#14

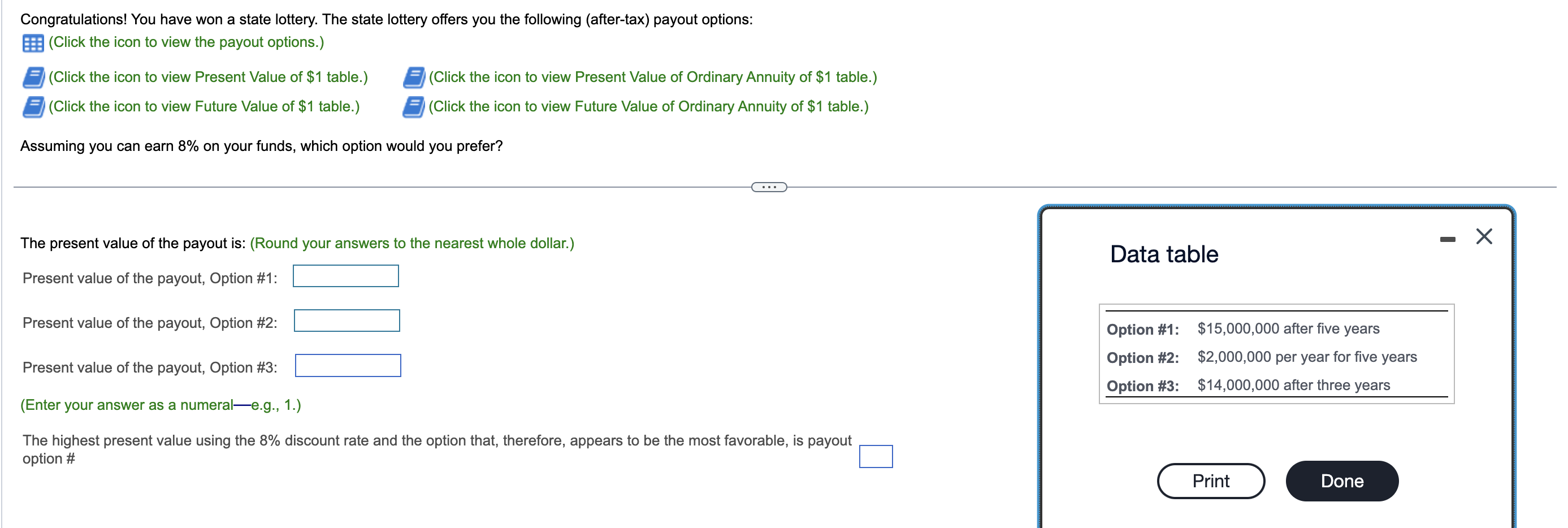

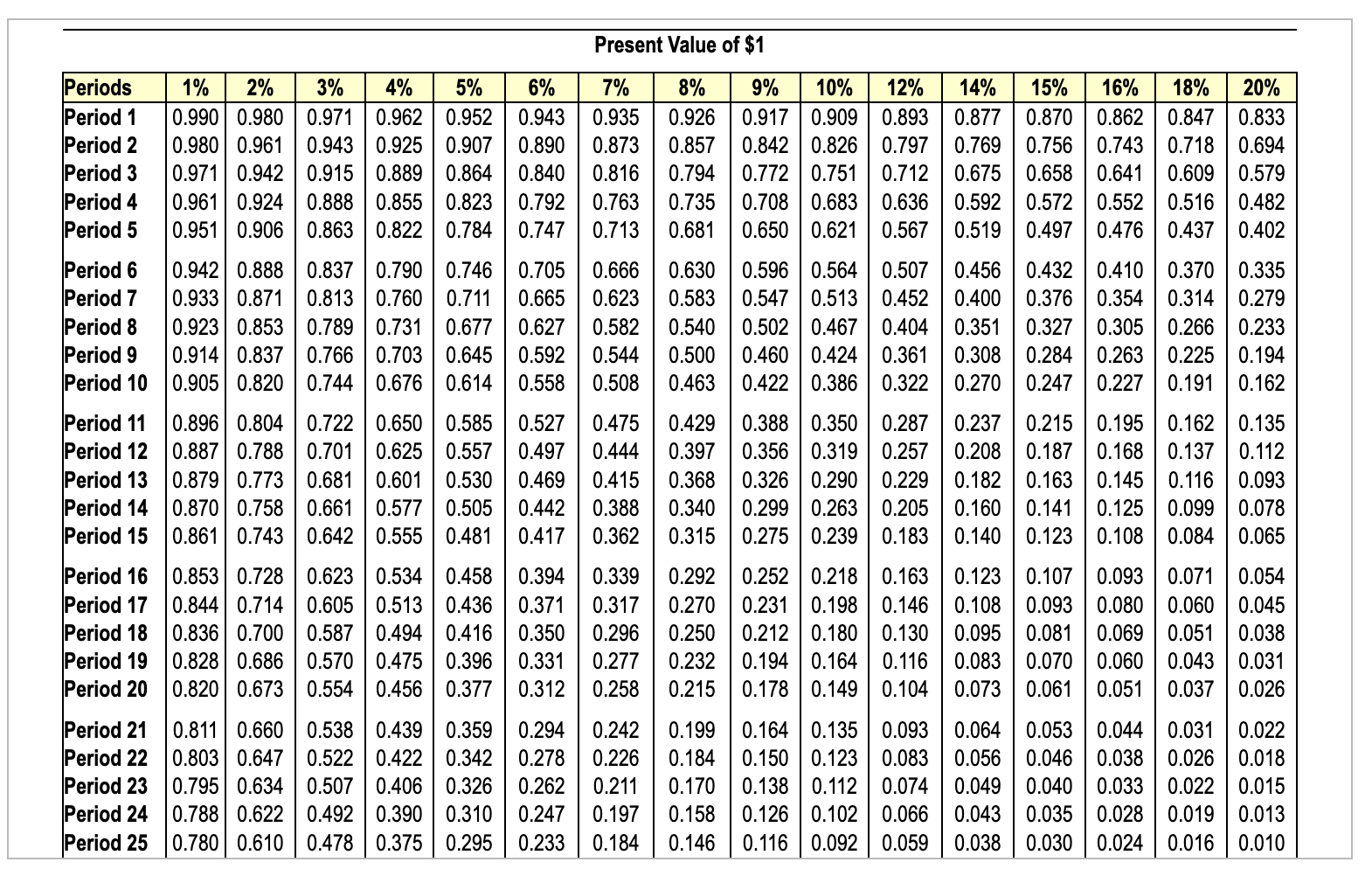

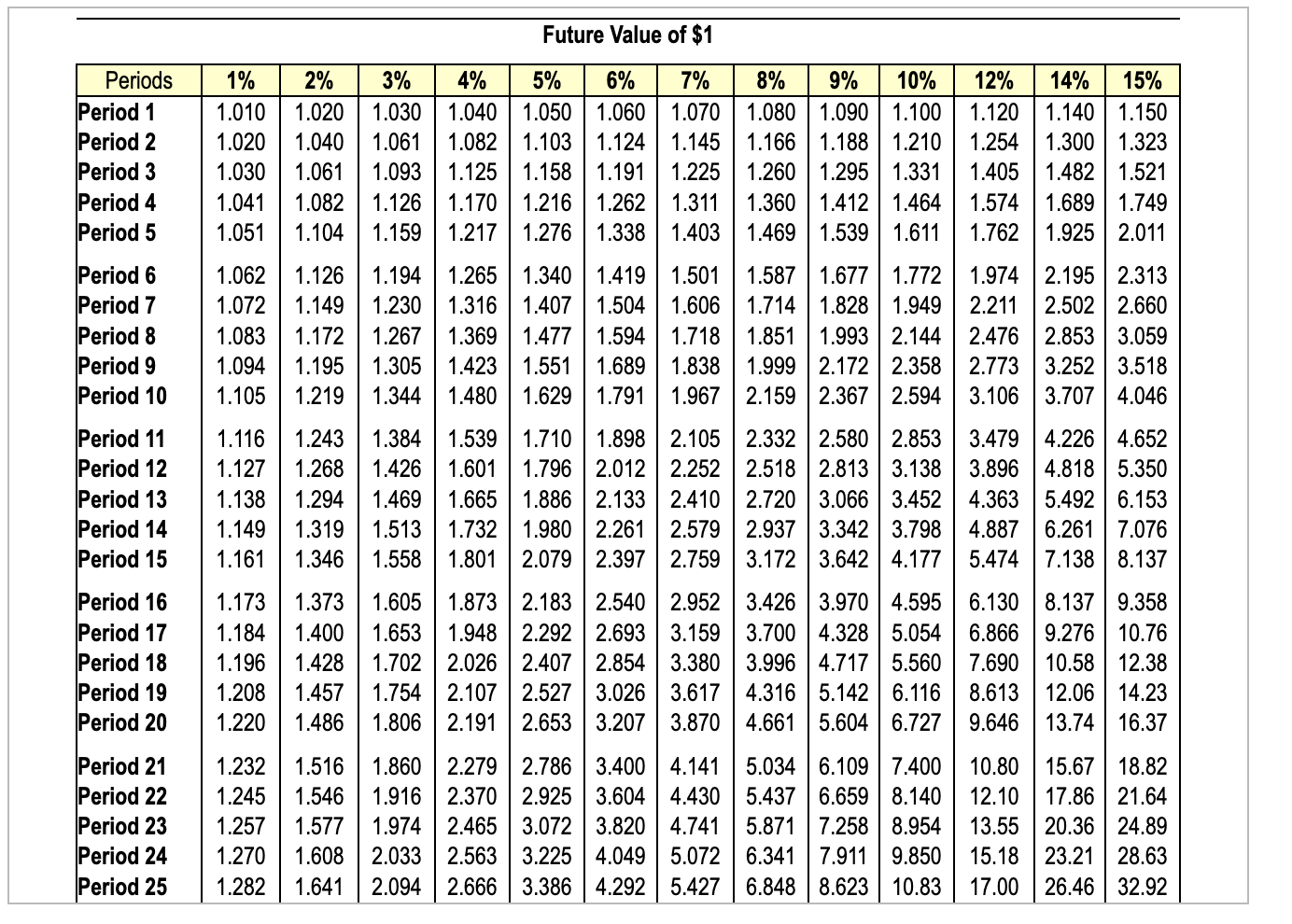

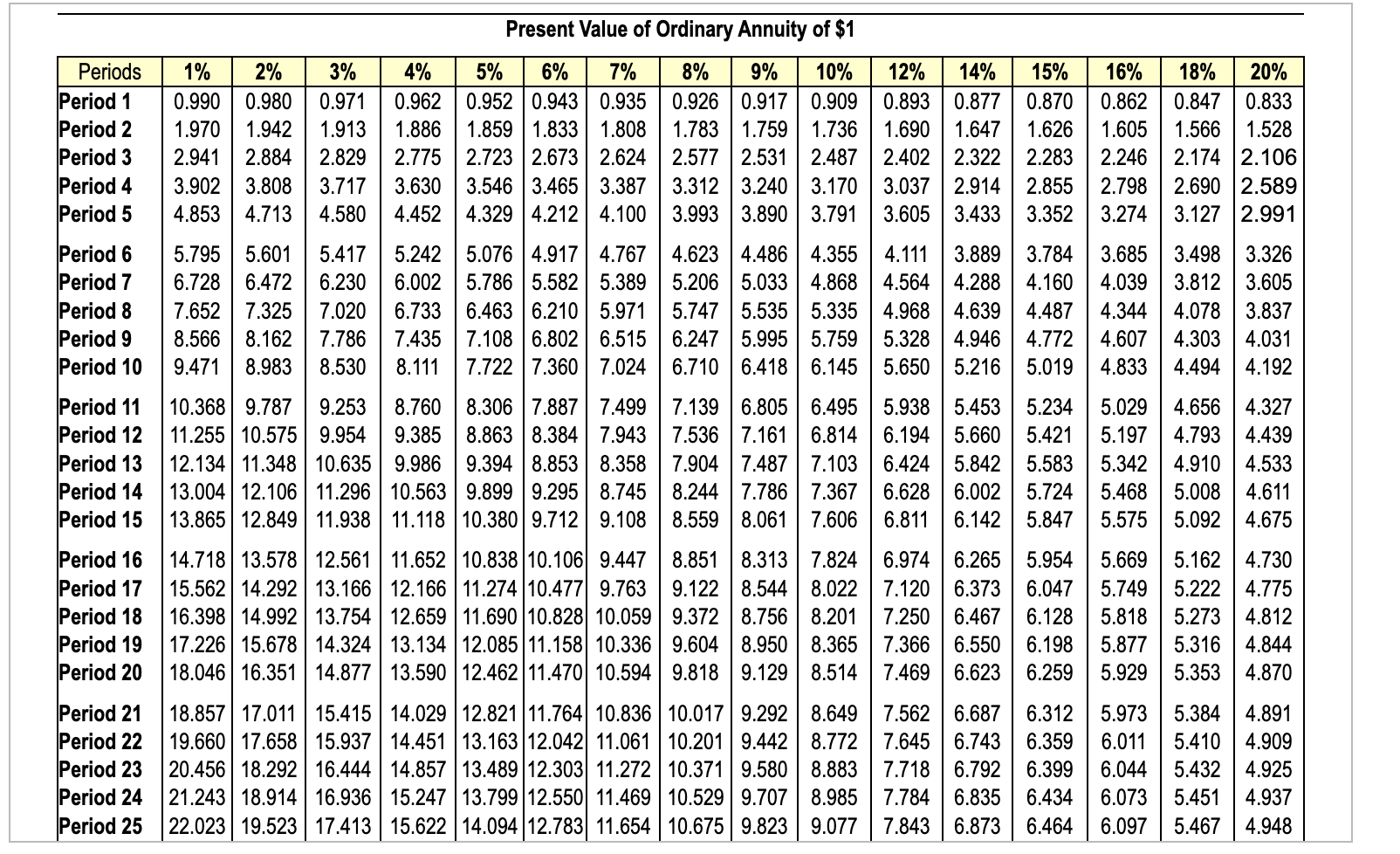

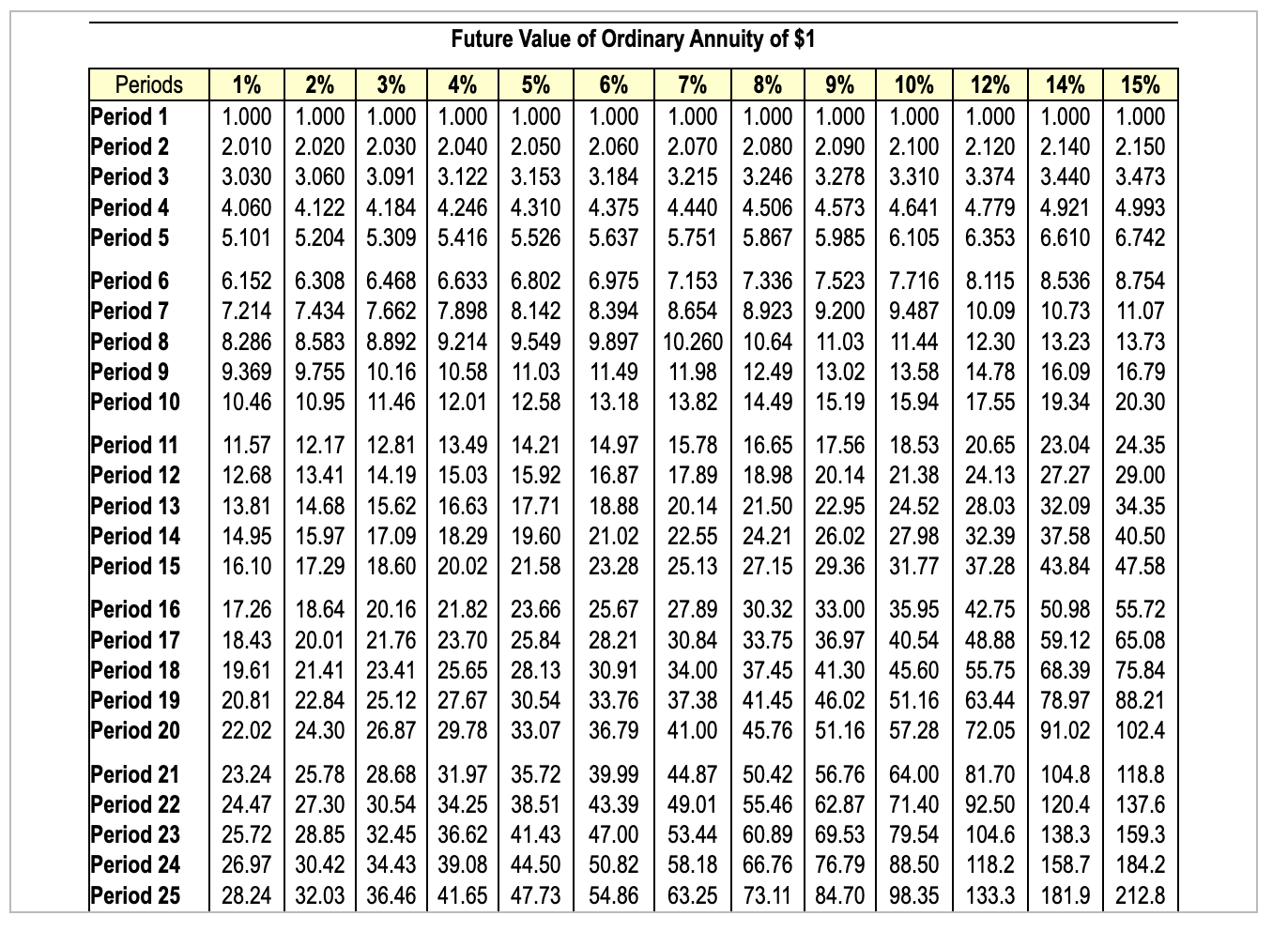

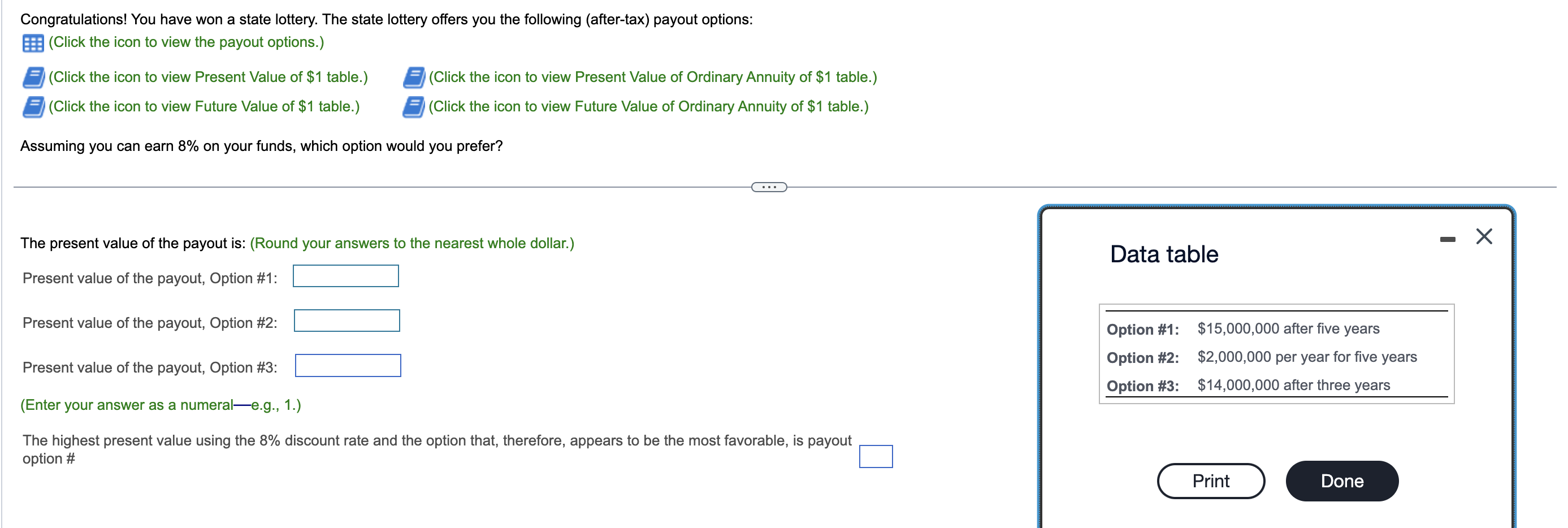

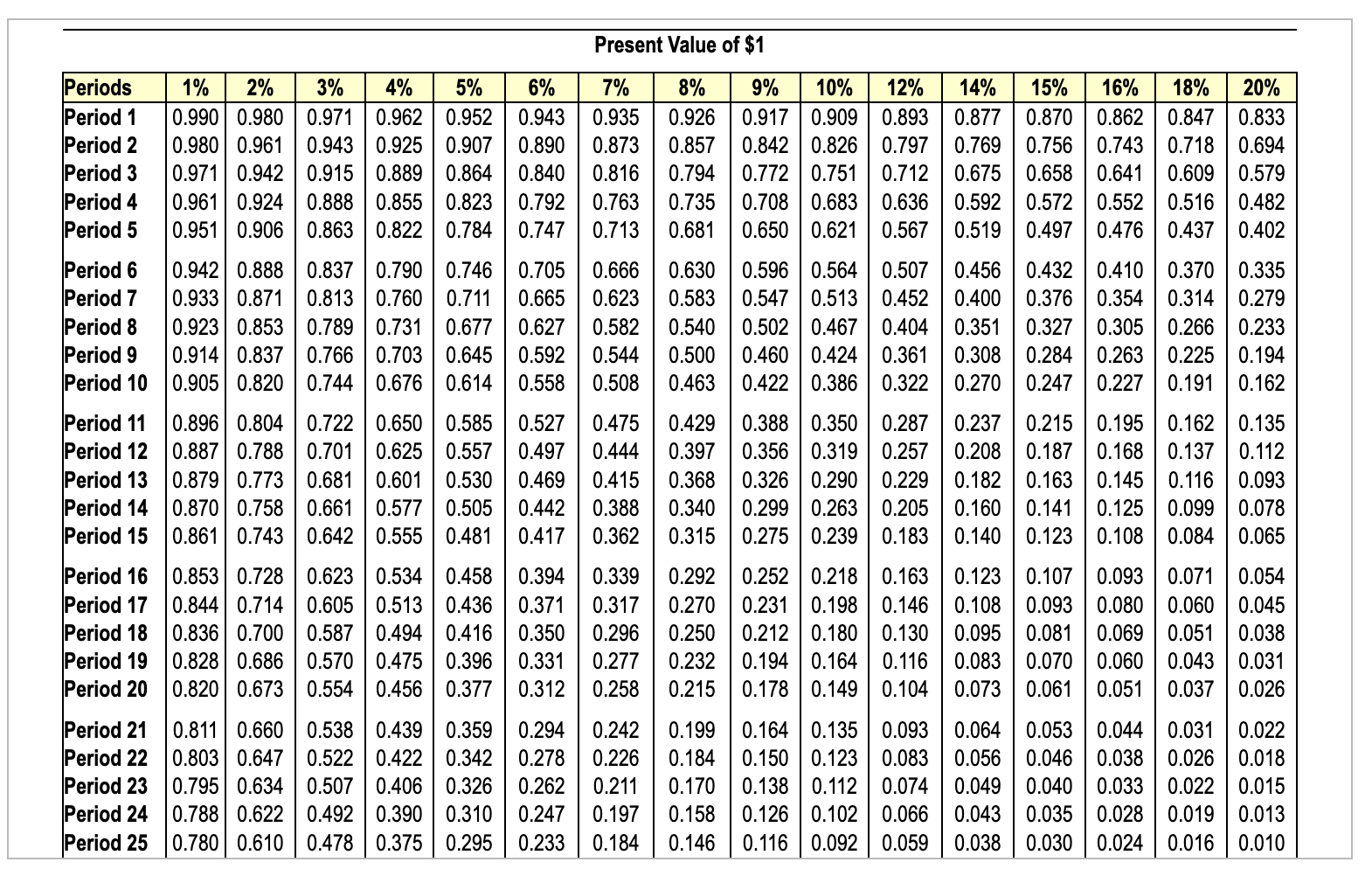

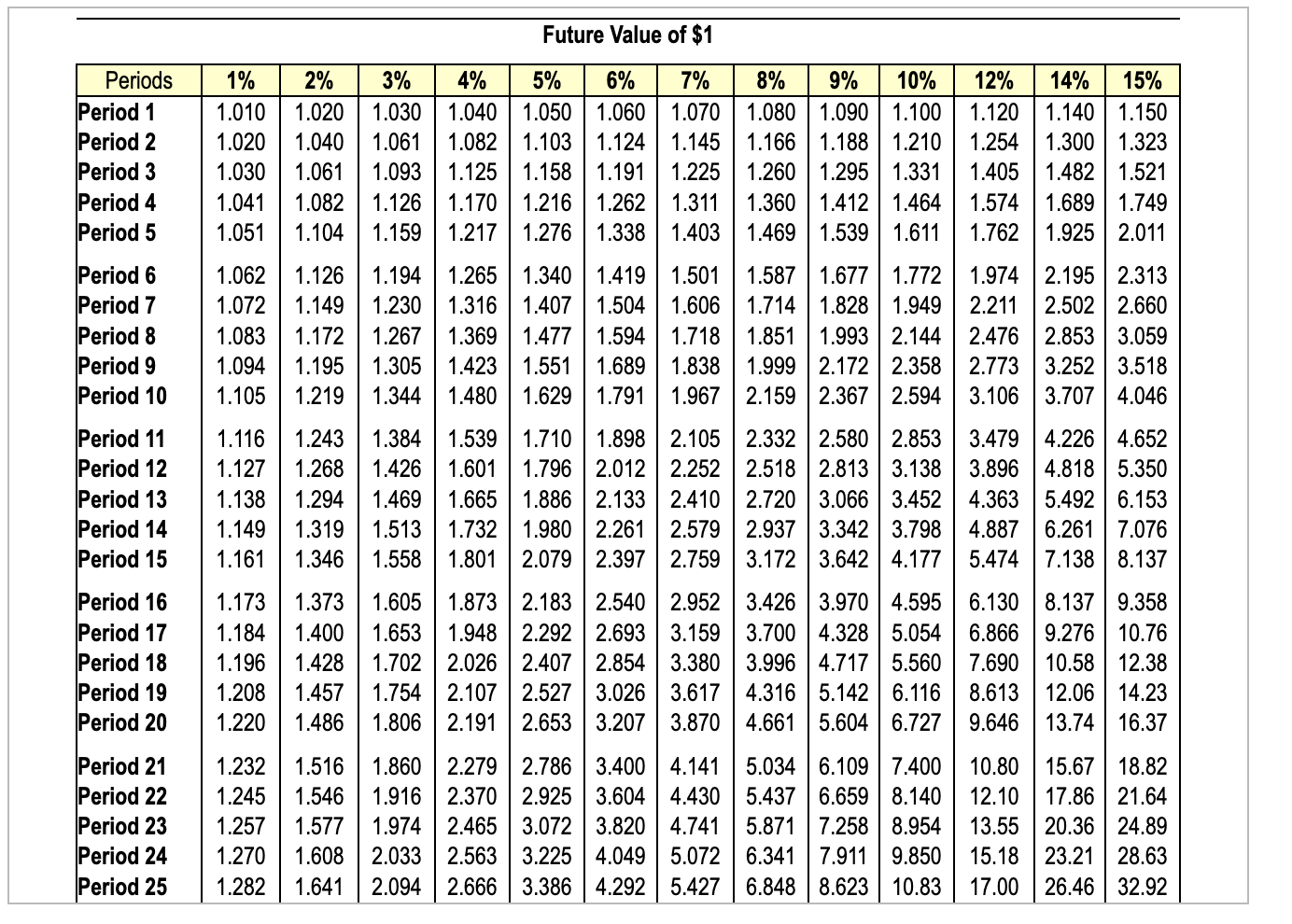

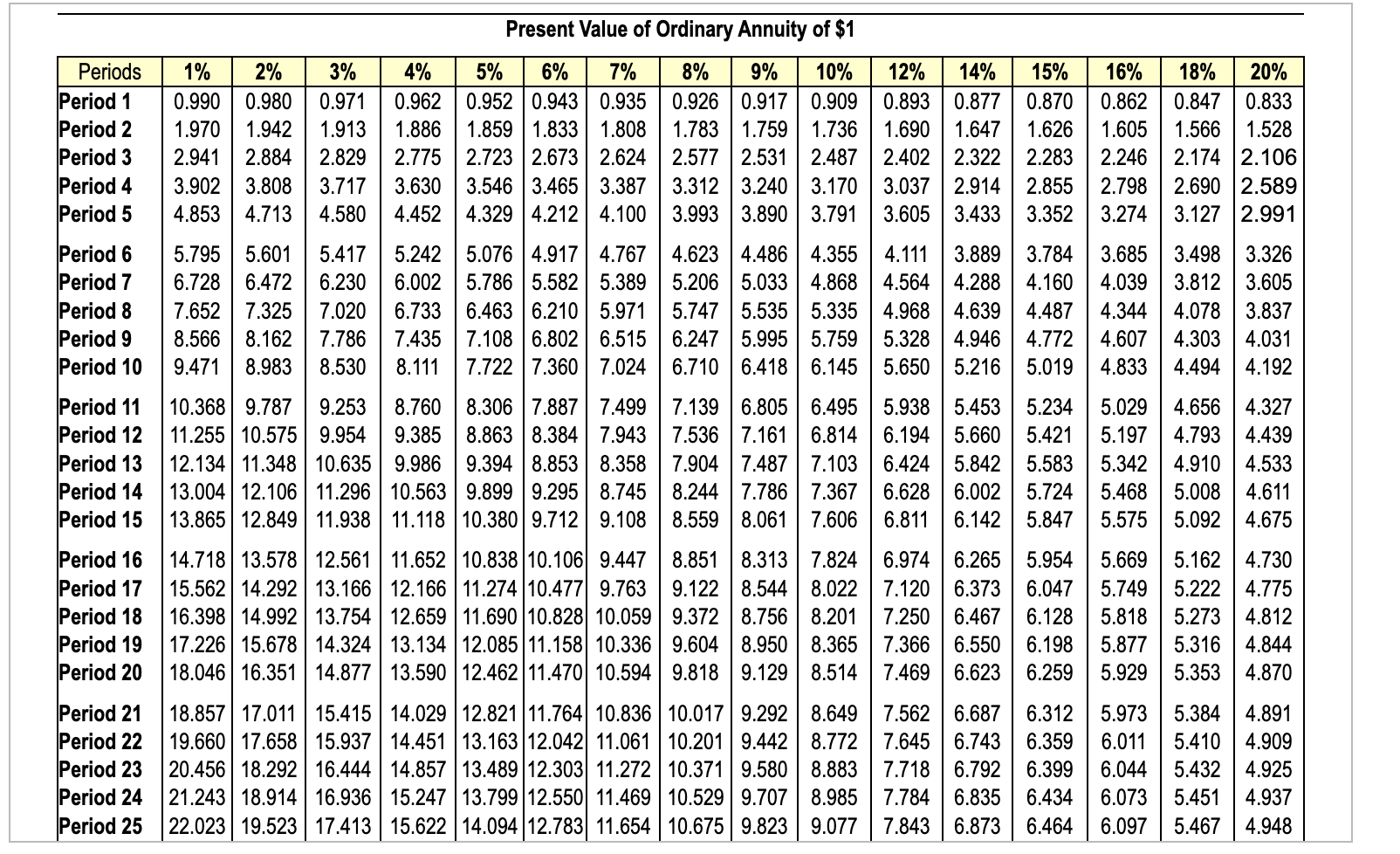

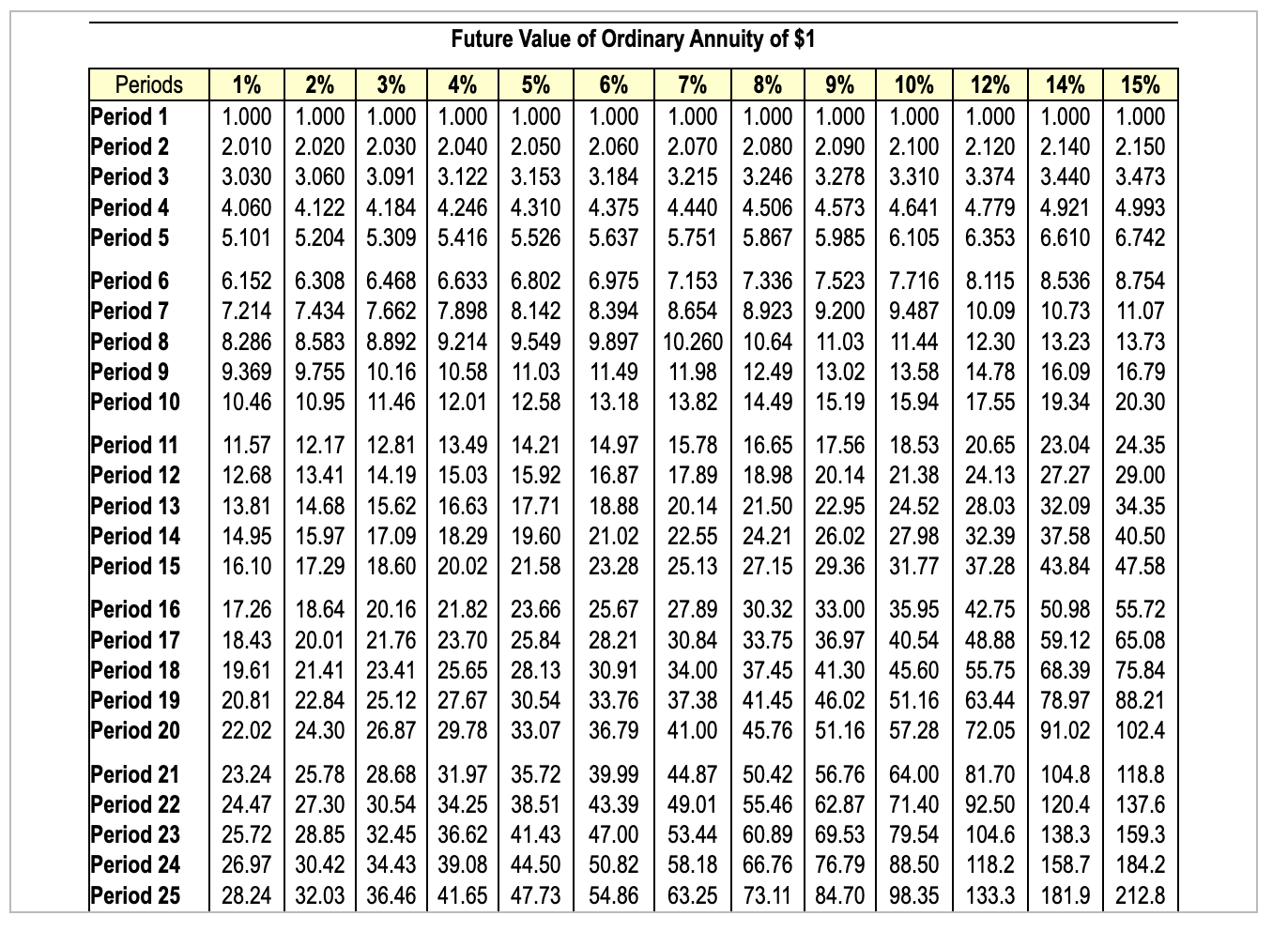

