Answered step by step

Verified Expert Solution

Question

1 Approved Answer

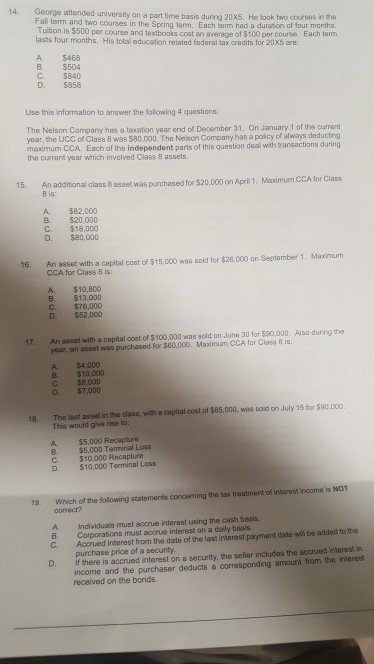

14. George attended university on a part time basis during 20X5. He look two courses in the Fall term and two courses in th t

14. George attended university on a part time basis during 20X5. He look two courses in the Fall term and two courses in th t e Spring term. Each term had a duraion of four months Tuition is $500 per course and textbooks cost an average of $100 per course. Each tem lasts four months. His total education related federal tax credits for 20X5 are: A $468 B. 5504 C 3840 D? $858 Use this information to answer the folowing 4 questions The Nelson Company has a taxation year end of December 31. On January 1 of the cument year, the UCC of Class 8 was $80,000. The Nelson Company has a poicy of always deducting maximum CCA. Each of the independent parts of this question deal with transactions during the current year which involved Class 8 assets. An additional class 8 asset was purchased for $20,000 on Apri 1, Maximum CCA for Class B is A $82,000 B. $20,000 C. $18,000 D. $80,000 An asset with a capital cost of $15,000 was sold for $26,000 on Septamber 1. Maximum CCA for Class 8 is 16. A. $10,800 B. $13,000 C $76,000 D $52,000 17. An ssset with a capital coet of $100,000 was sold an Juna 30 for 500,000. Also during the year, an asset was purchased for $80,000. Maximum CCA for Cisss 8 is: A $4,000 B $10,000 C $8,000 D $7,000 18. The lsst asset in the class, with a capital cost of $85,000, was soid on July 15 for $90,000. This would give rise to A $5,000 Recapture C 510,000 Recapture $5,000 Teminal Loss D. $10,000 Terminal LoGs Which of the following statements concerning the tax treatment of interest income is NOT correct? 19. A. Individuals must accrue interest using the cash besis B. Corporations must accrue interest on a daly basis. C. Accrued interest from the date of the last interest payment date whl be added to the purchase price of a security D If there is accrued interest on a security, the seler includes the accrued inarest in income and the purchaser deducts a coresponding amount from the iterest received on the bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started