Answered step by step

Verified Expert Solution

Question

1 Approved Answer

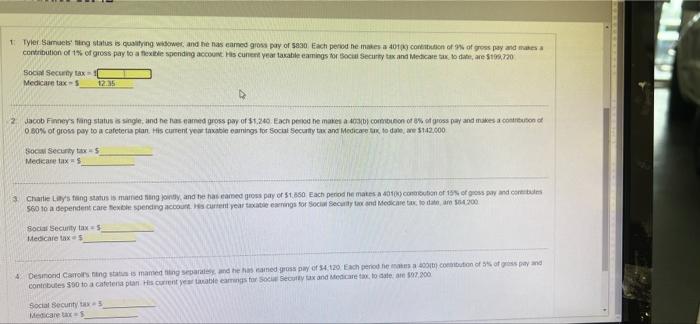

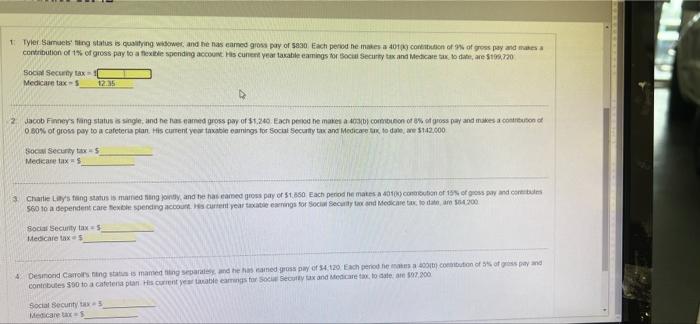

1-4 1 Tyler Samuel ning status is quitying widower and he has comed gross pay of 5000 Each period he makes a 4010 Con of

1-4

1 Tyler Samuel ning status is quitying widower and he has comed gross pay of 5000 Each period he makes a 4010 Con of of gross pay and contribution of 1% of gross pay to a flexible spending account. His cun year taxatile camings for Social Securty tax and Medical tax to date, are 106.720 Social Security tax Medicare tax 2 Jacob Finnes ing status is single, and he has med gross pay or $1.24. Each per ne mares a 4 combo of 8% of gross pay and makes a contribution 0 60% of gross pay to a cafeteria plan. His current year taxable canings for Social Security tax and Medicamento date $112.000 Social Security as Medicare taxes 3 Charlie Lay's fang status is meaning Joy, and he has comed gross pay of 51.650 Each periode mates 4010) Cotion of 100 Day and com 560 10 a dependent care este spending account corrent year wings for Social Security and Medicate toda a 200 Social Security tax 5 Medicare taxes 4 Desmond Carroll ning sammenges and the same grossay of 54.20. Eachpend motion of of payd contbutes 500 to a cafeteria plan is current yea table cars for social secull x and Medicare to date $7.200 Social Security Medicare

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started