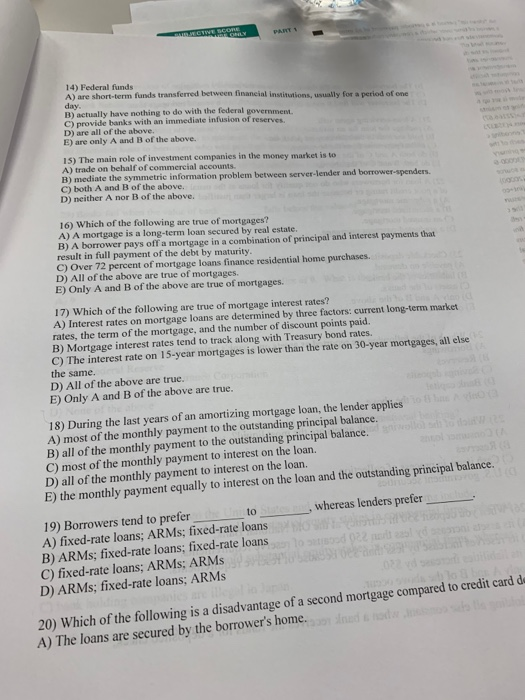

14) Federal funds A) are short-term funds transferred between financial institutions, usually for a period of one day B) actually have nothing to do with the federal gover C) provide banks with an immediate infusion of rese D) are all of the above. rrveS E) are only A and B of the above. 15) The main role of investment companies in the money market is to A) trade on behalf of commercial accounts. B) mediate the symmetric information problem between server-lender and borrow C) both A and B of the above. D) neither A nor B of the above. 16) Which of the following are true of mortgages? A) A mortgage is a long-term loan secured by real estate B) A borrower pays off a mortgage in a combination of principal and interest payments that result in full payment of the debt by maturity C) Over 72 percent of mortgage loans finance residential home purchases. D) All of the above are true of mortgages E) Only A and B of the above are true of mortgages. 17) Which of the following are true of mortgage interest rates? A) Interest rates on mortgage loans are determined by three factors: current long-term market rates, the term of the mortgage, and the number of discount points paid. B) Mortgage interest rates tend to track along with Treasury bond rates. C) The interest rate on 15-year mortgages is lower than the rate on 30-year mortgages, all else the same D) All of the above are true. E) Only A and B of the above are true. 18) During the last years of an amortizing mortgage loan, the lender applies A) most of the monthly payment to the outstanding principal balance. B) all of the monthly payment to the outstanding principal balance. C) most of the monthly payment to interest on the loan. D) all of the monthly payment to interest on the loan. E) the monthly payment equally to interest on the loan and the outstanding principal balance. , whereas lenders prefer 19) Borrowers tend to prefer to_w A) fixed-rate loans; ARMs; fixed-rate loans B) ARMs; fixed-rate loans; fixed-rate loans C) fixed-rate loans; ARMs; ARMs D) ARMs; fixed-rate loans; ARMs 20) Which of the following is a disadvantage of a second mortgage compared to credit card de A) The loans are secured by the borrower's home