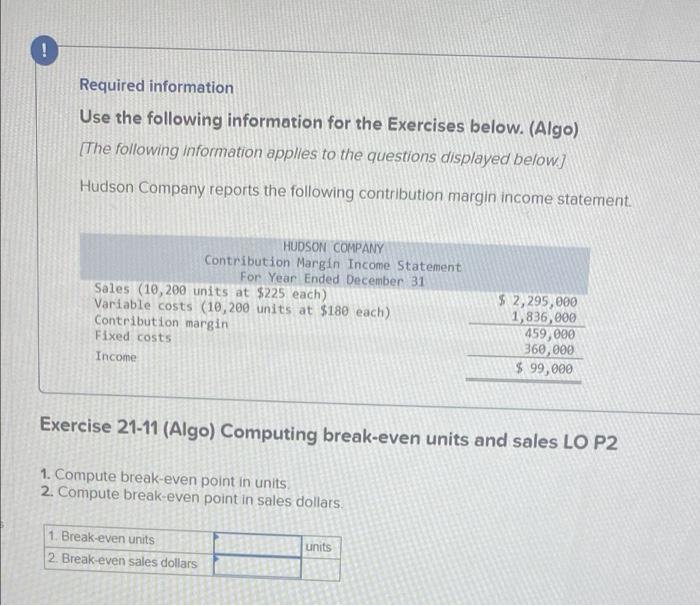

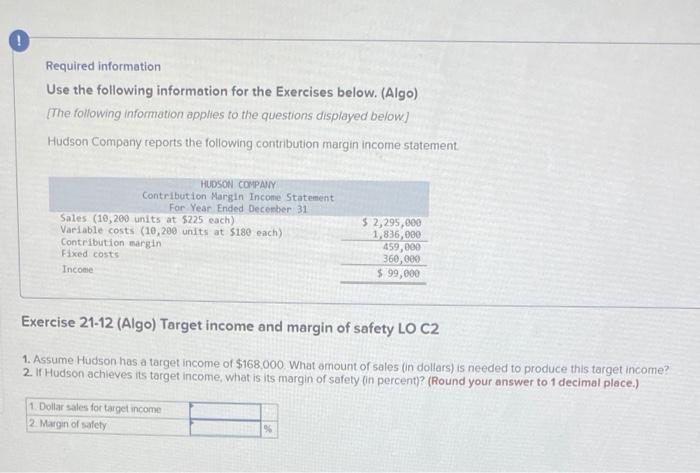

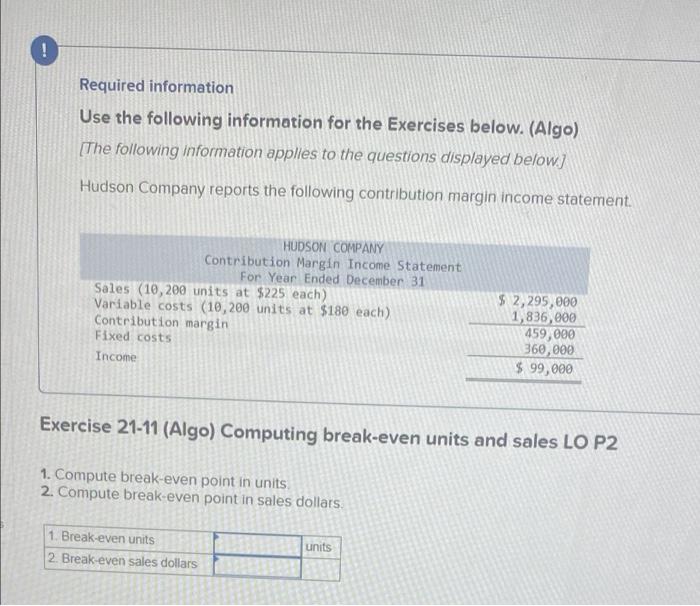

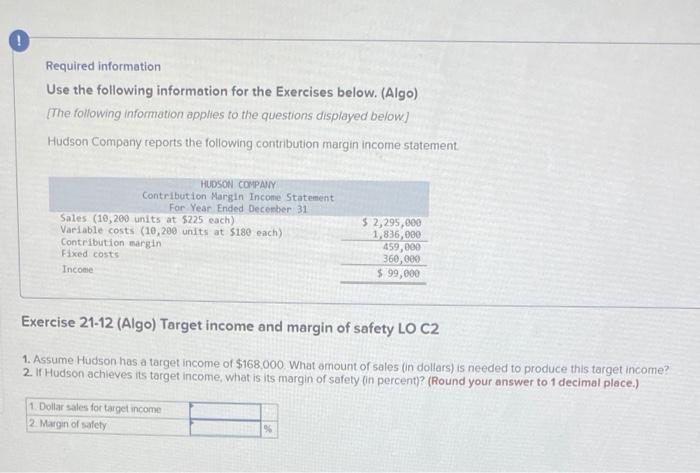

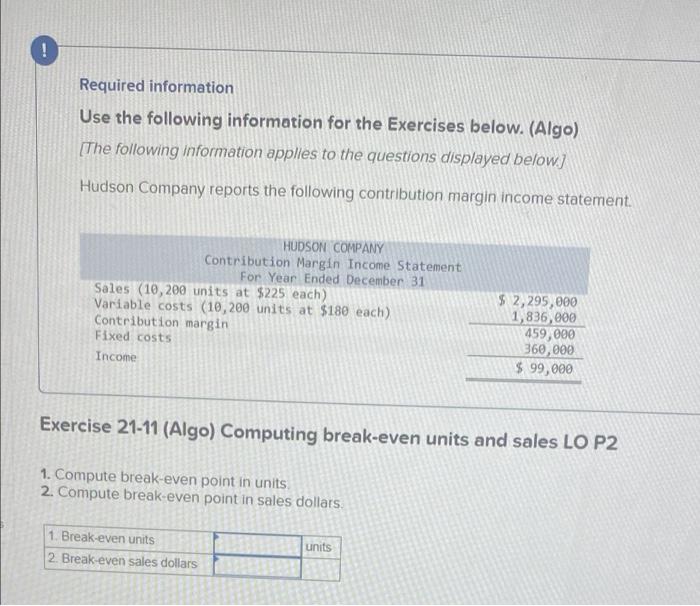

Exercise 21-23 (Algo) CVP analysis with three products LO P3 R&R Tax Service offers tax and consulting services to individuals and small businesses. Data for fees and costs for three types of tax returns follow Fixed costs total $91.840 Type of Return Easy Moderate Business Sales Mix Fee Charged 30% $ 70 10% 170 60% 410 Variable Cost per Return $ 40 100 250 (1) Determine the weighted average contribution margin Weighted average contribution margin (2) Determine the break-even point in units using the weighted average contribution margin Numerator: 1 Denominator Break Even Units Break even units (3) Determine the number of units of each product that will be sold at the break-even point Easy 90 units Moderate 70 units Business 960 units Required information Use the following information for the Exercises below. (Algo) The following information apples to the questions displayed below) Hudson Company reports the following contribution margin income statement HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (10,200 units at $225 each) Variable costs (10,200 units at $180 each) Contribution margin Fixed costs Income $ 2,295,000 1,836,000 459,000 360,000 $ 99,000 Exercise 21-12 (Algo) Target income and margin of safety LO C2 1. Assume Hudson has a target income of $168,000 What amount of sales (in dollars) is needed to produce this target Income? 2. If Hudson achieves its target income, what is its margin of safety in percent)? (Round your answer to 1 decimal place.) 1. Dollar sales for target income 2. Margin of safety ! Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (10,200 units at $225 each) Variable costs (10,200 units at $180 each) Contribution margin Fixed costs Income $ 2,295,000 1,836,000 459,000 360,000 $ 99,000 Exercise 21-11 (Algo) Computing break-even units and sales LO P2 1. Compute break-even point in units 2. Compute break-even point in sales dollars. 1. Break-even units 2. Break-even sales dollars units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started