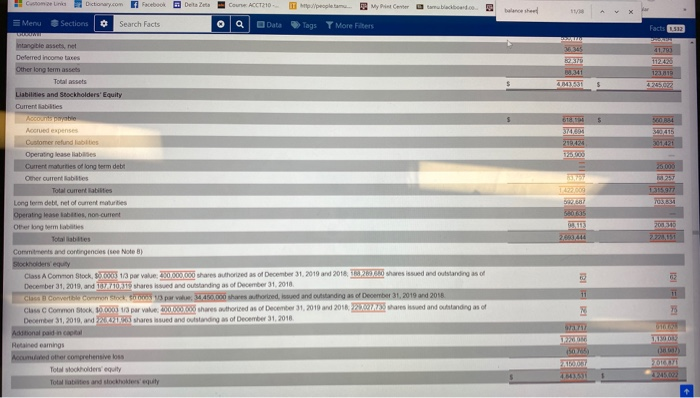

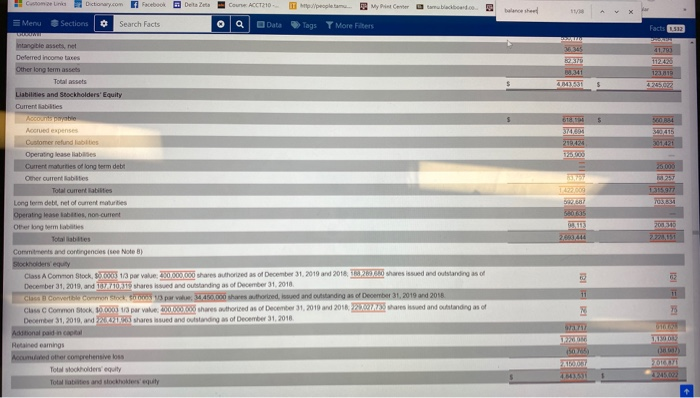

14. Liabilities: On the balance sheet, at the end of 2019, what amount does Under Armour report for (a) current liabilities? (b) total liabilities? (c) Current liabilities make up what percentage of total liabilities? What is the largest liability shown on the balance sheet? 16. Under Armour has three classes of Common Stock: Class A Common, Class B Convertible Common, and Class C Common Stock. Who may own Class B stock? How does Class B stock differ from Class A and Class C? eteet 1 badoo Comens Dictionary.com Facebook m Menu Sections Search Facts Cone ACCT210 a Data /peopletam. My Printer Tags T More Filters D O Facts 1.312 37 171226 173119 AMST 340,415 301.42 257 100 Intangible asset, net Deferred income taxes Other long term assets Total assets Liabilities and Stockholders' Equity Current abilities Accounts payable Accrued expenses Customer refund liabilities Operating leasellabies Current maturties of long term debt Other current abilities Total current abilities Long term debt of current maurities Operating lase obties, nos current Other long term e s Total bites Commitments and contingencies ise Note B) Stockholders Class A Common Stock X 1/3 por value: 2000000 shares authorized as of December 31, 2010 and 2016, 2 0 shares issued and c December 31, 2017, and 1 /10 shares issued and outstandings of December 31, 2018 Class B Convertible con the para shoes thorred, issued and outstanding as of December 31, 2019 and 2018 Cass Common Sock 13 par value shares stored as of December 31, 2010 and 2018 ans and December 31, 2010, and shares sued and outstandings of December 31, 2018 Aditional and in capital Retained earnings Accumulated other comprehensive loss Tot stockholders equity Total abetes and stockhors' equity BT35 113 arings standing and 15005 ) 451 14. Liabilities: On the balance sheet, at the end of 2019, what amount does Under Armour report for (a) current liabilities? (b) total liabilities? (c) Current liabilities make up what percentage of total liabilities? What is the largest liability shown on the balance sheet? 16. Under Armour has three classes of Common Stock: Class A Common, Class B Convertible Common, and Class C Common Stock. Who may own Class B stock? How does Class B stock differ from Class A and Class C? eteet 1 badoo Comens Dictionary.com Facebook m Menu Sections Search Facts Cone ACCT210 a Data /peopletam. My Printer Tags T More Filters D O Facts 1.312 37 171226 173119 AMST 340,415 301.42 257 100 Intangible asset, net Deferred income taxes Other long term assets Total assets Liabilities and Stockholders' Equity Current abilities Accounts payable Accrued expenses Customer refund liabilities Operating leasellabies Current maturties of long term debt Other current abilities Total current abilities Long term debt of current maurities Operating lase obties, nos current Other long term e s Total bites Commitments and contingencies ise Note B) Stockholders Class A Common Stock X 1/3 por value: 2000000 shares authorized as of December 31, 2010 and 2016, 2 0 shares issued and c December 31, 2017, and 1 /10 shares issued and outstandings of December 31, 2018 Class B Convertible con the para shoes thorred, issued and outstanding as of December 31, 2019 and 2018 Cass Common Sock 13 par value shares stored as of December 31, 2010 and 2018 ans and December 31, 2010, and shares sued and outstandings of December 31, 2018 Aditional and in capital Retained earnings Accumulated other comprehensive loss Tot stockholders equity Total abetes and stockhors' equity BT35 113 arings standing and 15005 ) 451