Answered step by step

Verified Expert Solution

Question

1 Approved Answer

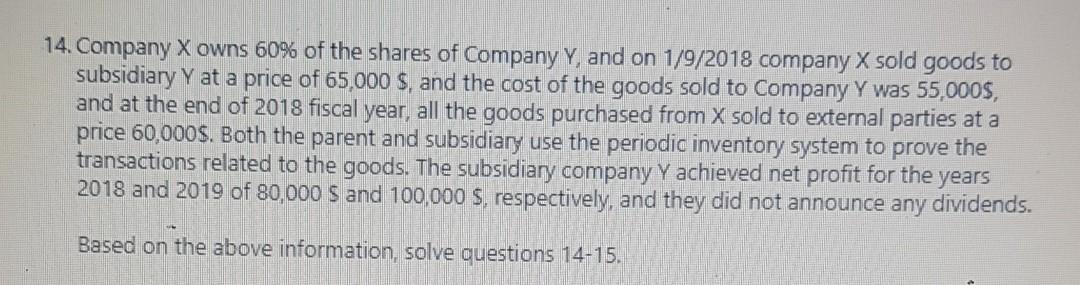

14. Company Xowns 60% of the shares of Company Y, and on 1/9/2018 company X sold goods to subsidiary Y at a price of 65,000

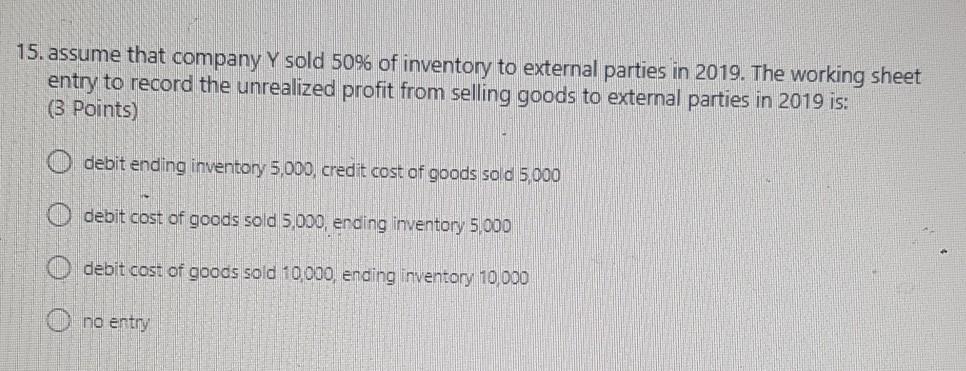

14. Company Xowns 60% of the shares of Company Y, and on 1/9/2018 company X sold goods to subsidiary Y at a price of 65,000 s, and the cost of the goods sold to Company Y was 55,000$, and at the end of 2018 fiscal year, all the goods purchased from X sold to external parties at a price 60,000$. Both the parent and subsidiary use the periodic inventory system to prove the transactions related to the goods. The subsidiary company Y achieved net profit for the years 2018 and 2019 of 80,000 S and 100,000 $, respectively, and they did not announce any dividends. Based on the above information, solve questions 14-15. 15. assume that company Y sold 50% of inventory to external parties in 2019. The working sheet entry to record the unrealized profit from selling goods to external parties in 2019 is. (3 Points) debit ending inventory 5,000, credit cost of goods sold 5,000 O debit cost of goods sold 5,000, ending inventory 5.000 O O O debit cost of goods sold 10,000, ending inventory 10,000 no entry 14. Company Xowns 60% of the shares of Company Y, and on 1/9/2018 company X sold goods to subsidiary Y at a price of 65,000 s, and the cost of the goods sold to Company Y was 55,000$, and at the end of 2018 fiscal year, all the goods purchased from X sold to external parties at a price 60,000$. Both the parent and subsidiary use the periodic inventory system to prove the transactions related to the goods. The subsidiary company Y achieved net profit for the years 2018 and 2019 of 80,000 S and 100,000 $, respectively, and they did not announce any dividends. Based on the above information, solve questions 14-15. 15. assume that company Y sold 50% of inventory to external parties in 2019. The working sheet entry to record the unrealized profit from selling goods to external parties in 2019 is. (3 Points) debit ending inventory 5,000, credit cost of goods sold 5,000 O debit cost of goods sold 5,000, ending inventory 5.000 O O O debit cost of goods sold 10,000, ending inventory 10,000 no entry

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started