Question

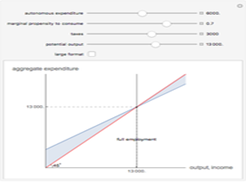

1.4. Create three diagrams for the aggregate expenditures (AE) model for a public closed economy by adding different taxes. For the Diagram #1 suppose: Autonomous

1.4. Create three diagrams for the aggregate expenditures (AE) model for a public closed economy by adding different taxes.

For the Diagram #1 suppose:

Autonomous Expenditures: $6000;

MPC: 0.75;

Taxes: $1500;

Potential Output: $16500

For the Diagram #2 suppose:

Autonomous Expenditures: $6000;

MPC: 0.75;

Taxes: $3000;

Potential Output: $16500

For the Diagram #3 suppose:

Autonomous Expenditures: $6000;

MPC: 0.75;

Taxes: $2500

Potential Output: $16500

Explain each diagram by determining economic gaps and/or equilibriums. How does an increase in taxes affect GDP? How does a decrease in taxes affect GDP?

You can use Keynesian Cross Diagram - Wolfram Demonstrations Project and share it with me. You can change your data for autonomous expenditures*, taxes, potential output to show that the 45-degree line expresses equilibriums. Your changes in autonomous expenditure must lead to a larger-sized change in national income.

* Economists distinguish two types of expenditures. Expenditures that do not vary with the level of real GDP are called autonomous aggregate expenditures. In our example, we assume that planned investment expenditures are autonomous. Expenditures that vary with real GDP are called induced aggregate expenditures. (Retrieved from 28.2 The Aggregate Expenditures Model Principles of Economics (umn.edu)).

See my example below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started