Congratulations! You have won a state lottery. The state lottery offers you the following (after-tax) payout options: (Click the icon to view the payout options.) (Click the icon to view Present Value of $1 table.) (Click the icon to view Present Value of Ordinary Annuity of $1 table.) (Click the icon to view Future Value of $1 table.) ( (Click the icon to view Future Value of Ordinary Annuity of $1 table.) Assuming you can earn 8% on your funds, which option would you prefer? The present value of the payout is: (Round your answers to the nearest whole dollar.) Data table Present value of the payout, Option #1: Present value of the payout, Option #2: Option #1: $15,000,000 after five years Option #2: $2,000,000 per year for five years Present value of the payout, Option #3: Option #3: $14,000,000 after three years (Enter your answer as a numeral-e.g., 1.) The highest present value using the 8% discount rate and the option that, therefore, appears to be the most favorable, is payout option # \begin{tabular}{|l|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{} \\ \hline Periods & 1% & 2% & 3% & 4% & 5% & 6% & 7% & 8% & 9% & 10% & 12% & 14% & 15% & 16% & 18% & 20% \\ \hline Period 1 & 0.990 & 0.980 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 & 0.909 & 0.893 & 0.877 & 0.870 & 0.862 & 0.847 & 0.833 \\ Period 2 & 0.980 & 0.961 & 0.943 & 0.925 & 0.907 & 0.890 & 0.873 & 0.857 & 0.842 & 0.826 & 0.797 & 0.769 & 0.756 & 0.743 & 0.718 & 0.694 & \\ Period 3 & 0.971 & 0.942 & 0.915 & 0.889 & 0.864 & 0.840 & 0.816 & 0.794 & 0.772 & 0.751 & 0.712 & 0.675 & 0.658 & 0.641 & 0.609 & 0.579 & \\ Period 4 & 0.961 & 0.924 & 0.888 & 0.855 & 0.823 & 0.792 & 0.763 & 0.735 & 0.708 & 0.683 & 0.636 & 0.592 & 0.572 & 0.552 & 0.516 & 0.482 & \\ Period 5 & 0.951 & 0.906 & 0.863 & 0.822 & 0.784 & 0.747 & 0.713 & 0.681 & 0.650 & 0.621 & 0.567 & 0.519 & 0.497 & 0.476 & 0.437 & 0.402 & \\ Period 6 & 0.942 & 0.888 & 0.837 & 0.790 & 0.746 & 0.705 & 0.666 & 0.630 & 0.596 & 0.564 & 0.507 & 0.456 & 0.432 & 0.410 & 0.370 & 0.335 & \\ Period 7 & 0.933 & 0.871 & 0.813 & 0.760 & 0.711 & 0.665 & 0.623 & 0.583 & 0.547 & 0.513 & 0.452 & 0.400 & 0.376 & 0.354 & 0.314 & 0.279 & \\ Period 8 & 0.923 & 0.853 & 0.789 & 0.731 & 0.677 & 0.627 & 0.582 & 0.540 & 0.502 & 0.467 & 0.404 & 0.351 & 0.327 & 0.305 & 0.266 & 0.233 & \\ Period 9 & 0.914 & 0.837 & 0.766 & 0.703 & 0.645 & 0.592 & 0.544 & 0.500 & 0.460 & 0.424 & 0.361 & 0.308 & 0.284 & 0.263 & 0.225 & 0.194 & \\ Period 10 & 0.905 & 0.820 & 0.744 & 0.676 & 0.614 & 0.558 & 0.508 & 0.463 & 0.422 & 0.386 & 0.322 & 0.270 & 0.247 & 0.227 & 0.191 & 0.162 & \\ Period 11 & 0.896 & 0.804 & 0.722 & 0.650 & 0.585 & 0.527 & 0.475 & 0.429 & 0.388 & 0.350 & 0.287 & 0.237 & 0.215 & 0.195 & 0.162 & 0.135 & \\ Period 12 & 0.887 & 0.788 & 0.701 & 0.625 & 0.557 & 0.497 & 0.444 & 0.397 & 0.356 & 0.319 & 0.257 & 0.208 & 0.187 & 0.168 & 0.137 & 0.112 & \\ Period 13 & 0.879 & 0.773 \end{tabular} Future Value of $1 Present Value of Ordinarv Annuitv of $1 Future Value of Ordinary Annuity of $1