Answered step by step

Verified Expert Solution

Question

1 Approved Answer

14. Jack L. and Matthew C.'s partnership agreements states that net income will be allocated based upon salary allowances and interest on the partners' capital

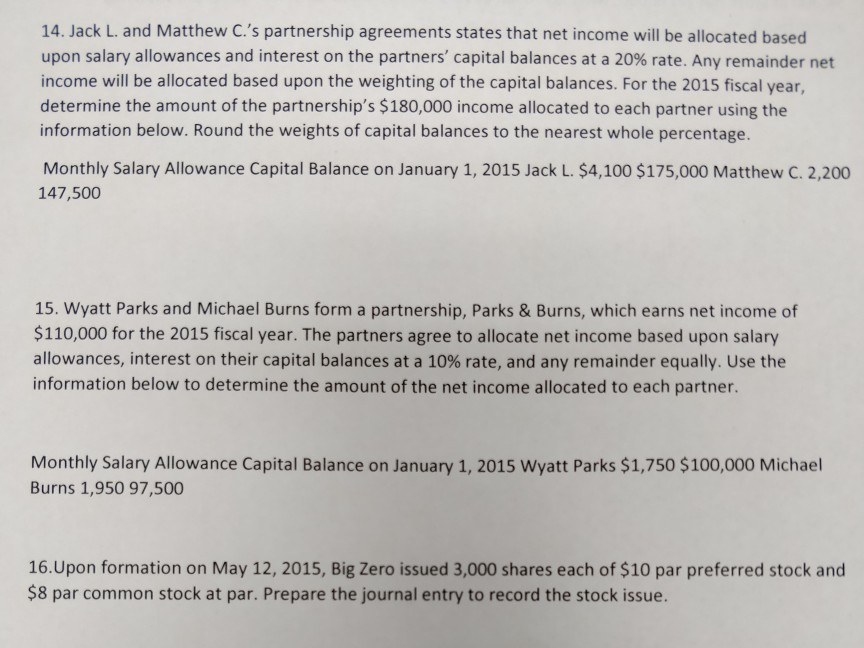

14. Jack L. and Matthew C.'s partnership agreements states that net income will be allocated based upon salary allowances and interest on the partners' capital balances at a 20% rate. Any remainder net income will be allocated based upon the weighting of the capital balances. For the 2015 fiscal year, determine the amount of the partnership's $180,000 income allocated to each partner using the information below. Round the weights of capital balances to the nearest whole percentage. Monthly Salary Allowance Capital Balance on January 1, 2015 Jack L. $4,100 $175,000 Matthew C. 2,200 147,500 15. Wyatt Parks and Michael Burns form a partnership, Parks & Burns, which earns net income of $110,000 for the 2015 fiscal year. The partners agree to allocate net income based upon salary allowances, interest on their capital balances at a 10% rate, and any remainder equally. Use the information below to determine the amount of the net income allocated to each partner Monthly Salary Allowance Capital Balance on January 1, 2015 Wyatt Parks $1,750 $100,000 Michael Burns 1,950 97,500 16.Upon formation on May 12, 2015, Big Zero issued 3,000 shares each of $10 par preferred stock and $8 par common stock at par. Prepare the journal entry to record the stock issue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started