Answered step by step

Verified Expert Solution

Question

1 Approved Answer

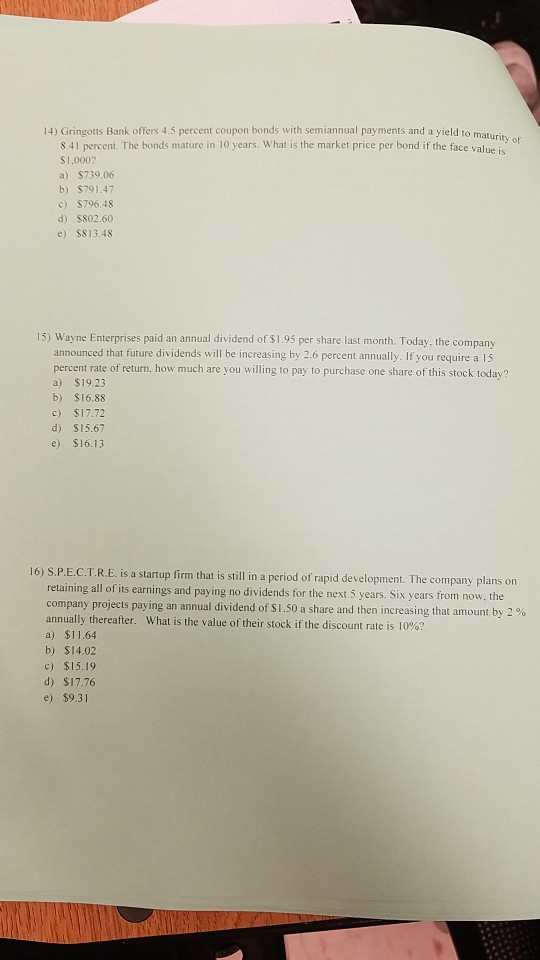

14) Gringotts Bank offers 4.5 percent coupon bonds with semiannual payments and a yield to m 8.41 percent. The bonds mature in 10 years. What

14) Gringotts Bank offers 4.5 percent coupon bonds with semiannual payments and a yield to m 8.41 percent. The bonds mature in 10 years. What is the market price per bond if the face value is $1.0002 a) $739.06 b) $791.47 c) $796.48 d) $802.60 e) $813.48 15) Wayne Enterprises paid an annual dividend of $1.95 per share last month. Today, the company announced that future dividends will be increasing by 2.6 percent annually. If you require a 15 percent rate of return, how much are you willing to pay to purchase one share of this stock today? a) $19.23 b) $16.88 c) $17.72 d) S15.67 e $16.13 16) S...C.T.R.E. is a startup firm that is still in a pe retaining all of its earnings and paying no dividends for the next 5 years. Six years from now, the company projects paying an annual dividend of $1.50 a share and then increasing that amount by 2 % annually thereafter. What is the value of their stock if the discount rate is 10% riod of rapid development. The company plans on a) $11.64 b) $14.02 c) $15.19 d) S17.76 e) $9.31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started