Answered step by step

Verified Expert Solution

Question

1 Approved Answer

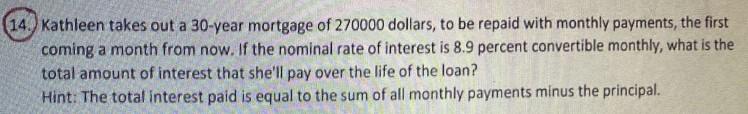

(14.) Kathleen takes out a 30-year mortgage of 270000 dollars, to be repaid with monthly payments, the first coming a month from now. If the

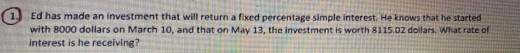

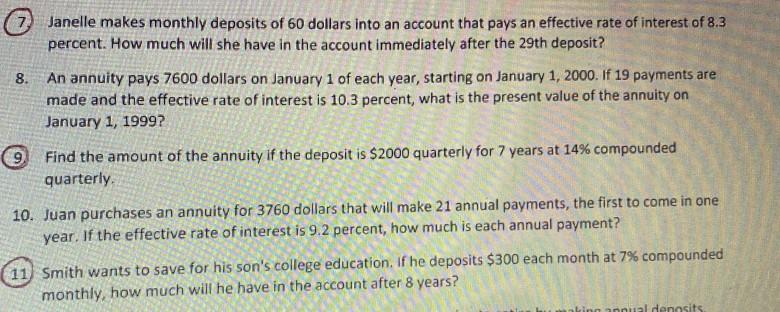

(14.) Kathleen takes out a 30-year mortgage of 270000 dollars, to be repaid with monthly payments, the first coming a month from now. If the nominal rate of interest is 8.9 percent convertible monthly, what is the total amount of interest that she'll pay over the life of the loan? Hint: The total interest paid is equal to the sum of all monthly payments minus the principal. Ed has made an investment that will return a fixed percentage simple interest. He knows that he started with 8000 dollars on March 10, and that on May 13, the investment is worth 8115.02 dollars. What rate of interest is he receiving? Janelle makes monthly deposits of 60 dollars into an account that pays an effective rate of interest of 8.3 percent. How much will she have in the account immediately after the 29th deposit? 8. An annuity pays 7600 dollars on January 1 of each year, starting on January 1, 2000. If 19 payments are made and the effective rate of interest is 10.3 percent, what is the present value of the annuity on January 1, 1999? 9 Find the amount of the annuity if the deposit is $2000 quarterly for 7 years at 14% compounded quarterly 10. Juan purchases an annuity for 3760 dollars that will make 21 annual payments, the first to come in one year. If the effective rate of interest is 9.2 percent, how much is each annual payment? 11 Smith wants to save for his son's college education. If he deposits $300 each month at 7% compounded monthly, how much will he have in the account after 8 years? inn aldenosits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started