Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14 Fly Products, Inc. reports the following comparative balance sheets and income statement for the current year. BE: (Click the icon to view the balance

14

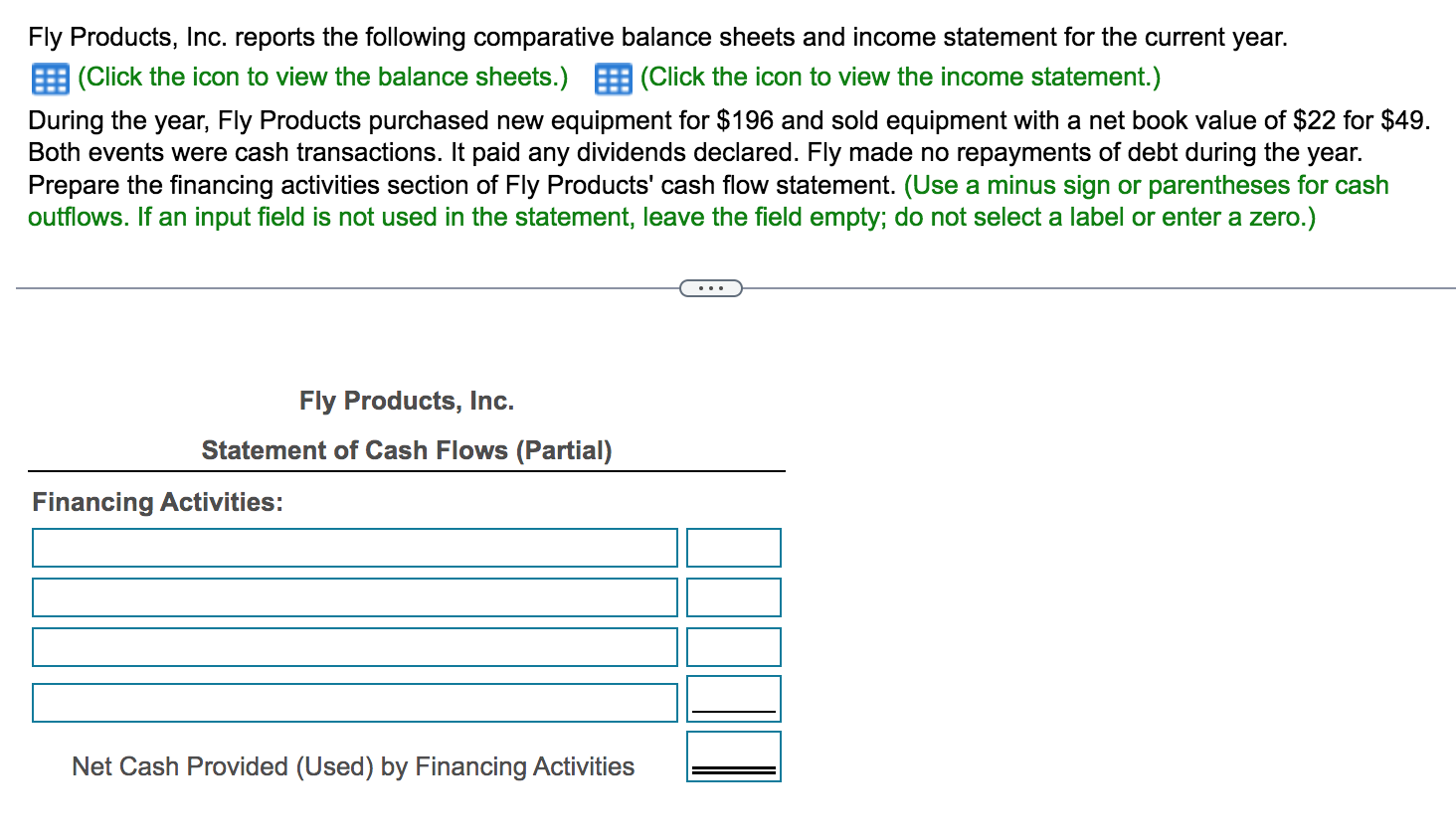

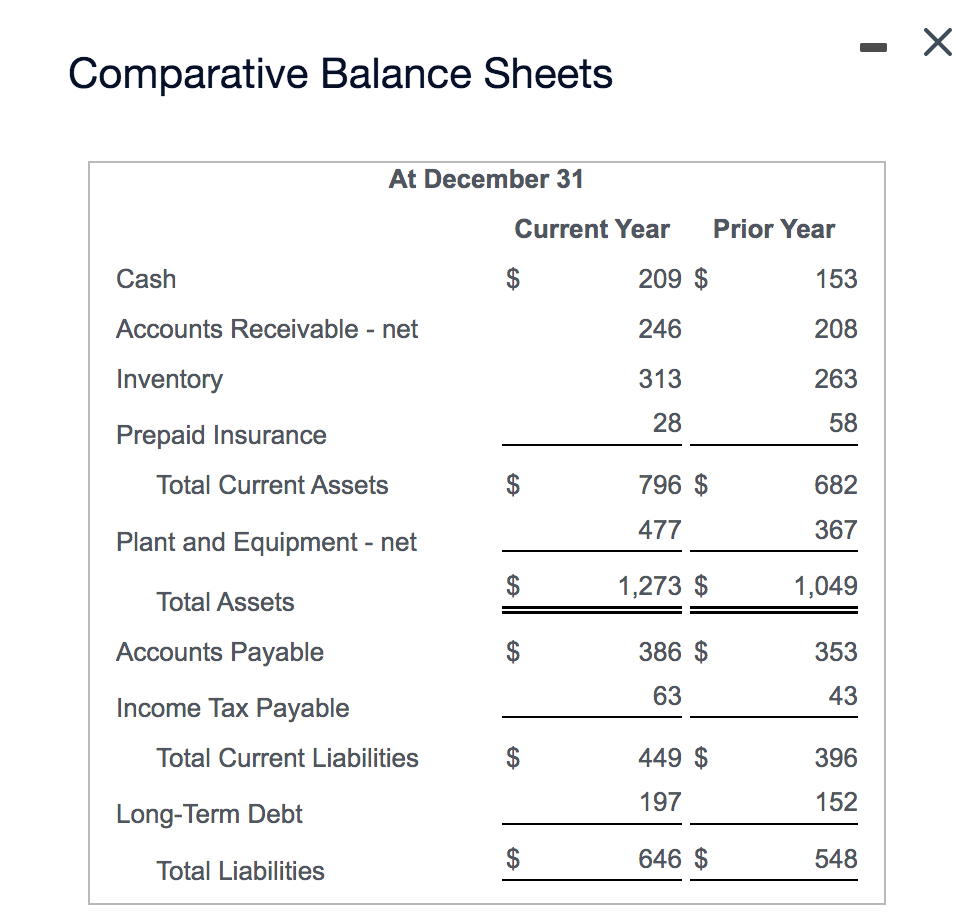

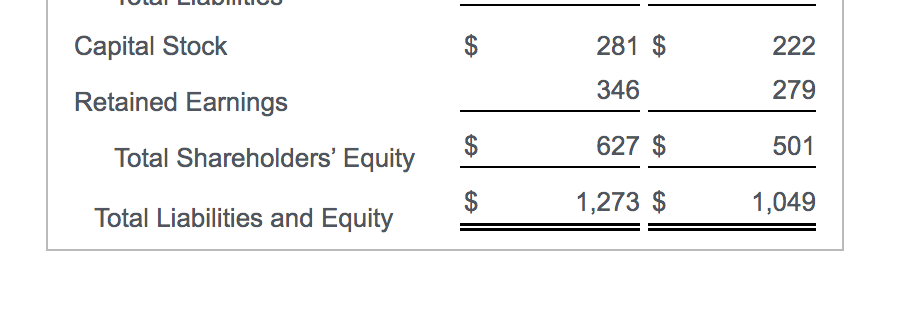

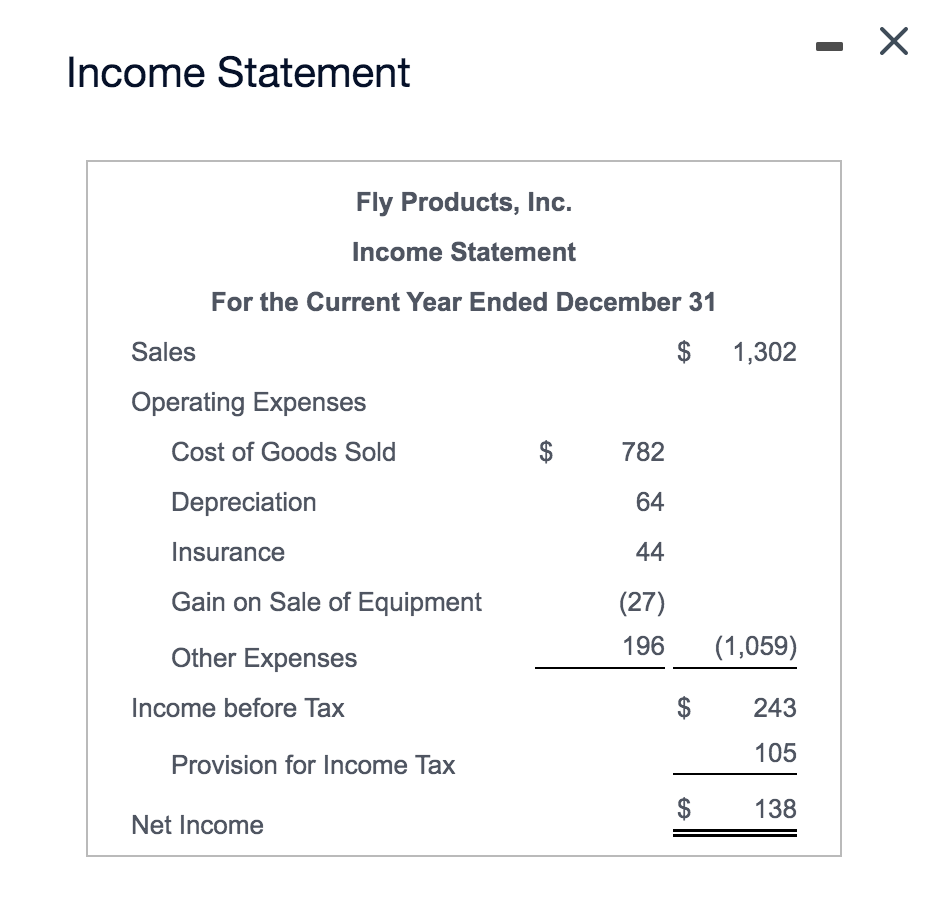

Fly Products, Inc. reports the following comparative balance sheets and income statement for the current year. BE: (Click the icon to view the balance sheets.) (Click the icon to view the income statement.) During the year, Fly Products purchased new equipment for $196 and sold equipment with a net book value of $22 