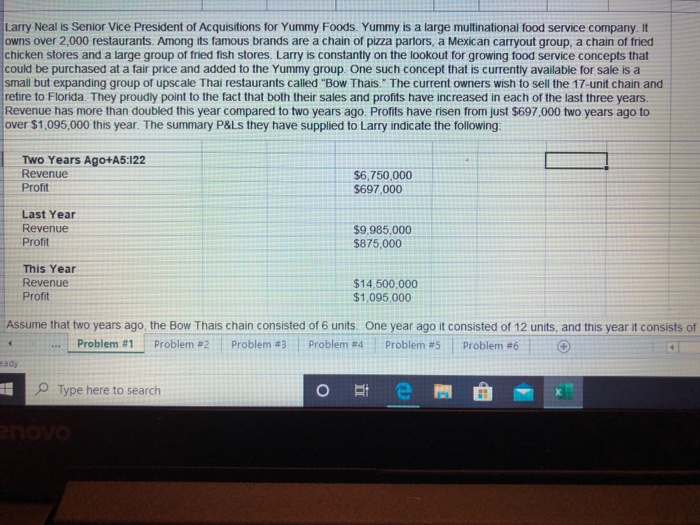

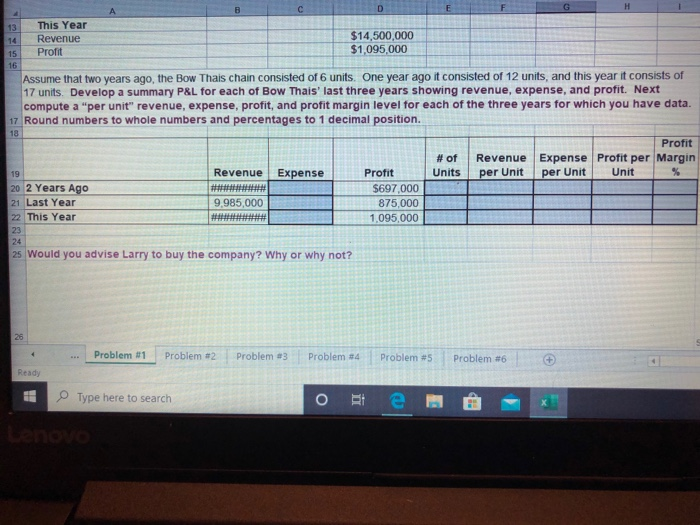

Larry Neal is Senior Vice President of Acquisitions for Yummy Foods. Yummy is a large multinational food service company. It owns over 2,000 restaurants. Among its famous brands are a chain of pizza parlors, a Mexican carryout group, a chain of fried chicken stores and a large group of fried fish stores. Larry is constantly on the lookout for growing food service concepts that could be purchased at a fair price and added to the Yummy group. One such concept that is currently available for sale is a small but expanding group of upscale Thai restaurants called "Bow Thais." The current owners wish to sell the 17-unit chain and Tretire to Florida. They proudly point to the fact that both their sales and profits have increased in each of the last three years Revenue has more than doubled this year compared to two years ago. Profits have risen from just $697,000 two years ago to over $1,095,000 this year. The summary P&Ls they have supplied to Larry indicate the following: Two Years Ago+A5:122 Revenue Profit $6,750,000 $697 000 Last Year Revenue Profit $9.985.000 $875,000 This Year Revenue Profit $14,500,000 $1.095,000 Assume that two years ago, the Bow Thais chain consisted of 6 units. One year ago it consisted of 12 units, and this year it consists of Problem #1 Problem #2 Problem #3 Problem #4 Problem #5 Problem #6 Type here to search G H 13 14 This Year Revenue Profit $14,500,000 $1,095,000 Assume that two years ago, the Bow Thais chain consisted of 6 units. One year ago It consisted of 12 units, and this vear it consists of 17 units. Develop a summary P&L for each of Bow Thais' last three years showing revenue, expense, and profit. Next compute a "per unit" revenue, expense, profit, and profit margin level for each of the three years for which you have data. 17 Round numbers to whole numbers and percentages to 1 decimal position. # of Units Profit Revenue Expense Profit per Margin per Unit per Unit Unit 1 % Expense 20 2 Years Ago 21 Last Year 22 This Year Revenue # ***# 9.985,000 # ****** Profit $697.000 875,000 1.095,000 25 Would you advise Larry to buy the company? Why or why not? Problem #1 Problem #2 Problem #3 Problem #4 Problem #5 Problem #6 Ready Type here to search ote