Answered step by step

Verified Expert Solution

Question

1 Approved Answer

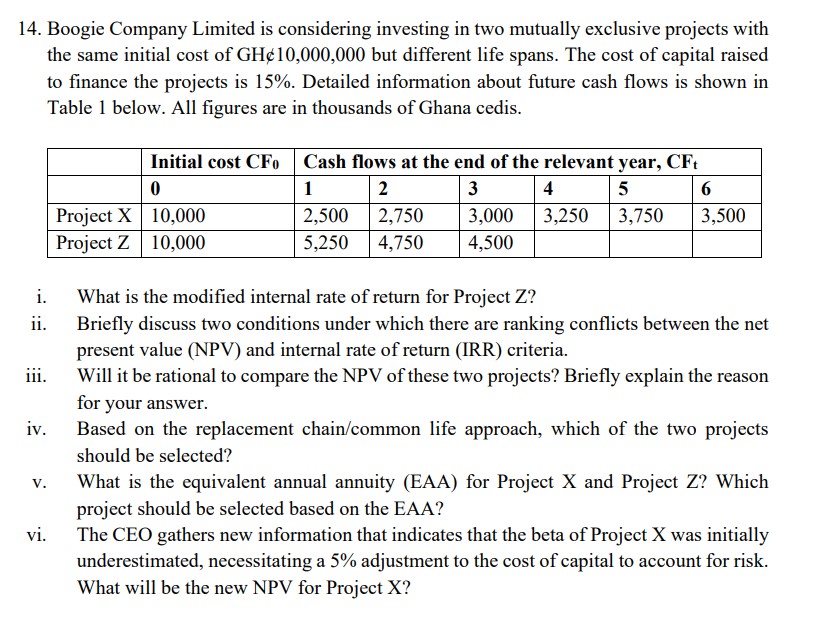

14. Boogie Company Limited is considering investing in two mutually exclusive projects with the same initial cost of GH&10,000,000 but different life spans. The cost

14. Boogie Company Limited is considering investing in two mutually exclusive projects with the same initial cost of GH\&10,000,000 but different life spans. The cost of capital raised to finance the projects is 15%. Detailed information about future cash flows is shown in Table 1 below. All figures are in thousands of Ghana cedis. i. What is the modified internal rate of return for Project Z ? ii. Briefly discuss two conditions under which there are ranking conflicts between the net present value (NPV) and internal rate of return (IRR) criteria. iii. Will it be rational to compare the NPV of these two projects? Briefly explain the reason for your answer. iv. Based on the replacement chain/common life approach, which of the two projects should be selected? v. What is the equivalent annual annuity (EAA) for Project X and Project Z ? Which project should be selected based on the EAA? vi. The CEO gathers new information that indicates that the beta of Project X was initially underestimated, necessitating a 5% adjustment to the cost of capital to account for risk. What will be the new NPV for Project X

14. Boogie Company Limited is considering investing in two mutually exclusive projects with the same initial cost of GH\&10,000,000 but different life spans. The cost of capital raised to finance the projects is 15%. Detailed information about future cash flows is shown in Table 1 below. All figures are in thousands of Ghana cedis. i. What is the modified internal rate of return for Project Z ? ii. Briefly discuss two conditions under which there are ranking conflicts between the net present value (NPV) and internal rate of return (IRR) criteria. iii. Will it be rational to compare the NPV of these two projects? Briefly explain the reason for your answer. iv. Based on the replacement chain/common life approach, which of the two projects should be selected? v. What is the equivalent annual annuity (EAA) for Project X and Project Z ? Which project should be selected based on the EAA? vi. The CEO gathers new information that indicates that the beta of Project X was initially underestimated, necessitating a 5% adjustment to the cost of capital to account for risk. What will be the new NPV for Project X Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started