for $49. Both events were cash transactions. It paid any dividends declared. Fly made no repayments of debt during the year. Prepare the financing activities section of Fly Products' cash flow statement. (Use a minus sign or parentheses for cash outflows. If an input field is not used in the statement, leave the field empty; do not select a label or enter a zero.) Fly Products, Inc. Statement of Cash Flows (Partial) Financing Activities: Net Cash Provided (Used) by Financing Activities Comparative Balance Sheets At December 31 Current Year Prior Year Cash $ 209 $ 153 Accounts Receivable - net 246 208 Inventory 313 263 28 58 Prepaid Insurance Total Current Assets $ 796 $ 682 477 367 Plant and Equipment - net $ 1,273 $ 1,049 Total Assets Accounts Payable $ 386 $ 353 63 Income Tax Payable 43 Total Current Liabilities $ 449 $ 396 197 152 Long-Term Debt 646 $ $ 548 Total Liabilities Capital Stock $ 281 $ 222 Retained Earnings 346 279 $ 501 627 $ Total Shareholders' Equity $ 1,273 $ 1,049 Total Liabilities and Equity Income Statement Fly Products, Inc. Income Statement For the Current Year Ended December 31 Sales $ 1,302 Operating Expenses Cost of Goods Sold $ 782 Depreciation 64 Insurance 44 Gain on Sale of Equipment (27) 196 (1,059) Other Expenses Income before Tax $ 243 105 Provision for Income Tax $ 138 Net IncomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started