Answered step by step

Verified Expert Solution

Question

1 Approved Answer

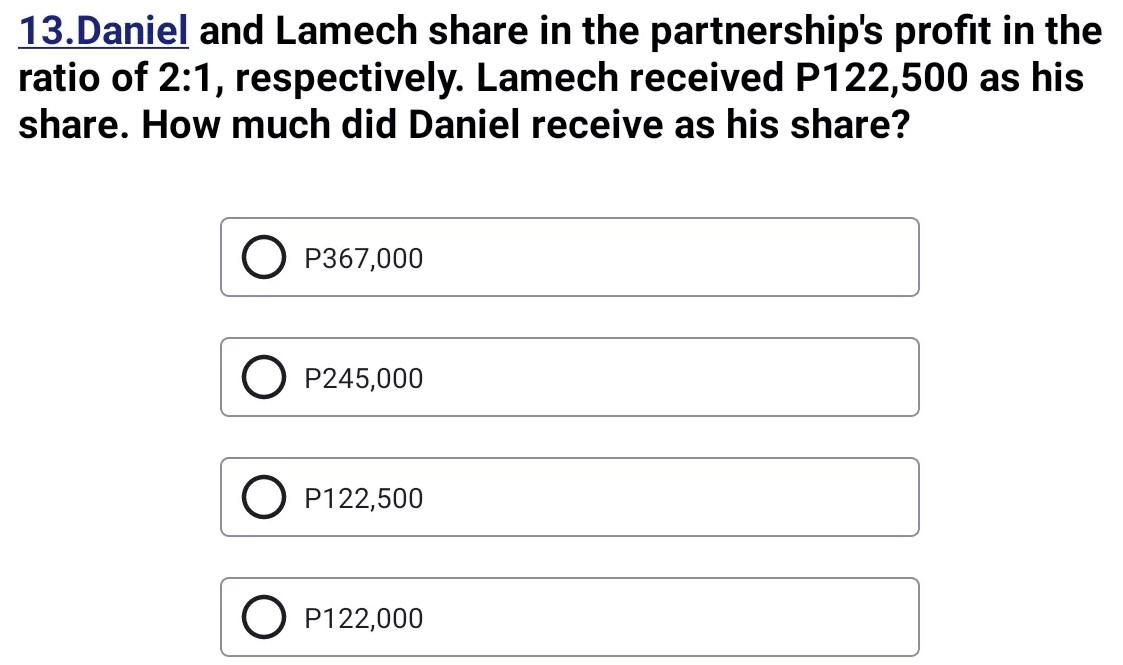

13.Daniel and Lamech share in the partnership's profit in the ratio of 2:1, respectively. Lamech received P122,500 as his share. How much did Daniel receive

