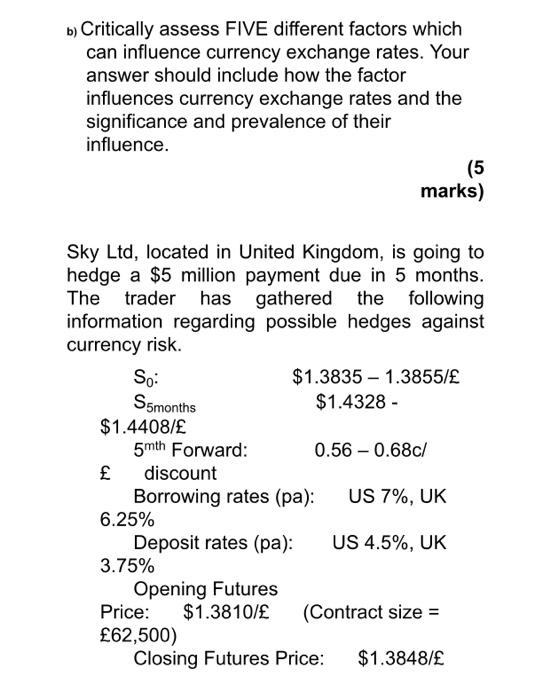

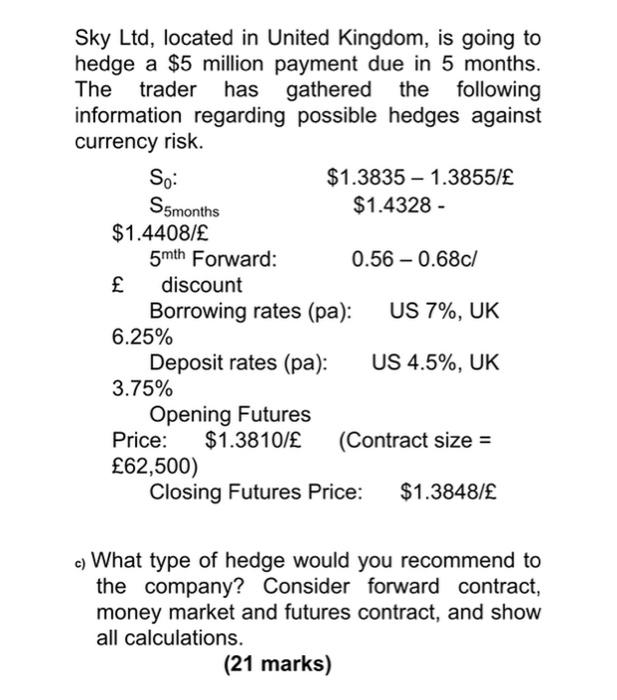

1:39 Done G Sky Lid, the UK company is also owed $2.500,000. by a US company. It is payable in May (it is currently January). The current spot exchange rates are the same as shown above. The company is concerned that the $ might weaken, so intends to hedge this transaction using foreign currency options (see below table) Sky Ltd decides to hedge at a strike price of $1.4250/E. Calculate the sterling outcome should the spot rate in May be $1.4100E (10 marks) Calle Der 1. 22:06 1.4501 15:45 Crop and scale or select text UD b) Critically assess FIVE different factors which can influence currency exchange rates. Your answer should include how the factor influences currency exchange rates and the significance and prevalence of their influence. (5 marks) Sky Ltd, located in United Kingdom, is going to hedge a $5 million payment due in 5 months. The trader has gathered the following information regarding possible hedges against currency risk. So: $1.3835 - 1.3855/ S5months $1.4328 - $1.4408/ 5mth Forward: 0.56 -0.68c/ discount Borrowing rates (pa): US 7%, UK 6.25% Deposit rates (pa): US 4.5%, UK 3.75% Opening Futures Price: $1.3810/ (Contract size = 62,500) Closing Futures Price: $1.3848/ Sky Ltd, located in United Kingdom, is going to hedge a $5 million payment due in 5 months. The trader has gathered the following information regarding possible hedges against currency risk. So: $1.3835 - 1.3855/ S5months $1.4328 - $1.4408/ 5mth Forward: 0.56 -0.68c/ discount Borrowing rates (pa): US 7%, UK 6.25% Deposit rates (pa): US 4.5%, UK 3.75% Opening Futures Price: $1.3810/ (Contract size = 62,500) Closing Futures Price: $1.3848/ c) What type of hedge would you recommend to the company? Consider forward contract, money market and futures contract, and show all calculations. (21 marks) 1:39 Done G Sky Lid, the UK company is also owed $2.500,000. by a US company. It is payable in May (it is currently January). The current spot exchange rates are the same as shown above. The company is concerned that the $ might weaken, so intends to hedge this transaction using foreign currency options (see below table) Sky Ltd decides to hedge at a strike price of $1.4250/E. Calculate the sterling outcome should the spot rate in May be $1.4100E (10 marks) Calle Der 1. 22:06 1.4501 15:45 Crop and scale or select text UD b) Critically assess FIVE different factors which can influence currency exchange rates. Your answer should include how the factor influences currency exchange rates and the significance and prevalence of their influence. (5 marks) Sky Ltd, located in United Kingdom, is going to hedge a $5 million payment due in 5 months. The trader has gathered the following information regarding possible hedges against currency risk. So: $1.3835 - 1.3855/ S5months $1.4328 - $1.4408/ 5mth Forward: 0.56 -0.68c/ discount Borrowing rates (pa): US 7%, UK 6.25% Deposit rates (pa): US 4.5%, UK 3.75% Opening Futures Price: $1.3810/ (Contract size = 62,500) Closing Futures Price: $1.3848/ Sky Ltd, located in United Kingdom, is going to hedge a $5 million payment due in 5 months. The trader has gathered the following information regarding possible hedges against currency risk. So: $1.3835 - 1.3855/ S5months $1.4328 - $1.4408/ 5mth Forward: 0.56 -0.68c/ discount Borrowing rates (pa): US 7%, UK 6.25% Deposit rates (pa): US 4.5%, UK 3.75% Opening Futures Price: $1.3810/ (Contract size = 62,500) Closing Futures Price: $1.3848/ c) What type of hedge would you recommend to the company? Consider forward contract, money market and futures contract, and show all calculations. (21 marks)