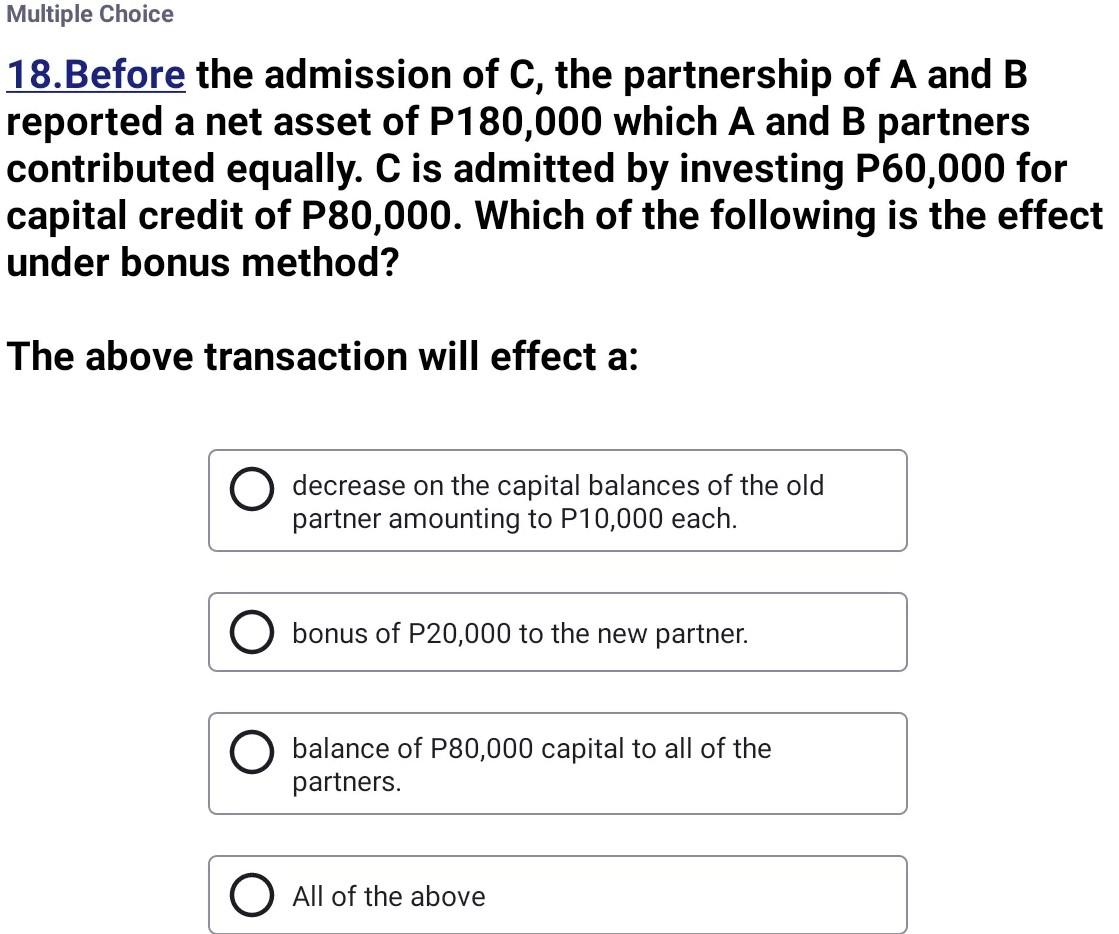

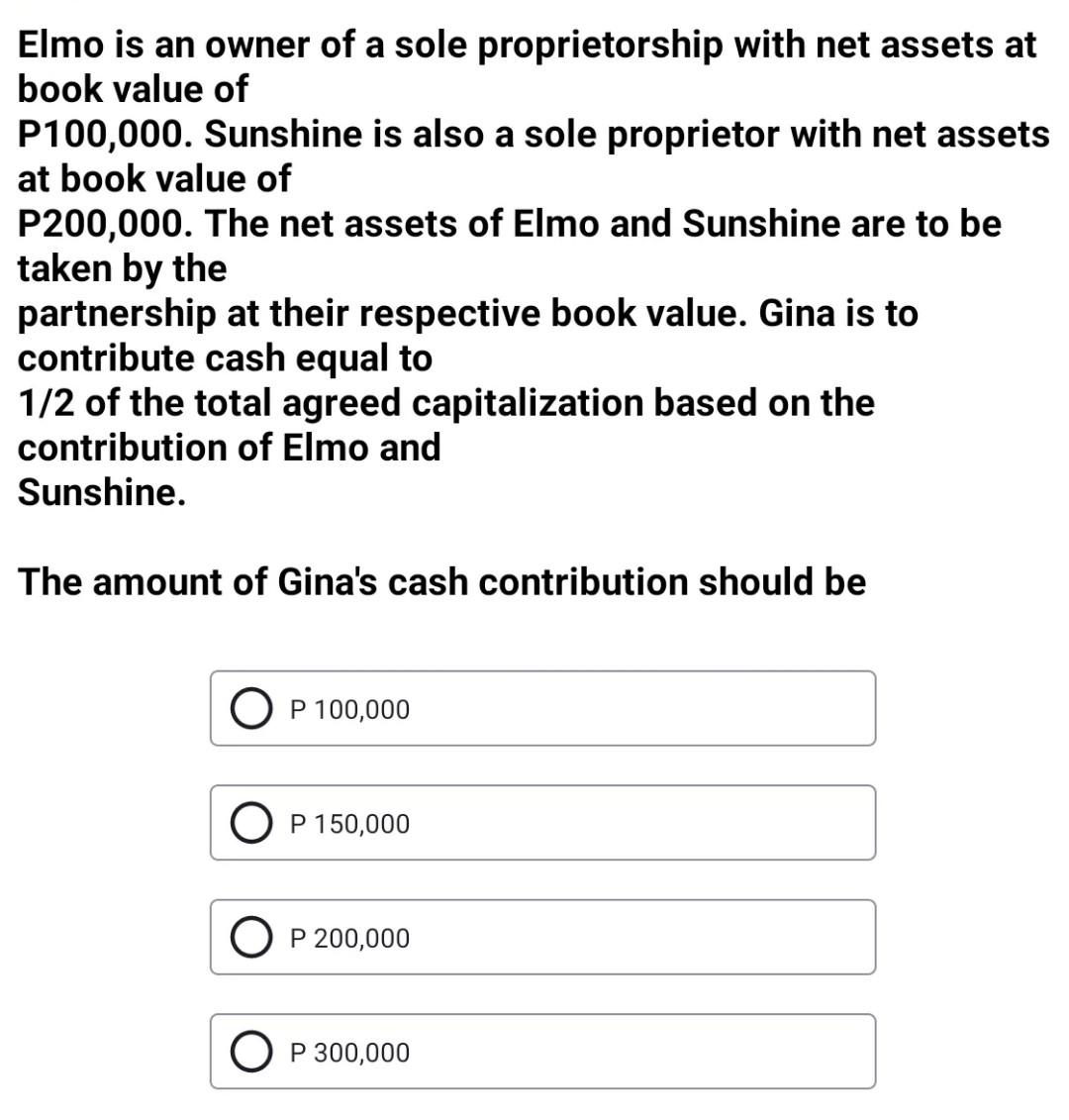

13.Daniel and Lamech share in the partnership's profit in the ratio of 2:1, respectively. Lamech received P122,500 as his share. How much did Daniel receive as his share? P367,000 P245,000 O P122,500 O P122,000 Multiple Choice 18.Before the admission of C, the partnership of A and B reported a net asset of P180,000 which A and B partners contributed equally. C is admitted by investing P60,000 for capital credit of P80,000. Which of the following is the effect under bonus method? The above transaction will effect a: O decrease on the capital balances of the old partner amounting to P10,000 each. O bonus of P20,000 to the new partner. balance of P80,000 capital to all of the partners. O All of the above Elmo is an owner of a sole proprietorship with net assets at book value of P100,000. Sunshine is also a sole proprietor with net assets at book value of P200,000. The net assets of Elmo and Sunshine are to be taken by the partnership at their respective book value. Gina is to contribute cash equal to 1/2 of the total agreed capitalization based on the contribution of Elmo and Sunshine. The amount of Gina's cash contribution should be P 100,000 O P 150,000 P 200,000 O P 300,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started